No.3561

Paper Packaging Market in Japan: Key Research Findings 2024

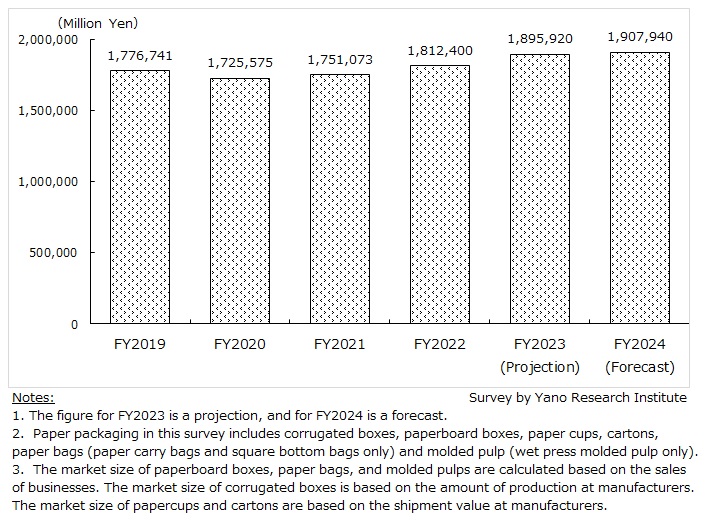

Domestic Paper Packaging Market Sized at 1.8 Trillion Yen Level / By Passing on Costs to Sales Price, The Market Foresees Continued Expansion for FY2023

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic market of paper packaging, and analyzed the market trends by packaging type and the future outlook of the market.

Market Overview

This survey targeted to six types of paper packaging, i.e., corrugated boxes, paperboard boxes, paper cups, cartons, paper bags, and molded pulp. Together with the market trends by category, we elucidated the actual demand and marketability of paper packaging.

In tandem with the recovery of economy from the COVID crisis, the demand for paper packaging made an upturn in FY2022. However, repeated price hikes of consumer products including food stemming from the surge in prices of raw materials, logistic cost, and energy declined consumer sentiment, thus affecting the demand for paper packaging used for processed foods and confectioneries. Moreover, as securing revenue became a top priority for brand owners, they wavered on introducing new packaging. The moves to switch plastic packaging to paper packaging also became stagnant.

As the negative impact of the price rise continued to affect the market in FY2023, while the sharp increase in consumer demand during the pandemic came to an end, the demand for paper packaging became sluggish, particularly for corrugated boxes, folding carton, and paper bags (square bottom bags).

Meanwhile, in terms of value, the market saw expansion as the majority of paper packaging converters passed on the incremental cost on their sales price in FY2022, which continued to impact of the market throughout FY2023. For this reason, the paper packaging market size (as a total of six categories) was estimated at 1,812,400 million yen for FY2022, up by 3.5% from the preceding fiscal year, and at 1,895,920 million yen for FY2023, up by 4.6% from the previous fiscal year, which is inconsistent with the demand trend.

Noteworthy Topics

This survey targeted to six types of paper packaging, i.e., corrugated boxes, paperboard boxes, paper cups, cartons, paper bags, and molded pulp. Together with the market trends by category, we elucidated the actual demand and marketability of paper packaging. In tandem with the recovery of economy from the COVID crisis, the demand for paper packaging made an upturn in FY2022. However, repeated price hikes of consumer products including food stemming from the surge in prices of raw materials, logistic cost, and energy declined consumer sentiment, thus affecting the demand for paper packaging used for processed foods and confectioneries. Moreover, as securing revenue became a top priority for brand owners, they wavered on introducing new packaging. The moves to switch plastic packaging to paper packaging also became stagnant. As the negative impact of the price rise continued to affect the market in FY2023, while the sharp increase in consumer demand during the pandemic came to an end, the demand for paper packaging became sluggish, particularly for corrugated boxes, folding carton, and paper bags (square bottom bags). Meanwhile, in terms of value, the market saw expansion as the majority of paper packaging converters passed on the incremental cost on their sales price in FY2022, which continued to impact of the market throughout FY2023. For this reason, the paper packaging market size (as a total of six categories) was estimated at 1,812,400 million yen for FY2022, up by 3.5% from the preceding fiscal year, and at 1,895,920 million yen for FY2023, up by 4.6% from the previous fiscal year, showing a conflict with the demand trend.

Now that the society is back from the pandemic state, the movement of free plastic/plastic-to-paper is expected to resume in the packaging market in FY2024. Despite stagnations due to surging costs, the priority of “eco-friendliness” in packaging development have dramatically increased in the last couple of years. Today, brand owners focus not only to the “alteration” of packaging materials from fossil-based plastic to plant-based materials, but also to the “resource circulation” (recycling).

Under the circumstances, as plastic packaging suppliers have also been developing “ecologically considerate” items that cater to the needs of brand owners, a range of sustainable packaging has been widened. To compete with plastic packaging, there is a pressing need for paper converters to come up with ecological value that is not just using recyclable plant-based materials.

In response to the situation, new attempts are witnessed in the last few years, where some business operators engage in initiatives that aims to establish ‘collect & recycle’ scheme for paper cups and cartons. To compete against plastic packaging, we believe that further development of ecological value is a theme that paper packaging converters should address.

Future Outlook

From FY2024, population decline (declining birthrate and aging society) and the trend of reduced packaging may hamper the growth. Still, the market is expected to grow moderately as it is underpinned by the stable demand for corrugated boxes (that holds a little less than 60 percent of the market share) and the plastic-to-paper movement fuels the demand.

The paper packaging market (as a total of six categories) is projected to attain 1,907,940 million yen in FY2024 (up by 0.6% from the previous fiscal year). We also estimate that the market size will expand by 10%-plus from the market size of FY2022.

Research Outline

2.Research Object: Paper packaging converters

3.Research Methogology: Face-to-face interviews by our expert researchers (including online), survey via telephone, mailed questionnaire, and literature research.

What is Paper Packaging?

In this report, paper packaging includes six types of packaging: corrugated boxes, paperboard boxes, paper cups, cartons, paper bags, and molded pulp. Note that paper bags indicate square bottom bags and carry bags only. Likewise, molded pulp refers only to wet press molded pulp.

<Products and Services in the Market>

Corrugated boxes, paperboard boxes, paper cups, cartons, paper bags (paper carry bags, square bottom bags), molded pulp (wet press molded pulp)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.