No.3882

Package Printing Market in Japan: Key Research Findings 2025

Package Printing Market Trending Toward Expansion

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic package printing market and found out the trends by segment/demand field, market player trends, and future outlook.

Market Overview

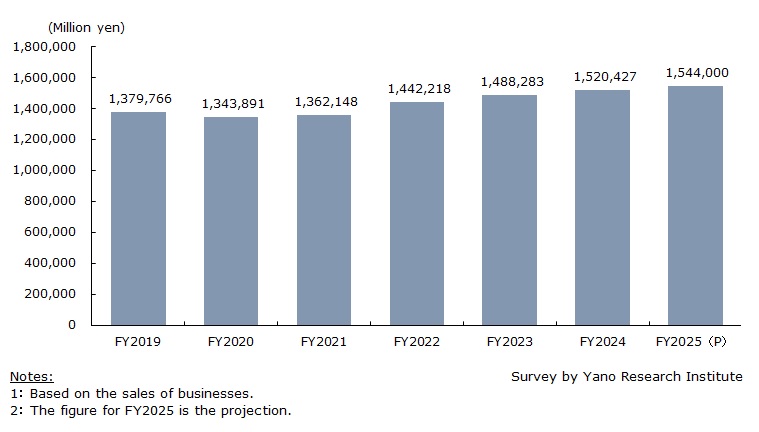

The domestic package printing market was valued at 1,520,427 million yen in FY2024, up 2.2% from the preceding fiscal year (based on the sales of businesses). Continued weak consumer spending due to repeated price hikes stagnated demand in the food sector, a key segment of the package printing market. However, with fewer occasions requiring face masks and a growing focus on self-care, demand for packaging in OTC drugs and cosmetics stayed resilient.

In addition, demand in the prescription drug segment rebounded, particularly for generic drugs. This recovery was driven by the medical fee system revision by the Ministry of Health, Labour and Welfare (MHLW) in October 2024, which promoted the use of generic drugs (also referred to as follow-on or off-patent drugs) *. As a result, demand for paper containers for generic drugs rose sharply in the second half of FY2024. Combined with the converters’ ongoing efforts to pass higher fuel, logistics, and labor costs on to end prices, the market is indicating an upward trend.

*Source: MHLW https://www.mhlw.go.jp/stf/newpage_39830.html (The site is in Japanese only)

Noteworthy Topics

Lowering Environmental Impact

Flexible packaging converters are working to reduce environmental impact by making changes in their production methods and delivering more eco-friendly packaging. A key initiative has been the adoption of solvent-free production equipment, particularly nonsolvent lamination systems. While some challenges remain (in areas such as performance and material handling,) these systems are garnering attention as an effective way to cut volatile organic compounds (VOCs) emissions.

The market is also seeing the introduction of new printing technologies. Flexographic printer using solvent ink can significantly lower VOC emissions compared to conventional printers, while EB (electron beam) offset printers, which use (EB) to cure inks and coatings, offer the combined benefits of zero VOC emissions and substantially reducing CO2 emissions compared to gravure printing. Although EB offset printing is not yet widely adopted, commercial use is expected to grow.

In recent years, there has been an increase in the use of inkjet digital printers with water-based pigment inks for flexible packaging films. Some converters are already experiencing higher sales from water-based inkjet production. The role of water-based inkjet printing as a future market driver is still under observation.

Future Outlook

Size of the domestic package printing market in FY2025 is projected to grow to 1,544 billion yen, up 1.6% from the previous fiscal year (based on the sales of businesses).

The demand outlook for FY2025 is moderate. Once consumers move past their cautious spending habits aimed at protecting household budgets, the food sector is expected to regain some momentum. However, a dramatic shift in demand trend is unlikely. Meanwhile, persistent increases in operating costs suggest that the converters may once again pass these higher costs on to end prices in FY2025. This price adjustment is expected to further expand the size of package printing market.

Research Outline

2.Research Object: Flexible packaging converters, aluminum foil laminate manufacturers, paper container converters and related manufacturers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), interviews via telephone, mailed questionnaire, and literature research

What is the Package Printing Market?

In this research, package printing refers to the post-press conversion of flexible packaging and paper containers. The market size is measured based on the sales of businesses engaged in this field.

Flexible packaging includes packaging made from plastic films and laminated aluminum foils.

Paper containers refer primarily to converted (print-processed) cardboard boxes, but do not include paper bags or liquid containers such as paper cups and beverage cartons.

Within paper containers, this research specifically focuses on:

- Converted (print-processed) cardboard boxes

- Micro-flute corrugated boards (F-flute and G-flute) and laminated corrugated cardboards used in the food industry

The following are excluded from the scope of this research:

- Rigid paper boxes covered with finishing papers (wrappers)

- Boxes without print-processing

- Corrugated boards (with the exception of those listed above)

<Products and Services in the Market>

Flexible packaging, paper containers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.