No.3140

Insurance Brokerage Shop Market in Japan: Key Research Findings 2022

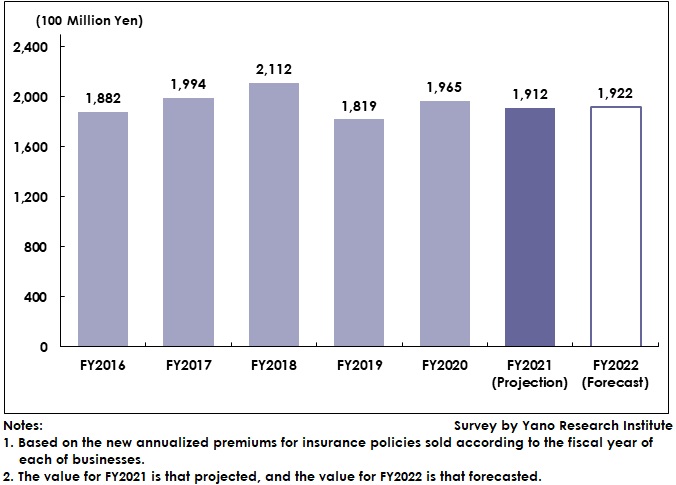

Insurance Brokerage Shop Market for FY2021 Projected to Decrease by 2.7% to 191,200 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic insurance brokerage shop market, and found out the market trends, the market size (new annualized premiums), number of new contract deals, and the future outlook.

Summary of Research Findings

Partly because of new coronavirus crisis, new deals and new contract amount of life insurance policies in FY2019 declined, which also reduced new annualized premiums*. The insurance brokerage shop market, with face-to-face sales having used to be the mainstream, was significantly affected in FY2019. The market upturned in FY2020, because of in addition to increase in the number of online consultation users after responding to the demand for a contactless customer service, the resume of customer-attended events under infection-prevention measures.

In FY2021 despite the lift for activity restrictions, the influence of lingering infection crisis remained to have prevented the customers from visiting insurance brokerage shops and encouraged the integration and abolishment of those shops. While there were some insurance brokerage shops that enjoyed both increase in sales and profits, more shops suffered from decreased sales and profits, further distinguished the gap. As a result, the insurance brokerage shop market (new annualized premiums) for FY2021 was projected to have declined by 2.7% to 191,200 million yen.

For FY2022, while the customer behavior continues to have changed amid the COVID-19 calamity, each company tries to refine its hybrid sales styles that have added a contactless online consulting service into face-to-face sales that can be attained by door-to-door style and shop style. Also, companies press ahead with promoting insurance policies for young generations and families to earn new deals, or appeal the policies by focusing on longer-life risks, such as those that can form assets foreseeing the future after being aged, etc. Still, visits by customers have not recovered enough, as the market size for FY2022 is projected to be up by 0.5% to 192,200 million yen, with the number of new deals at 1,900 thousand.

*A statistics material by the Life Insurance Association of Japan

Noteworthy Topics

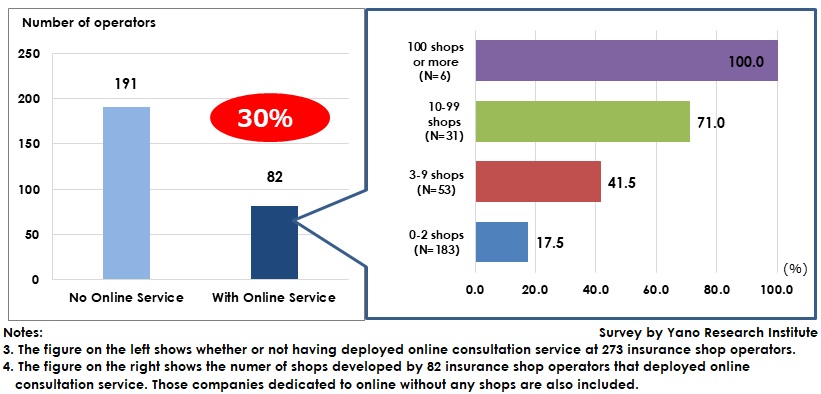

Rate of Companies Deploying Online Consultation Service Expanded from 20% to 30% Over a Year, Some Introducing Avatar

A new attempt that spread by the COVID-19 calamity is “an online consultation service” which is contactless. As of August 2022, of 273 insurance-shop operating companies, 82 companies (30.0%) have introduced an online consultation service. In the previous survey in August 2021, the deployment rate was 20%, indicating that the rate has increased by about 10 points. While a certain level of face-to-face sales is potentially needed in insurance sales, an online consultation service i.e. a newly diversified way of consulting, has shown its possibility to supplement new shop-visiting or consultation customers that have decreased significantly.

When observing the deployment rate of an online consultation service by the number of shops those companies operate, while all six operators of 100 or more of insurance brokerage shops have already deployed the service (100.0%), the deployment rate at companies of 0-2 shops remained at 17.5% (32 companies), indicating there is gap between companies by the number of shops they operate. On the other hand, it shows that the service has been introduced regardless of the number of shops to operate, from small local companies with small number of shops to large, nationwide companies.

Not to mention AI-utilized chat bot functions, an avatar-utilized consultations service has also been introduced at some companies, which is an attempt to improve customer experiences.

Research Outline

2.Research Object: Conventional life-insurance companies, online insurance companies, insurance brokerage shop operators, joint agencies operating online insurance and insurance-related websites, joint agencies operating door-to-door sales insurance, companies that have insurance solicitation, newly entered companies, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

What is an Insurance Brokerage Shop?

An insurance brokerage shop in this research refers to a shop of an insurance broker that has made alignments with multiple insurance companies. The market size is calculated based on the new annualized premiums for insurance policies sold at the shop according to the fiscal year of each of businesses.

<Products and Services in the Market>

Life insurance and non-life insurance for individuals, Life insurance and non-life insurance for corporations

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.