No.3154

Beverage Co-Packer (Contract Packer) Market in Japan: Key Research Findings 2022

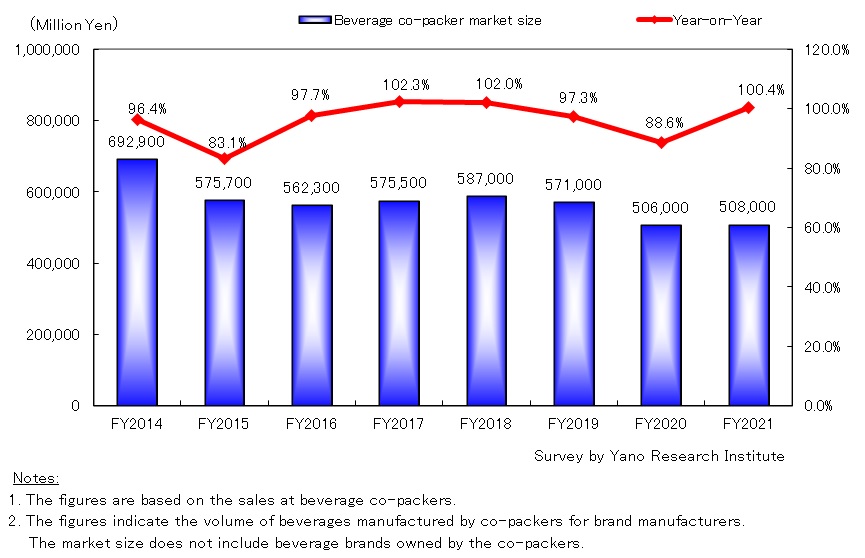

Beverage Co-Packers Still Grappling with Market Downturn Triggered by Pandemic

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic beverage co-packer (contract packer) market, and found out the trends by area, the trends by product category, the trends at market players, and future perspectives.

Market Overview

Size of the domestic beverage co-packer market based on the sales at beverage co-packers dropped to 506,000 million yen for FY2020, 88.6% of that of the previous fiscal year. Subsequently, the market stayed at almost the same level to 508,000 million yen for FY2021, 100.4% year-on-year basis.

Not only the business of beverage manufacturers (referred to as “brand owners” hereafter) but also the business of beverage contract manufacturers (“co-packers”) has been affected negatively by the outbreak of COVID-19 in FY2020. Although the demand for beverages has turned for the better in the following fiscal year, due to the time lag between the brand owner's production plan and the consignment to the co-packer, the co-packer's market has been slower in recovery. Outlook for the beverage market and the beverage co-packer market is still dim.

Noteworthy Topics

Brand Owner’s Production Strategy

Brand owners are explicitly demonstrating their emphasis on profitability in recent years. The tendency has become apparent during the pandemic, particularly in securing profits from core brands, which they can generate stable sales. As production in large lots is required to improve production efficiency and prevent a decline in factory utilization rates, the volume of consignments to beverage co-packers declined.

Meanwhile, because of the market uncertainty, brand owners, mainly leading soft drink manufacturers, decelerated capital investments and construction of new plants, despite their vigorous attempts before the outbreak of the pandemic.

As the beverage market is anticipated to shrink in the medium to long term, the beverage co-packer market is likely to follow the route. As much as the brand owners and co-packers both want stable operation of their manufacturing plants, since the demand for contracted production fluctuates in accordance with the changes in production strategies at brand owners, co-packers are more vulnerable. Besides the fact that brand owners have the initiative, they are increasingly moving toward in-house manufacturing. The situation may lead to the decline of co-packers' total contracted volume in the medium to long term.

Nonetheless, production by co-packers has significant meaning in brand owners’ business strategies. As industry observers expect brand owners to cutdown the cost of logistics further, they may pursue dispersed manufacturing to meet the demand in each area. Should the situation occur, there is a chance that co-packers see the rise in the total contracted volume.

Research Outline

2.Research Object: Beverage contract packers (co-packers) and beverage manufacturers (brand owner companies)

3.Research Methogology: Face-to-face interviews by the specialized researchers (including online interviews), survey via telephone/email, and literature research

What is the Beverage Co-packer Market?

In this research, a beverage co-packer indicates a company that produces beverages for clients (beverage brand owners) on a contract basis. The beverage co-packer market indicates the sales volume of beverages manufactured by co-packers. The market size does not include sales of brands that are owned by the co-packers.

<Products and Services in the Market>

Carbonated beverages, beverages with fruit juice, tea drinks, coffee drinks, mineral water, soy milks, vegetable juices, functional sports drinks, dairy beverages, and other soft drinks.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.