No.3112

InsurTech Market for Life Insurance in Japan: Key Research Findings 2022

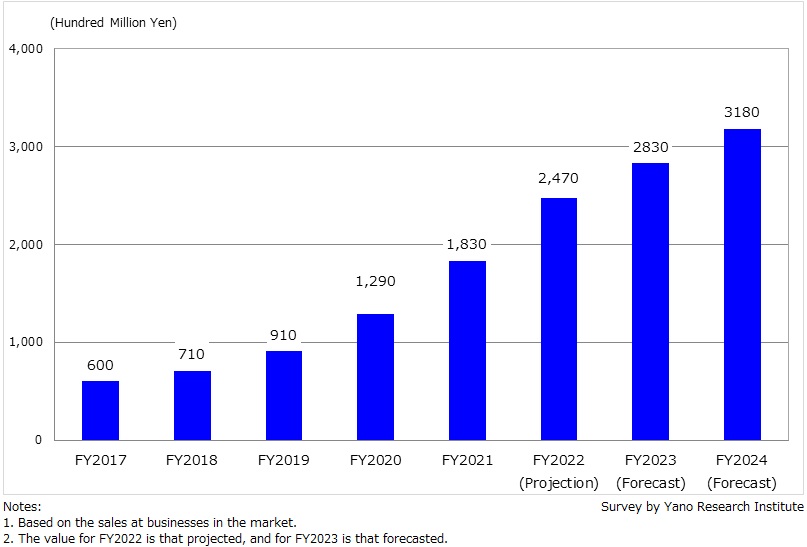

Domestic InsurTech Market Size for FY2022 Expected to Rise by 34.9% YoY to 247,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic InsurTech market for life insurance, and found out the current status, trends by category, and future outlook.

Market Overview

The domestic InsurTech market in this research is calculated based on the sales at IT vendors and startups in the market developing new insurance products and services and supporting the streamlining and upgrading of business processes.

The domestic InsurTech market size in FY2022 is expected to rise to 134.9% of that of previous fiscal year to attain 247,000 million yen. For insurance products for individuals, health promotion services for women have begun being enhanced, as life insurance companies one after another have collaborated with startups, affected partly by infertility treatment started being covered by insurance. Meanwhile, as for products and services geared to corporations, those products and services aiming for health & productivity management for SMEs and health promotions for all company members including company managers have gradually started being released.

When observing each environment surrounding InsurTech, first of all, while no particular changes in terms of legislation have been shown, the trend of PHR is worth focusing, because the promotion of PHR has been stipulated in the “Basic Policy on Economic and Fiscal Management and Reform 2022”, which has caused the preparation for it to rapidly be underway, including the launch of PHR Service Business Association (tentative name) in June 2022.l

Secondly, in terms of supporting environment, as no dramatic changes have been observed from the year before, building and expansion of proactive supporting environment remains being expected.

Lastly, in terms of technology, use of cloud has been gradually underway mainly at major life insurance companies while making a good balance with on premise configuration. On the other hand, open API is announced by limited life insurance companies, which indicates that each company is yet to determine the potential of blockchain and Metaverse.

Noteworthy Topics

InsurTech Expanded Not Only in Insurance Products & Services for Individuals but Also Those for Corporations

Conventionally, many of insurance products and services for corporations have been geared for SMEs. Namely, they have the nature to be used for business continuation measures such as for working capital, business continuation capital, inheritance measures, etc. Since around 2019, however, there emerged businesses offering insurance products and services covering from health promotion to early detection and early intervention for corporations, which are increasing.

Such products and services can be categorized into following three: Those for corporation, for corporate managers, and for employees.

First, among those services for corporation, in addition to help obtaining the “Health and Productivity Management Award” by METI as well as to address diagnosing and practicing health and productivity management, a service to help appoint industrial physicians has emerged. As those corporations certified as those that practice health and productivity management are to gain an advantage of being socially praised, such services are increasing.

Secondly, as for those services for corporate managers, advent of insurance to cover disease prevention, health promotion, early detection and even post-treatment support for corporate managers and executives is observed, as the enterprise operation as a whole can be affected if any contingency occurs to corporate managers or executives. In addition, new services including private nursing care for corporate managers have also emerged.

For employees, health promotion insurance geared to corporate managers and employees has been released. Service providers elaborate to offer various services including web-based management of medical check-up results as well as exercise amount management through the linkage with wearable terminals, and those services with gamification (game element) such as sharing goals with all employees and having fun while engaging in health management.

Future Outlook

The domestic InsurTech market size is expected to attain 318,000 million yen in FY2024.

For the development of insurance products and services, in addition to increase in those products with wider coverage from health promotion to prevention of progression of diseases for individuals, major life insurance companies are likely to be proactive in building and expanding the ecosystem with healthcare-related companies and startups. Aiming to attract the young generation, acquisition or launch of small-amount and short-term insurance companies have been in progress mainly by major life insurance companies, which have led to commence developing small-amount and short-term insurance products, some of which becoming noteworthy.

On the other hand, streamlining of business processes that used to be observed among conventional major life insurance companies, has spread to mid-size life insurance companies, which is likely to make automation of business procedures and quicker billing processing to be rapidly in progress.

Research Outline

2.Research Object: Domestic Life Insurance Companies, Small Amount & Short Term Insurance companies, Siers, and InsurTech Ventures, and etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone and email, and literature research

About InsurTech for Life Insurance

InsurTech is a coined word from insurance and technology. It means life insurance-related services using IT that enable to develop new insurance products and services and/or to streamline and upgrade business processes that had not been available at conventional life insurance companies.

InsurTech in this research can be categorized into the following 8 categories: 1) Development of personalized health-promotion insurance products and services, 2) Disease control program, 3) AI-used insurance consultation service/AI-used insurance sales support service, 4) Automation of underwriting using AI, 5) Tracking services from recommending to seek a diagnosis to an actual diagnosis, or tracking a process until being diagnosed when informed of abnormality, 6) An after sales service for contractors and their families, 7) Automation of assessment utilizing AI and/or BRMS (Business Rule Management System), and 8) Infrastructure-related services (insurance cloud services/API/blockchain*.)

*A blockchain is a database of recording and authenticating the transactions for transfer of rights by utilizing computers on the P2P network that links the users.

About InsurTech Market for Life Insurance Domain

The domestic InsurTech market in this research focuses on IT vendors and startups that develop new insurance products and services or support streamlining and upgrade business processes that was not offered by conventional insurance companies. The market size is calculate based on the sales at market players.

<Products and Services in the Market>

Development of personalized health-promotion insurance products and services, Disease control program, AI-used insurance consultation service/AI-used insurance sales support service, Automation of underwriting using AI, Tracking services from recommending to seek a diagnosis to an actual diagnosis, or tracking a process until being diagnosed when informed of abnormality, An after sales service for contractors and their families by means of applications and other methods, Automation of assessment utilizing AI and/or BRMS (Business Rule Management System), and Infrastructure-related services (insurance cloud services/API/blockchain*.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.