No.3906

Pet Business in Japan: Key Research Findings 2025

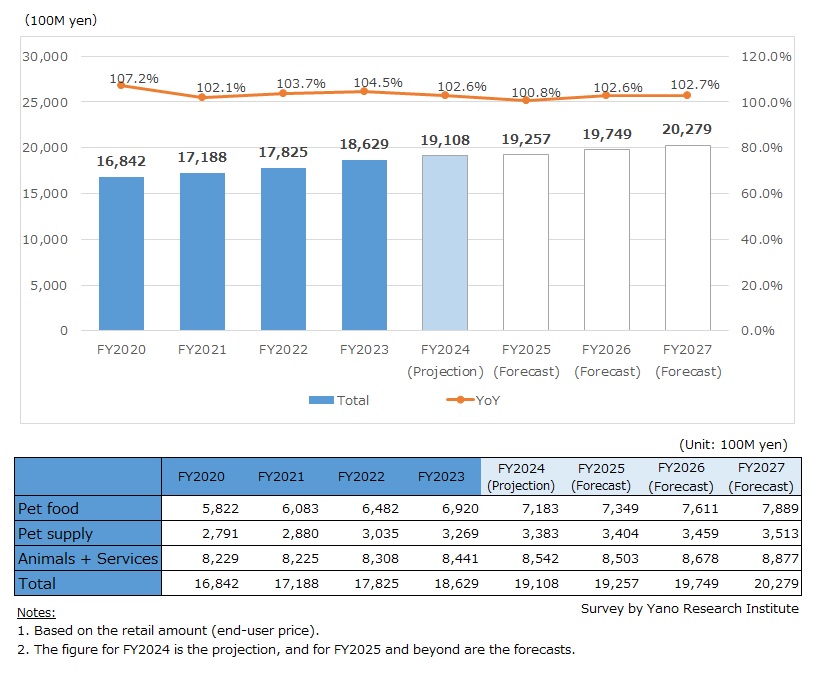

Total Pet Business Market Forecasted to Grow by 2.6% From Preceding Fiscal Year to 1,910,800 Million Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic pet business market and found out the market trends by segment, trends of market players, and future perspectives.

Market Overview

The total pet business market size by retail amount (end-user price) in FY2024 expects to reach 1,910,800 million yen, 102.6% of the preceding fiscal year.

In fiscal years 2022 and 2023, rising costs for materials (such as ingredients and packaging), logistics, and labor strained profit margins and made it challenging to maintain product quality without raising prices. While most companies completed their price increases by FY2024, persistent cost pressures have led some businesses to make further adjustments.

Despite these challenges, the market performed well in FY2024, driven by robust sales of value-added products and significant growth in the cat product category.

Noteworthy Topics

Pet Food Market Shows Stable Growth with Value-Added Products and New Products

Soaring costs have driven repeated price hikes since FY2022, but the pet food market has continued to expand. With high product prices, as well as the launch of value-added and new products, market growth was sustained in FY2024. This expansion was led primarily by the cat food category.

Growth in the dog food market has been flat to marginal. This modest growth is attributed to rising demand and prices for premium, high quality products and dog treats. An increasing number of health-conscious dog owners are opting for products tailored to specific life stages, breeds, or health conditions. Natural & organic, meat-enriched (more protein), and domestically produced options have been particularly strong sellers since FY2023. Dog treats are favored also gaining popularity as a tool to strengthen the bond between dogs and their owners.

The cat food market is expanding rapidly. The growth is being fueled by manufacturers releasing new products and renewals, as well as pet specialty stores expanding their shelves for cat products. While there's a strong demand for dry foods in standard and affordable price ranges, presumably because there are more cat-owning households with multiple cats compared to dog owners that have multiple dogs, demand for healthier options is also increasing. These healthier options include formulations for kidney health and immune support, highly palatable cat foods made with high-quality ingredients, and variety packs (multiple flavors in one package). Cat treats are also selling well, driven by a desire among cat owners to use them as a tool to bond with their cats.

Future Outlook

The total market size of pet business in Japan in FY2025 is projected to reach 1,925,700 million yen, 100.8% of the previous fiscal year.

Looking ahead, as pet companion ownership continues to rise, demand for value-added products is expected to grow, even if overall sales volume does not see significant increases. The pet industry remains a promising market, driven by the evolving and increasingly sophisticated needs of pet owners. For this reason, we forecast steady market expansion in FY2025 and beyond.

In the pet food category, cat food is expected to be the strongest market driver. Demand is increasing for tastier, healthier options. Value-added pet food will remain the key segment for manufacturers, wholesalers and retailers seeking to sustain sales growth. Nonetheless, competition is likely to intensify as more companies introduce products in this space, even as consumer demand increases.

The pet supplies market also poised to grow. Essential products for indoor pets such as potty pads and cat litter make up a large share of this segment. Strong growth is anticipated particularly for disposable dog diapers, which are increasingly used as a form of “etiquette” at pet cafés (a dining establishment where people and pets can enjoy meals together) and fenced dog parks. Another promising area is veterinary dental supplies for cats and dogs, supported by rising pet owner awareness of oral health and a growing number of dental treatments for pets.

Research Outline

2.Research Object: Manufacturers, wholesalers, and retailers of pet food and supplies, etc.

3.Research Methogology: Face-to-face interviews by expert researchers (including online interviews), surveys via telephone, and literature research

The Total Pet Business Market

Pets in this research cover animals sold at pet shops, mainly cats and dogs. The total pet business market encompasses pet food, pet supplies, pets themselves, and services for pets including insurance, long-term care, medical care, and funeral.

<Products and Services in the Market>

Pet food, pet supplies (potty pads, cat litter, pet diapers, shampoos & conditioners, deodorants, odor eliminator, etc.), pet services (insurance, long-term care, medical care, funeral, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.