No.3580

Strategies on ASEAN Vehicle Electrification and Batteries: Key Research Findings 2024

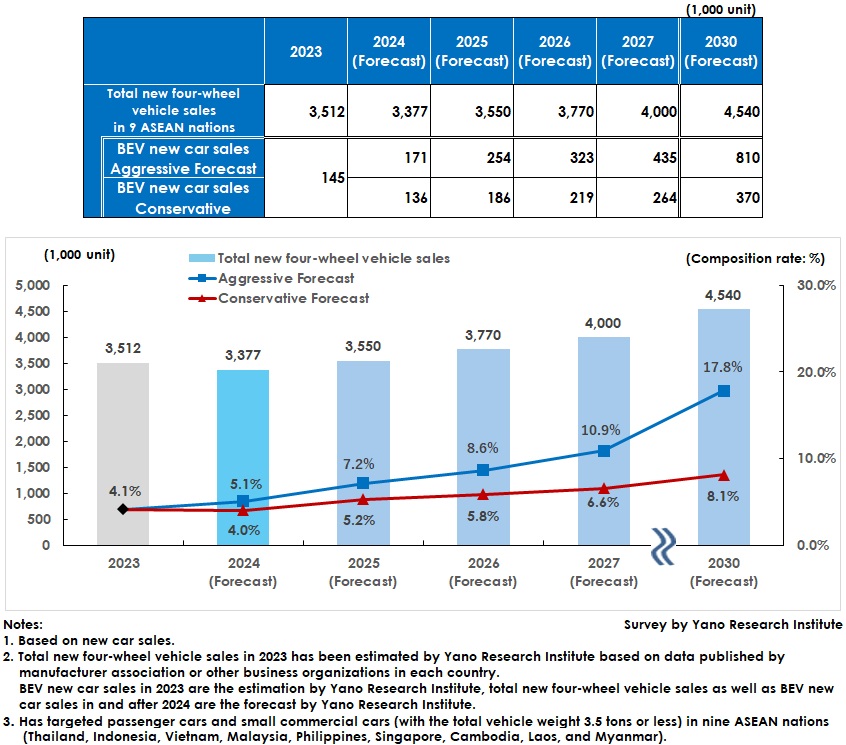

Aggressive Forecast Expects BEV Sales Rate in Nine ASEAN Countries to Grow to 17.8% by 2030

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the four-wheel and two-wheel vehicle market and the automotive battery market in nine ASEAN countries and has found out the market statuses, general conditions of battery electric vehicles (BEVs) and business strategy by major market entrants. Here discloses the forecasts on new car sales of four-wheel cars and BEVs in nine ASEAN countries until 2030.

Market Overview

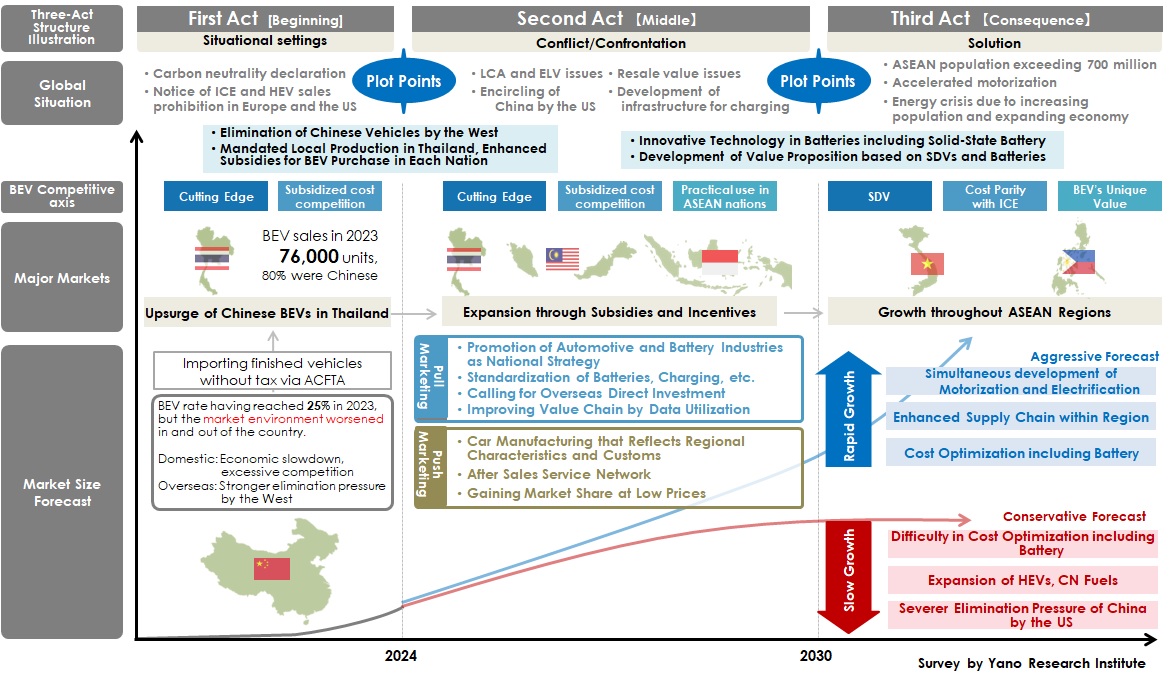

Growth of battery electric vehicles (BEVs) gathered praises for the past few years, as global carbon neutrality trends, resilience from the pandemic, and political speculations by each country fueled large-scale financial aids and investments aiming at market penetration. However, the expectations for overheated BEV boom have fallen, after facing the reality such as the end or reduction of subsidies, the bottoming out of automotive battery prices, and the gap in user friendliness from internal combustion engine vehicles. Mercedes-Benz has retracted its aim to be fully electric by 2030, GM and Ford have decided to postpone or reduce the production of EV models for pick-up trucks, Apple has gone back to the drawing board after a decade of EV development plan. Tesla, driven the BEV market, has recorded negative growth in new car sales for the second quarter (April to June) of 2024 for two quarters in a row.

