No.3603

Global High-Performance Films Market: Key Research Findings 2024

High Performance Films Projected to Show a Pickup in 2024, after Sluggish 2022 and 2023

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic and overseas markets (Japan, South Korea, and Taiwan) of high-performance films which include base films and processed films geared to displays and optics, electronic & electric applications, and general industries and found out the trends by product segment, trends of market players, and future perspectives.

Market Overview

Major high-performance films in 2024 are projected to achieve a double-digit growth from the preceding year in shipment volume at manufacturers.

During 2022 and 2023 a downturn occurred from special demand prosperity of at-home spending amid the pandemic until preceding years, demand for final products like smartphones, tablets, notebook laptops, large TVs has dropped, having led to inventory adjustment by downstream companies such as manufacturers of finished products and components. This has caused demand reduction for secondary materials such as protective films and release films that are used in the component production processes, as well as their base films. As the high-performance film market has overall settled by the end of 2023, the market for 2024 is expected to return to normal, showing an increase and decrease in line with actual demand.

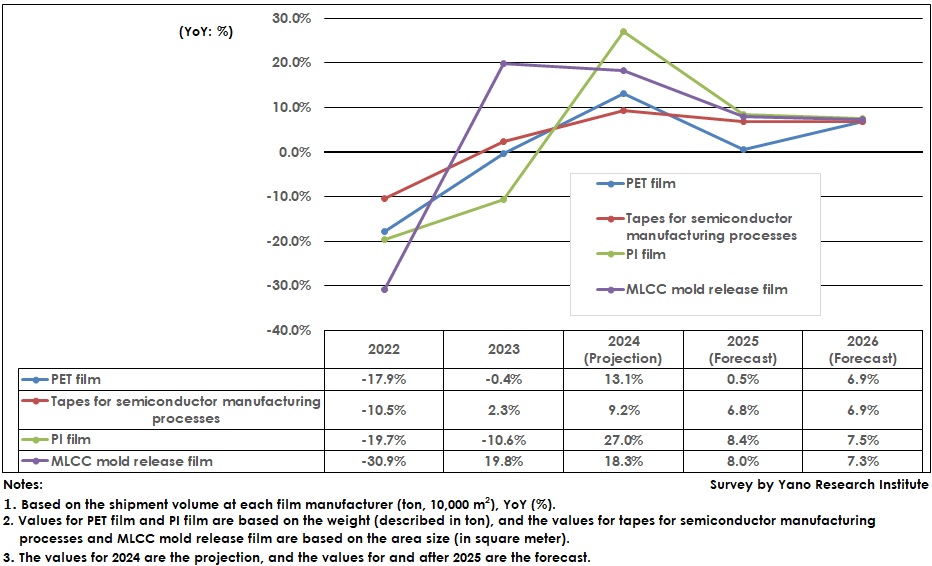

When observing increase/decrease rates in shipment volume for major high-performance films on a year-over-year basis in the last few years, decrease has been estimated in PET films in 2022 by 17.9%, tapes for semiconductor manufacturing processes by 10.5%, PI films by 19.7%, and MLCC mold release films by 30.9%. For 2023, a decrease has been estimated in PET films by 0.4%, increase in tapes for semiconductor manufacturing processes by 2.3%, decline in PI films by 10.6%, and in MLCC mold release films by 19.8% all on a YoY basis. All these films are estimated to increase on YoY for 2024, with PET films by 13.1%, tapes for semiconductor manufacturing processes by 9.2%, PI films decline by 27.0%, and MLCC mold release films by 18.3%.

Noteworthy Topics

Shifting the Focus from Applications and Market to Technology and Products May Lead to Unique Product Development, Despite Small-Scale

Flexible printed circuits (FPCs), displays, and semiconductors are the business pillars for Japanese high-performance film manufacturers. However, matured markets of final products such as TVs and smartphones have made it difficult to generate new components to be embedded in recent years.

Now that a quarter of a century has passed since the market formation, FPCs and displays, for high-performance film manufacturers, can be said as the application that has completed harvesting after efforts of fruit bearing from seeds. Currently, these manufacturers are required to conduct “seeding” and “development of new breed” for another harvesting. In this case, the development should be manufacturer-oriented, rather than conventional customer-oriented. Therefore, manufacturers should identify their advantages in respective technologies, product properties, and distinctions from other competitors, and to decide how to use them in marketing and development.

Future Outlook

Japanese high-performance film manufacturers have conventionally developed their products in customer-oriented style, focusing on the applications and the market, which led them to collaborate with user companies (final product manufacturers), component manufacturers and converters to develop and breed new products. To shift from consumer-oriented to manufacturer-oriented marketing, product development will be something without any knowing of what burgeons to grow and where but must nurture the burgeons anyway. To facilitate it and to increase certainty, cooperative efforts that have never been seen before will be required.

There can be some cases of competing companies to join hands in some parts of business to co-develop customers and applications by bringing forward mutual ideas and materials. It may be good for film manufacturers and materials that are competing in the existing, mature market ready to harvest to cooperate with each other in the seeding period until burgeoning ends and the roots expand stably.

For Japanese high-performance film manufacturers, market development from seeding and to bringing up big can lead to the opportunity for having the next business pillar with competitive edge, where technologies and products that they have strived and accumulated over the years can be applied. In order not to fail obtaining the opportunity, alignment and collaborations across companies are necessary.

Research Outline

2.Research Object: Film manufacturers, converters (in Japan, South Korea, and Taiwan)

3.Research Methogology: Face-to-face interviews by expert researchers (including online), and literature research

High Performance Films

High performance films in this research refer to base films and process films geared to displays and optics, electronic & electric applications, and to general industries. They include polyethylene terephthalate (PET) films, polyimide (PI) films (colored, colorless/transparent), multilayer ceramic capacitor (MLCC) mold release films, tapes used in semiconductor manufacturing processes (tapes for back grind or for dicing, and die attach films), recycled films, etc.

<Products and Services in the Market>

Polyethylene terephthalate (PET) films, polyimide (PI) films (colored, colorless/transparent), multilayer ceramic condenser (MLCC) release films, tapes used in semiconductor manufacturing processes (tapes for back grind or for dicing, and die attach films), and recycled films (film to film)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.