No.3968

Health Checkup & Comprehensive Medical Examination Market in Japan: Key Research Findings 2025

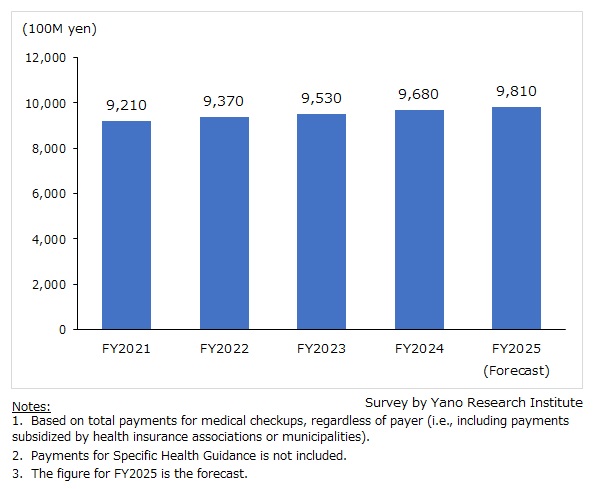

Domestic Health Checkup & Comprehensive Medical Examination Market Projected to Rise by 1.3% YoY to 981 Billion Yen in FY2025

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the health checkup and comprehensive medical examination market in Japan and found out the market conditions and future perspectives.

Market Overview

In this research, the health checkup and comprehensive medical examination market encompasses a broad range of screening programs. These include municipality-provided health checkups for residents; periodic health checkups provided by employers under the Industrial Safety and Health Act; health checkups conducted under the Maternal and Child Health Act and the School Health and Safety Act; Specific Medical Checkups targeting individuals insured under public health insurance schemes at ages between 40 and 74; cancer screening optionally offered as part of municipality-provided resident health checkups; and statutory health checkups for elderly persons covered by the Medical Care System for the Elderly Aged 75 and Over. Optional comprehensive medical examination (commonly referred to in Japan as Ningen Dock, a full-body health checkup program) is also included in the scope of this market.

Traditionally, Japan’s national policy has emphasized preventive health, with the objective of balancing the containment of healthcare expenditures and the extension of healthy life expectancy. In line with this approach, individuals have been encouraged to undergo pre-symptomatic health checkups on a voluntary basis and to modify lifestyle behaviors to prevent lifestyle-related diseases. For statutory health checkups in particular, the government has positioned the medical examination participation rate as a key performance indicator (KPI) since FY2017, publicly disclosing participation rates by insurer and operating the system through a combination of incentives and disincentives. This policy framework is grounded in a “monitor, compare, and incentivize” approach designed to drive behavioral change among insurers and patients.

Under the fourth phase of the Specific Medical Checkups and Specific Health Guidance program commenced in FY2024, insurers are required to set target participation rates. For example, the Japan Health Insurance Association (JHIA / Kyokai Kenpo) has set a target of 70%, while company-based Health Insurance Societies have set targets as high as 90%. However, actual participation rates remain well below these benchmarks. As a result, challenges persist in establishing a sustainable mechanism to promote medical checkups. Key issues include addressing regional and insurer-based disparities, introducing digital systems that enable workflow-based patient* flow designs to guide individuals through examinations in a predefined sequence, applying behavioral science approaches such as nudge theory to encourage participation, and strengthening coordination between municipalities and corporations.

Noteworthy Topics

Optional Tests Commonly Added to Comprehensive Medical Examination

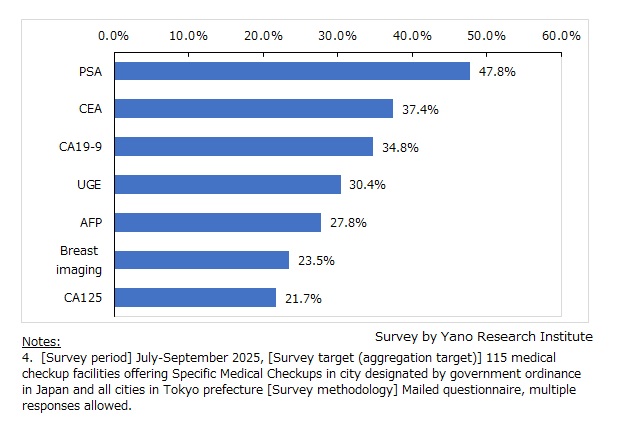

Medical checkup facilities have been introducing optional add-on tests to better address the needs of individuals undergoing comprehensive medical checkup (Ningen Dock), with the aim of differentiating themselves from competing facilities and increasing patient volumes. To assess the current situation, a questionnaire survey was conducted among medical checkup facilities offering Specific Medical Checkups (targeting individuals insured under public health insurance schemes at ages between 40 and 74) between July and September 2025, to which 115 facilities responded.

In response to a question on commonly offered add-on tests (multiple responses allowed), the PSA test ranked highest, followed by the CEA and CA19-9 tumor marker tests. Other relatively popular optional tests included upper gastrointestinal endoscopy (UGE), additional tumor marker tests, gynecological examination, and cranial nerve testing.

With respect to newly introduced add-on tests, risk assessment services for cancer, cerebral infarction, cardiovascular and cerebrovascular diseases, and dementia are gaining traction. In recent years, AI-based analytical services that project future health conditions using electrocardiogram data and medical checkup histories have also attracted increasing attention.

In addition, when asked about priority areas going forward, a notable proportion of respondents selected “comprehensive medical examination (Ningen Dock)”, indicating a growing inclination to shift from single-test offerings toward more comprehensive screening services.

*Translator’s note: In this press release, patient refers to someone getting a checkup, including healthy and asymptomatic persons.

Future Outlook

The domestic health checkup and comprehensive medical examination market is estimated at 968 billion yen in FY2024, representing 101.6% of the previous fiscal year (based on total payments for medical checkups, regardless of payer). Although the number of patients* declined during the COVID-19 pandemic, appointments and patients* rebounded in FY2022 and have continued to grow steadily. Underpinned by the resurgence of wellness-oriented consumer behavior and operational restructuring at healthcare facilities, the market has entered a phase of stable growth.

Backed by national policies aimed at extending healthy life expectancy and prevent lifestyle-related diseases, as well as by stronger collaboration among companies, health insurance associations, and municipalities, the medical examination rate is expected to increase moderately. While the population eligible for health checkups is projected to decline over the long term, improvements in examination rate and the expansion of value-added services are expected to underpin continued, gradual growth in the domestic health checkup and comprehensive medical examination market.

Research Outline

2.Research Object: Nationwide medical facilities providing health checkups, related businesses, insurers, municipalities, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, mailed questionnaire to the facilities providing health checkups, and literature research

The Health Checkup & Comprehensive Medical Examination Market

In this research, the health checkup and comprehensive medical examination market encompasses a broad range of screening programs. These include municipality-provided health checkups for residents; periodic health checkups provided by employers under the Industrial Safety and Health Act; health checkups conducted under the Maternal and Child Health Act and the School Health and Safety Act; Specific Medical Checkups targeting individuals insured under public health insurance schemes at ages between 40 and 74; cancer screening optionally offered as part of municipality-provided resident health checkups; and statutory health checkups for elderly persons covered by the Medical Care System for the Elderly Aged 75 and Over. Optional comprehensive medical examination (commonly referred to in Japan as Ningen Dock, a full-body health checkup program) is also included in the scope of this market.

<Products and Services in the Market>

Statutory health checkups (periodical checkups, specific medical checkups, specific health guidance, etc.) optional checkups (comprehensive medical examinations, specific medical examinations, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.