No.3564

Robo-Advisor Market in Japan: Key Research Findings 2024

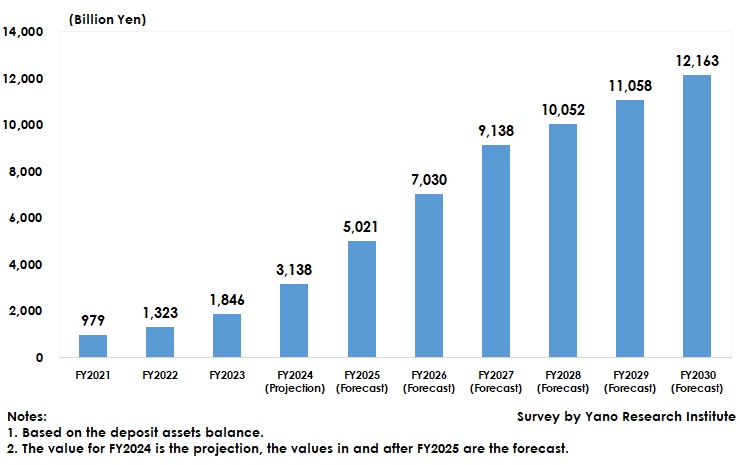

Robo-Advisor Market Size by Deposit Assets Balance to Exceed 12 Trillion Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the robo-advisor market in Japan and has found out the trend of robo-advisors and future perspectives.

Market Overview

In recent years, there has been an increase in users of robo-advisors that automatically build up a financial portfolio suitable for the financial goal and risk tolerance of an investor. The backdrop against this is diversifying financial products, causing some people in working generation to feel difficult to grasp entire information and make appropriate decisions on investment, which have raised the needs for asset building and management support. Most of robo-advisors overseas are powered by artificial intelligence (AI), but the mainstream of robo-advisors in Japan is those that do not employ AI, but those that do are emerging, recently.

The robo-advisor service providers in Japan mainly focus on supporting asset building for working generation. The service aims to provide customers an environment to form assets with an easy and stress-free method via the internet. The market shows a definite growth, as the service has been reputed for automatic allocation of a portfolio and long-term risk control, backed by the launch of new Nippon individual savings account (NISA) and by a favorable investment environment.

The robo-advisor market size for FY2023 based on the deposit assets balance has reached 1,846,000 million yen and is expected to exceed the three trillion-yen level by FY2024.

Noteworthy Topics

Progress of AI Applications

Although the mainstream of robo-advisors in Japan is those without using AI, AI-powered ones are emerging lately, pursuing improved efficiency in asset management by the combination of diversified investment with global assets included and foreseeing the market via AI. For example, if the market is likely to go for deterioration, a robo-advisor would reallocate into a highly market-cautious portfolio for controlling the operational risks, which leads to higher efficiency in asset management.

The conventional discretionary investment management has been considered as unsuitable for NISA transactions, because its proactive portfolio reallocations could use up the balance available for NISA accounts at the time of purchase or sales.

To increase affinity with NISA, robo-advisors have begun maintaining portfolio values by changing the monthly accumulation amount for each of assets accordingly, rather than rebalancing (*1) the portfolio by selling and buying the assets. Such addresses on heightening the affinity with NISA accounts and advising the investment trust development through accrual of know-how from robo-advisor operations have expanded the number of users.

*Rebalancing: the process of returning the values of a portfolio's asset allocations to the levels defined by an investment plan. Normally, it is done by selling the too-expanded parts than planned (e.g. American stocks, etc.) and buying the shrunk parts (e.g. American bonds, etc.)

Future Outlook

The robo-advisor market is projected to keep expanding steadily to exceed 12 trillion yen by FY2030, based on the deposit assets balance.

This owes not only to being able to acquire the working generation with little investment experiences that securities companies have had failed to obtain, but also to the likeliness of meeting the needs of experienced investors attracted to AI-powered robo-advisors widespread.

Hereafter, it becomes important to aim for improvement in the entire asset-building service with changes in user environment considered. To achieve this, it is necessary to provide the service that is in line with wealth management (asset management service that manages the entire asset portfolio that includes cash and other financial products, and real estates).

Research Outline

2.Research Object: Online securities companies robo-advisor service providers

3.Research Methogology: Face-to-face interviews (including online) by specialized researchers, and literature research

The Robo-Advisor Market

A robo-advisor in this research refers to the discretionary investment contract that automates the entire investment processes from selecting the appropriate financial products to deciding the timing to sell/buy, etc. It supports asset building by constituting a suitable portfolio for the investor and operates accumulation and long-term asset management. Users are mainly those who have little experience in investment in their 30s to 40s in working generation. Robo-advisors differ from conventional financial advisors in that they require lower fees for advising and allow investment from a small amount on the internet. The robo-advisor market size has been calculated based on the deposit assets balance.

<Products and Services in the Market>

Robo-advisor services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.