No.2659

Customer Satisfaction Survey for Leading Shopping Centers in Japan 2020

TAMAGAWA TAKASHIMAYA SC Scored Highest in Consumer Satisfaction Survey for Leading Shopping Centers 2020

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the current status/strategy/future outlook of developers and business operators of leading shopping centers nationwide, the assessment of developers and property management business by the tenant companies, and the facts regarding consumers’ use of shopping centers. This press release announces analytical results of the visiting consumer satisfaction survey for 50 leading shopping centers nationwide.

Summary of Research Findings

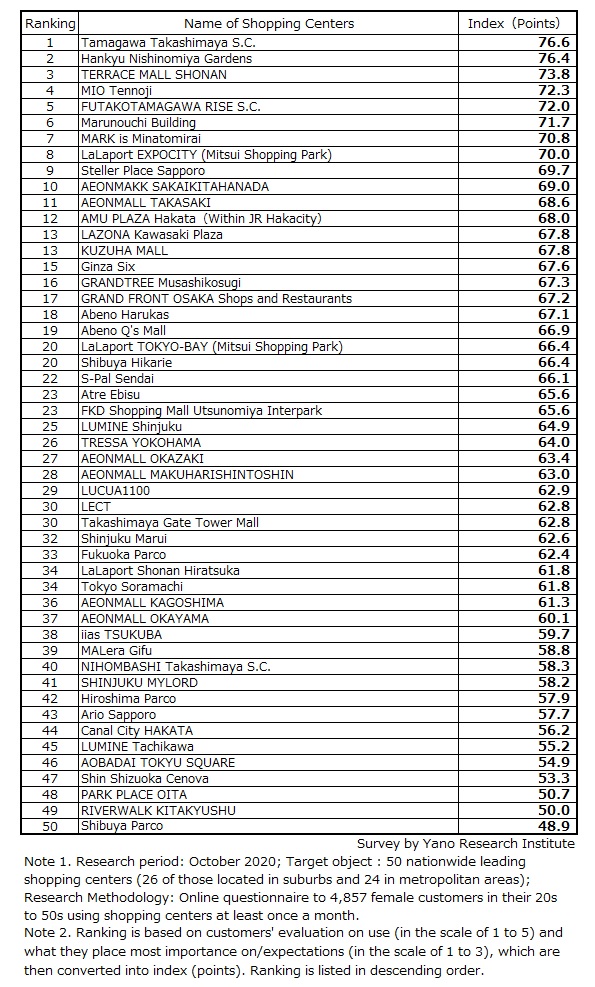

In this research, consumer satisfaction survey was carried out to 4,857 female consumers nationwide in their 20s to 50s, to measure their engagements at 50 leading shopping centers (referred to as SC hereafter) chosen at random across the country based on sales, gross leasable area, and topicality. From the scores on satisfaction of use (in the scale of 1 to 5) and what they most place importance on / expectations (in the scale of 1 to 3), current satisfaction level is indexed (scored) as the level of overall customer satisfaction. Based on the index, SC are ranked and listed in descending order.

This survey revealed that TAMAGAWA TAKASHIMAYA SC scored highest in overall consumer satisfaction, gaining the edge over Hankyu Nishinomiya Gardens, to whom TAMAGAWA TAKASHIMAYA fell behind in 2016 and 2018. The second in place is Hankyu Nishinomiya Gardens, followed by TERRACE MALL SHONAN, MIO Tennoji, and FUTAKOTAMAWAWA RISE SC. In the last survey, TERRACE MALL SHONAN ranked 9th, and FUTAKOTAMAWAWA RISE SC came 29th.

Noteworthy Topics

Utilization of Space for Local Contribution is Essential to Survive in the “With Corona” and “Post Corona” Era

The SC highly ranked in the consumer satisfaction survey enjoys large facility area and nice locations. Competitive SC is located near train stations, which provides good access for consumers using public transportation, or located in the region with high level of convenience, and has relatively large facility area. However, throughout the country, there aren’t many SC that have such an excellent commercial environment or condition for location. What consumers most place importance on is whether the “SC has the tenants they would like to visit”. This has two aspects for SC developers and business operators: for one, they must correspond to end-users’ existing demand; and for another, they must pitch to create new demand. The latter is literally a strategy to stimulate potential demand and to create new market, which brings out uniqueness that differentiates the SC from the other.

Through the era of “With-Corona” and “Post Corona”, it isn’t easy for SC developers and business operators to keep business stable only with the rents payed by their tenants. A perspective to contribute to local community by utilizing SC space will be essential going forward. The SC developers and business operators are asked to be flexible, so as to be adaptable to potential demands and changes that end users are unaware of.

Research Outline

2.Research Object: 4,857 female consumers in their 20s to 50s nationwide

3.Research Methogology: Online questionnaire

In this research, consumer satisfaction survey was carried out to 4,857 female consumers nationwide in their 20s to 50s, to measure their engagements at 50 leading shopping centers (referred to as SC hereafter) chosen at random across the country based on sales, gross leasable area, and topicality. From the scores on satisfaction of use (in the scale of 1 to 5) and what they most place importance on / expectations (in the scale of 1 to 3), current satisfaction level is indexed (scored) as the level of overall customer satisfaction, and based on the index, SC are ranked in descending order. Comparative analysis based on location, characteristics, and development strategy of SC with high customer satisfaction scores is also provided.

Shopping center is a facility planned and developed by developers, and it should be in accordance with the requirements defined by Japan Council of Shopping Centers as follows:

1. Retail spaces [gross leasing area for retailers] should not be less than 1,500square meters.

2. Shopping center tenants should include, apart from anchor tenants, at least 10 tenants.

3. For anchor tenants, their floor area should not exceed 80% of the entire shopping center area. However, this restriction does not apply if the space of the retail businesses among the other tenants occupies 1,500 square meters or more.

4. An association such as a Tenant Board (Store Association) or the like should be in place in order to conduct activities of common interest such as advertising and jointly held special events.

<Products and Services in the Market>

Shopping center, developers and business operators of shopping centers, shopping center tenants, consumers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.