No.3954

Building Management Market in Japan: Key Research Findings 2025

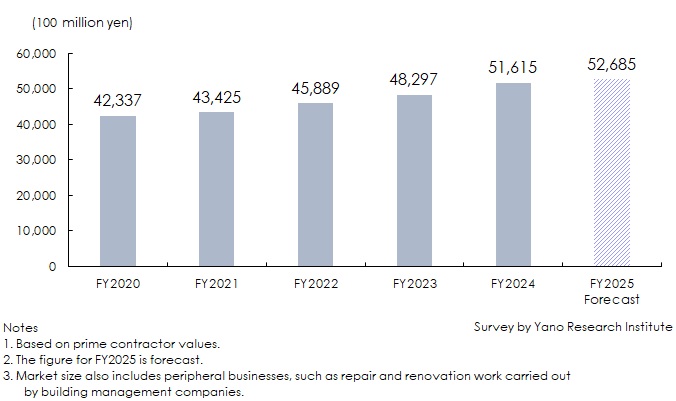

Building Management Market in Japan is Estimated at 5.1615 Trillion Yen in FY2024, 106.9% of Previous Fiscal Year’s Size

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the building management market in Japan. The survey revealed the trends in building usage, trends by service, trends among market players, and future perspectives.

Market Overview

Based on prime contractor values, the size of the building management market reached 5.1615 trillion yen in FY2024, up by 6.9% year over year.

This growth was driven by price revisions during contract renewals for existing managed properties, securing appropriate unit price levels for new contracts and operations, as well as an increase in new orders for construction projects expected to generate revenue during the fiscal year-end period.

Noteworthy Topics

“Office Building” Accounted for 20% of Overall Building Management by Building Usage

In FY2024, residential building management accounted for 3.9% of the building management market, amounting to 199.0 billion yen, which was a 6.2% year-over-year increase. Meanwhile, non-residential building management accounted for 96.1% of the market, or 4.9625 trillion yen, marking a 6.9% year-over-year increase.

Details of non-residential building management were as follows: office building management accounted for 21.8%, valued at 1.123 trillion yen, marking a 6.9% year-over-year increase. This was followed by commercial facility and store management, accounting for 18.0% at 926.8 billion yen, which was a 6.6% year-over-year increase. Medical and welfare facility management were in third place, accounting for 10.3%, valued at 532.2 billion yen, marking a 7.3 year-over-year increase. Factory and workshop management accounted for 9.2%, reaching 476.1 billion yen, a 6.5% year-over-year increase. School facility management accounted for 9.0% at 463.7 billion yen, a 5.0% year-over-year increase.

Future Outlook

The size of the building management market is forecast to reach 5.2685 trillion yen based on prime contractor values, which is a 2.1% increase from the previous year.

Since various costs have risen by FY2024, building management companies have proactively negotiated price revisions and have clearly accepted orders for new building management at appropriate prices taking soaring labor costs into account. Consequently, the market continues to grow.

Meanwhile, building owners appear to have high expectations for the quality of management services. While clients are showing understandings for rising costs, building management companies need to provide high-quality, added-value management services, such as using robots and suggesting ideas for more efficient operations than traditional methods.

Research Outline

2.Research Object: Leading building management businesses in Japan

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, questionnaires by phone, and literature research

What is the Building Management Market?

In this research, "building management" refers to the services provided by building management companies, including cleaning services, facility management, equipment management, and security. Market size is calculated based on prime contractor values. This calculation also includes peripheral businesses, such as repair and renovation work carried out by building management companies.

<Products and Services in the Market>

Services include sanitation management, facility management, security, and repair work.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.