No.3354

Apparel Market in Japan: Key Research Findings 2023

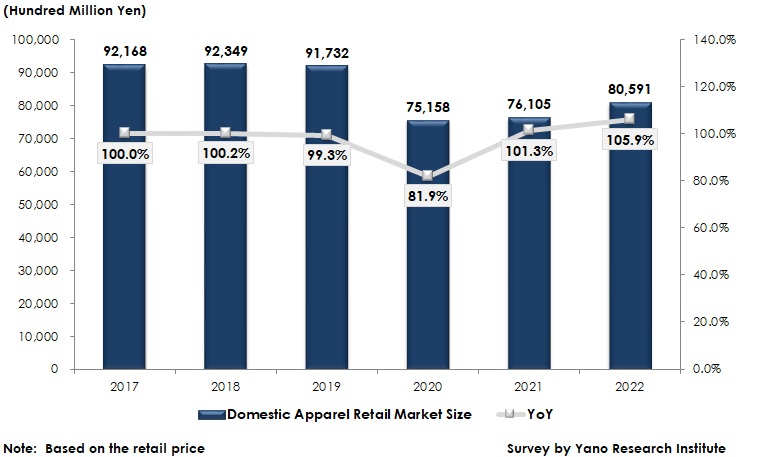

Domestic Apparel Retail Market Size in 2022 Rose to 8,059.1 Billion Yen, 105.9% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic apparel market and found out the market trends by item and by sales channel, and the status of apparel industry including apparel manufacturers and retailers.

Market Overview

The domestic apparel retail market size (total value of men’s, women’s babies’ children’s apparel items) in 2022 reached 8,059,100 million yen, 105.9% on YoY, exceeding the previous year results for two consecutive years.

By sales channel, department stores and specialty stores showed marked recovery in their physical stores. This seemed to be because the lift of behavior restrictions and self-restraint activities amid the corona crisis expanded the once-stagnant outing opportunities to use physical stores at which demand for replacement and for purchasing new items spurred. Flow of people particularly in urban areas increased to fuel the sales of expensive items at department stores.

On the other hand, ecommerce (online retailing) that had thrived during the corona crisis slowed down the growth, as the demand somewhat calmed down, partly because of increased purchase demand at physical stores.

Noteworthy Topics

Overall Apparel Industry Trend in 2022

Since 2021 major apparel companies have focused on strengthening OMO (Online-Merge-Offline) approach to mutually attract customers between online stores that have taken root amid the pandemic and physical stores.

Apparel companies were mandated to close the stores or shorten the business hours during behavior restrictions and self-constraint activities due to the pandemic, which significantly shrank physical store demand though flourished ecommerce. In such a situation, major apparel companies, that conventionally had not thought about linking physical and electronic stores for product sales, started focusing on preventing customers from leaving by sending physical store customers to ecommerce through comfortable purchasing environment, thereby to expand and to stabilize the sales.

Apparel companies have positioned the OMO approach as a significant strategy for survival, as they face declining and aging population with smaller numbers of children.

Future Outlook

The domestic apparel retail market size (total value of men’s, women’s babies’ children’s apparel items) is expected to recover to the pre-COVID level by around 2025. Now that COVID-19 has reclassified as the class 5 infectious disease, no behavior restrictions have become required, which is helping apparel companies to improve the once declined sales as demand for seasonal or occasional items (including celebration) and outing demand are rising. This tendency is projected to continue for a short term, fueling the market to approach the pre-corona level in about two-year period.

Meanwhile, in a long-term perspective, the waning and aging population with smaller numbers of children is likely to gradually shrink the market after 2025. Still, if the raise of unit selling price due to the recent product price rise can supplement the decreasing purchase volume stemming from declining population and falling consumption caused by price rise, the market size by value may temporarily grow, despite its declining tendency in a long run.

Research Outline

2.Research Object: Apparel manufacturers that manufacture products that belong to one or more of following apparel categories: men’s, women’s, babies’, and children’s), retailers (department stores, mass merchandisers, specialty stores, etc.,) business organizations, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, mailed questionnaire, and literature research

The Apparel Retail Market

The apparel market in this research targets the companies that belong to the following apparel categories: overall apparel, men’s, women’s, babies’, and children’s. The market size is calculated based on the retail price of apparel products at above-mentioned companies. No sales by secondary market such as secondhand shops are included.

<Products and Services in the Market>

Men’s apparel (suits, jackets/blazers, coats, slacks, trousers/pants, shirts), women’s apparel (suits, formal wear, dresses, jackets/blazers, coats, trousers/pants, shirts/blouses), others (knit products [sweaters, T-shirts, polo shirts, etc.,], denim items, babies’/children’s items, underwear, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.