No.3899

High-Performance Films Market: Key Research Findings 2025

High-Performance Films Market Will Conclude Its “Recovery Phase” during 2024 and 2025, Finding Next-Generation Markets and Products Will Be Next Challenge

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic and overseas markets (Japan, South Korea, and Taiwan) for high-performance films which include base and processed films used in displays, optics, electronics, electrical applications, and general industries and found out the trends by product segment, trends of market players, and future perspectives.

Market Overview

From 2024 to 2025, the high-performance films market aligned with actual demand as it fully recovered from the impact of the pandemic's surge in demand for ICT products and the subsequent decline.

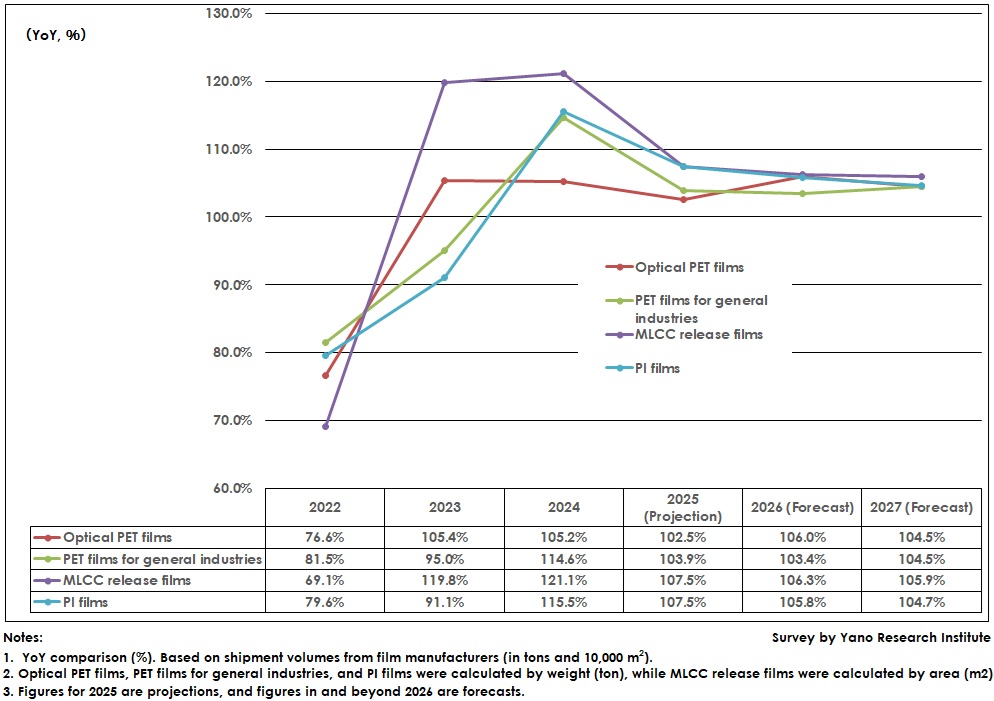

Based on shipment volumes from manufacturers, the growth of major high-performance films in 2024 was as follows: Optical PET films (105.2%), PET films for general industries (114.6%), MLCC release films (121.1%), and PI films (115.5%), all compared to the previous year. This shows that all films except for optical PET films experienced double-digit growth. However, film manufacturers referred to this as “recovery” from a decrease in reactionary demand after surges in special demand rather than “rapid growth.”

These films are expected to grow between 3 to 8% in 2025 compared to the previous year. From 2026 to 2027, the growth of these films is expected to be more moderate with annual growth in single digits.

Noteworthy Topics

Chinese Manufacturers Emerged in Low-End Segments of Optical Materials, PI, and MLCC Release Films

In recent years, high-performance film manufacturers and converters have undergone gradual change. This change is caused by the emergence of Chinese film manufacturers.

Chinese manufacturers hold significant market shares of optical PET films based on sales volume. Chinese manufacturers mainly supply the largest market segment of optical PET films, which is LCD backlight materials for TVs, while Japanese, South Korean and Taiwanese film manufacturers supply the high-end segment, including high-definition display materials such as AMOLED and QLED. Although Chinese manufacturers held small market share in 2014, it grew to an estimated 55% by 2019 and 64% by 2024.

In the PI film market, Chinese manufacturers were the producer and supplier of the low-end segment, including inexpensive, generic products such as electric insulating tapes. They had limited involvement in the mid-range segment, which includes products for general industries, such as flexible printed circuits (FPCs) and chip-on-film (COF). Chinese manufacturers held only about 4% of the market share by sales volume in 2019, but this figure was estimated to have grown to about 11% by 2024.

Chinese film manufacturers have suddenly increased their market share in MLCC release film applications. Traditionally, they supplied these films for household appliances, amusement applications, and toys, thus avoiding competition with MLCC release film manufacturers in Japan, South Korea, and Taiwan. However, they have started producing and supplying these films for low-end smartphone models. MLCC release films are materials consumed during the product manufacturing process. As usage of these films has increased, Chinese manufacturers have shifted from exporting to domestic procurement. Consequently, the Chinese converters’ sales share of these films is estimated to have increased from less than 1% to approximately 4% by 2024.

Future Outlook

Beyond 5G/6G technology, autonomous driving level 3 and higher, flying cars, aerospace, and soft robotics are attracting attention as next-generation markets to replace liquid crystal displays (LCDs) and flexible printed circuits (FPCs). These new markets require significantly higher performance and quality than traditional high-performance films. In many cases, these markets require features that were traditionally only available through trade-offs to be compatible with each other. Therefore, existing films can hardly respond to these requests. Currently, the aforementioned next-generation markets have not launched, and the current market scale is still small. Film manufacturers are developing new films that focus on these areas, but their efforts are still in the suggestion and sample phase. It will likely take time for these new films to grow and replace the largest existing market segment.

To create new films that fit the next-generation markets and products, it is necessary to pre-determine which films are needed as components or process materials as well as their features, and performance levels.

Japan excels at developing and fostering the next-generation markets and products by creating and suggesting high-performance films with unprecedented features. They explore the future beyond the existing cutting-edge market by identifying intangible film needs and developing new film features to fit new markets. Japanese film manufacturers are tasked with creating and expanding next-generation markets and products.

Research Outline

2.Research Object: Film manufacturers, converters (in Japan, South Korea, and Taiwan)

3.Research Methogology: Face-to-face interviews by expert researchers (including online), and literature research

High-Performance Films

In this research, high-performance films refer to base and process films used in displays, optics, electronics, electrical applications, and general industries. These films include polyethylene terephthalate (PET) films, polyimide (PI) films, multilayer ceramic capacitor (MLCC) mold release films, film-to-film recycled films, and films under development for use in the next-generation markets.

<Products and Services in the Market>

In this research, high-performance films refer to base and process films used in displays, optics, electronics, electrical applications, and general industries. These films include polyethylene terephthalate (PET) films, polyimide (PI) films, multilayer ceramic capacitor (MLCC) mold release films, film-to-film recycled films, and films under development for use in the next-generation markets.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.