No.3006

Impact Analysis on Financial Services Intermediary Business in Life Insurance Industry in Japan: Research Findings 2022

Potential Expansion of Financial Services Intermediary Business Depends on Alleviation and Solutions of Regulatory Challenges from Aspects of Institutions, Products, Distribution Channels, and IT Infrastructure

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the current status of domestic financial services intermediary business, and made clear of potential expansion of financial services intermediary business by finding out some limiting factors that prevent expansion and conditions that boost the expansion.

Summary of Research Findings

After legislation for comprehensive financial consulting services that enable one-stop intermediary services for all financial categories of banking, securities and insurance through a single registration, the law became effective in November 2021, establishing financial services intermediary business. However, as of May 2022, only three companies have registered as financial services intermediary business.

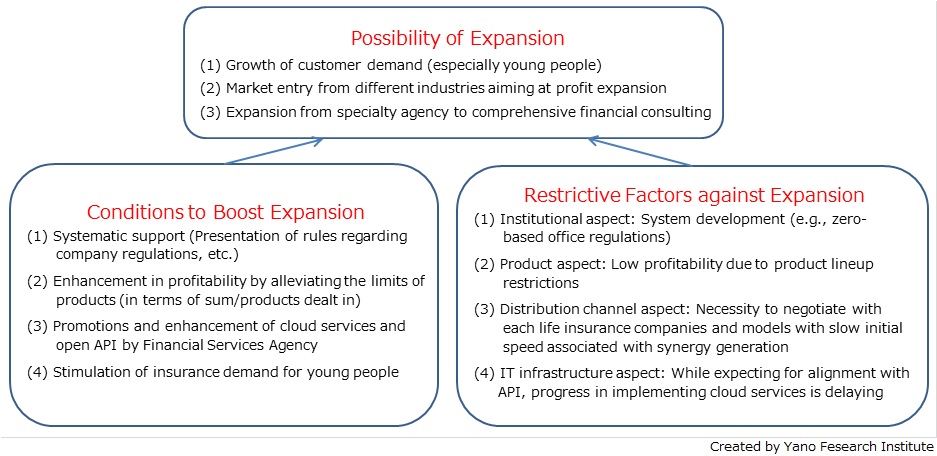

The research has found out some factors for potential expansion of financial services intermediary business shown in the above diagram. There also are some restrictive factors preventing expansion considered from the following four aspects: 1) institutional aspect, 2) product aspect, 3) distribution aspect, and 4) IT infrastructure aspect.

First of all, in regard to 1) institutional aspect, while regulations at each company must be generated and organized for each category as well as those in common, in addition for them to be principles-based, there are many things to be considered such as those regulations being obliged to conform to those established by Japan Financial Service Intermediary Business Association, which is quite a significant obstacle.

Next, regarding 2) product aspect, there is an issue of strictly limited products allowed to handle at the moment. In particular, in the life insurance category, the products are limited to less than 10 million yen, allowing the businesses to have small benefit from insurance intermediary business unless having a strong sales channel.

Thirdly, in terms of 3) distribution channels, unlike the existing insurance agencies, financial services intermediary businesses must negotiate with insurance companies on their own to have insurance products wholesaled, and they also need to explore the synergy effect between the two, which is costly.

Lastly, from 4) infrastructure aspect, insurance companies are expected to link API with financial services intermediary businesses from the perspectives of efficiency and of the rules of private information protection. However, they have not disclosed their API, and furthermore, system development costs must be taken into account, as cloud migration has gradually started.

* A principles-based approach seeks to set principles that specify the intention of regulation, rather than set rules detailing requirements of each business.

Noteworthy Topics

Alleviation of Regulatory Factors Increases Potential Expansion of Financial Services Intermediary Business

Currently, financial services intermediary business has limited products to handle, but if such limitation is alleviated, and if the environment becomes profitable, market entry from different industries is expected.

The use of this business as one of the methods to provide added values especially at those companies that have platforms of household accounting apps, cloud accounting software, welfare outsourcing, etc. and those businesses with many users (employees) may find themselves to acquire new customers including young people whom not able to obtain with the conventional approaches at existing life insurance companies.

In addition, those insurance agencies in the current joint agency system (multiple agencies dealing in common insurance products from multiple insurance companies) may develop into comprehensive financial consulting services by obtaining financial licenses other than insurance.

The Financial Services Agency and the Japan Financial Services Intermediaries Association are said to have begun studying the establishment of a format for internal rules and regulations, including those principles-based, to help eliminate a limiting factor for new entries, which is promising. Although the restrictive factors in terms of distribution channels will be costly in finding synergy effects, they are expected to be resolved as the number of use cases increase. As for the limiting factors in IT infrastructure including API linkage, they can be alleviated by progress of utilization of API, associated with cloud migration.

Research Outline

2.Research Object: Life insurance companies, a financial services intermediary company, a company considering entering financial services intermediary business

3.Research Methogology: Face-to-face & online interviews by the specialized researchers, survey via telephone & email, and literature research

About Financial Services Intermediary business

In Japan, financial services intermediaries conventionally needed to obtain separate licenses for each of the four following tasks: deposit brokerage, securities brokerage, insurance brokerage, and money lending brokerage.

In such a status, legislation was in progress for comprehensive financial consulting services that enable one-stop intermediary services for all financial categories of banking, securities and insurance through a single registration.

Based on the report for Financial System Council “Working Group for Legislation of Settlement and for Financial Services Intermediary Business” announced in December 2019, “Draft for Revision of Laws for Financial Product Sales to Improve Convenience of Financial Services for Users and for Protection” was enacted at Diet session in June 2020, and financial services intermediary business became effective in November 2021.

<Products and Services in the Market>

Financial services intermediary business

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.