On the other hand, new car sales for BEVs in nine ASEAN countries in 2023 have reached 145,000 units, with 4.1% for the BEV rate out of 3,512,000 of new four-wheel vehicle sales. Rapid growth in BEV new car sales in ASEAN owes to excess production in China having led to an influx of imported BEVs and parts as final automotive products or as knock-down production parts in Thailand, tax free via ASEAN China Free Trade Agreement (ACFTA) and by using Customs Free Zone, and to immense adoption of BEVs for its in-house taxi company by VinFast in Vietnam.

Noteworthy Topics

BEV Market Growth in ASEAN Gathers Attention Both for Unique Challenges and Expectations

Accelerated advancement of Chinese BEVs to Thailand has led Japanese automakers to be in the middle of pessimism since around 2023, as comments have been thrown at them such as “a collapse of ASEAN strongholds” or “paying for their delayed BEV development”. While it is true that the momentum of Chinese manufacturers is a threat, but it is somewhat questionable to equate the home Chinese market with the markets of ASEAN nations that can be unfamiliar for Chinese BEV manufacturers.

In fact, there were an influx of cheap Chinese bike parts into Vietnam in around 2000, which rapidly expanded the market share of two-wheel vehicles by Chinese brands, but ended up losing customers by numerous cases of irresponsible sales such as selling defective or imperfect products and providing no post-sales support. This ended up with the two-wheel market in Vietnam being reoccupied by Japanese manufacturers.

The latest Chinese BEV boom, however, differs completely from the precedence in that Chinese BEV manufacturers have technical strength developed in the fiercely competitive domestic market. Based on this prerequisite, Chinese companies must solve the challenges in the ASEAN market that are different from their own or European markets which have been the main battlefields for BEVs.

We have listed eight distinctive challenges in the ASEAN market, as follows: 1) Air conditioning needing to be in operation all the time, 2) risks of inundation, 3) smaller numbers of chargers installed and support to increase them, 4) after-sales support network, 5) soaring electricity fees, 6) to spread carbon neutral fuels, 7) subsidy support, and 8) the way of considering automobiles and habits.

On the contrary, ASEAN has its unique expectation factors: 1) Progress in motorization including spreading of four-wheel vehicles, and in related environmental regulations, 2) Influence of the US barrier on Chinese products, 3) Red supply chain, i.e., supply chain for products manufactured by Chinese companies backed by the Chinese government.

Future Outlook

When observing the details of 145,000 BEV new car sales in nine ASEAN countries for 2023, Thailand occupied almost half at 76,000 vehicles. Thailand commenced the “EV 3.0” subsidy program in 2022, which attracted the second car demand by the affluent population and reached to the purchasers in the upper-middle income class in urban areas, boosting the sales in the country. However, curtailed subsidy amount in association with the shift to the “EV3.5” program in 2024 and increased market entrants since the latter half of 2023 have caused a fiercer price competition chiefly among Chinese BEV manufacturers and a war of attrition being underway. Therefore, the Thai market has witnessed reluctant purchases due to potentially deteriorated resale values and further discount sales.

To achieve sustainable growth in automotive sales, after-sales services are important. However, because the BEVs have only been launched in the past one or two years in the ASEAN market, there still are many things unknown, such as depreciated values after being driven under the severe climate environment and road conditions, depletion levels of the battery, etc.

In such a situation, except for wealthy population and some of early adopters, BEV purchasers have not increased in the ASEAN market. Furthermore, repairing components themselves are expensive, which limits the bases available for repairing and may lead to higher insurance premium than ICE vehicles, potentially preventing BEVs from being widespread. Therefore, push marketing (development of after-sales support network, car manufacturing that reflects regional characteristics and customs, and gaining market share at low prices) is considered indispensable for BEV sales expansion in ASEAN.

Based on the above, new car sales for BEVs in nine ASEAN countries are forecasted as follows.

The aggressive forecast, that assumes the local manufacturing of BEVs to be mandated due to the governmental electrification initiative and BEV users to expand from wealthy population to middle income population, predicts 254,000 units by 2025 (7.2% of total sales of new four-wheel vehicles), and 810,000 units by 2030 (17.8%).

The conservative forecast, that assumes to take time for solving various challenges such as low-priced vehicle sales, delays in establishing post-sales service network, and shortage of charging infrastructure, anticipates 186,000 units by 2025 (5.2% of total new four-wheel vehicle sales) and 370,000 units (8.1%), affected also by reappreciation of hybrid electric vehicles (HEVs).

Research Outline

2.Research Object: Mobility companies, battery manufacturers, etc. that have developed business in ASEAN

3.Research Methogology: Face-to-face interviews by expert researchers (including online), and literature research

Strategies on Electrification of Four-Wheel and Two Wheel Vehicles and on Batteries in ASEAN

This research has targeted the automotive industry in nine ASEAN countries (Thailand, Indonesia, Vietnam, Malaysia, Philippines, Singapore, Cambodia, Laos, and Myanmar) except for Brunei with the least population.

New car sales of four-wheel vehicles and of battery electric vehicles (BEVs) have been calculated for passenger cars and small commercial cars (with the total vehicle weight 3.5 tons or less).

<Products and Services in the Market>

Four-wheel vehicles, two-wheel vehicles, automotive batteries in nine ASEAN countries

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.