No.3005

Global Polarizers and Component Films Market: Key Research Findings 2022

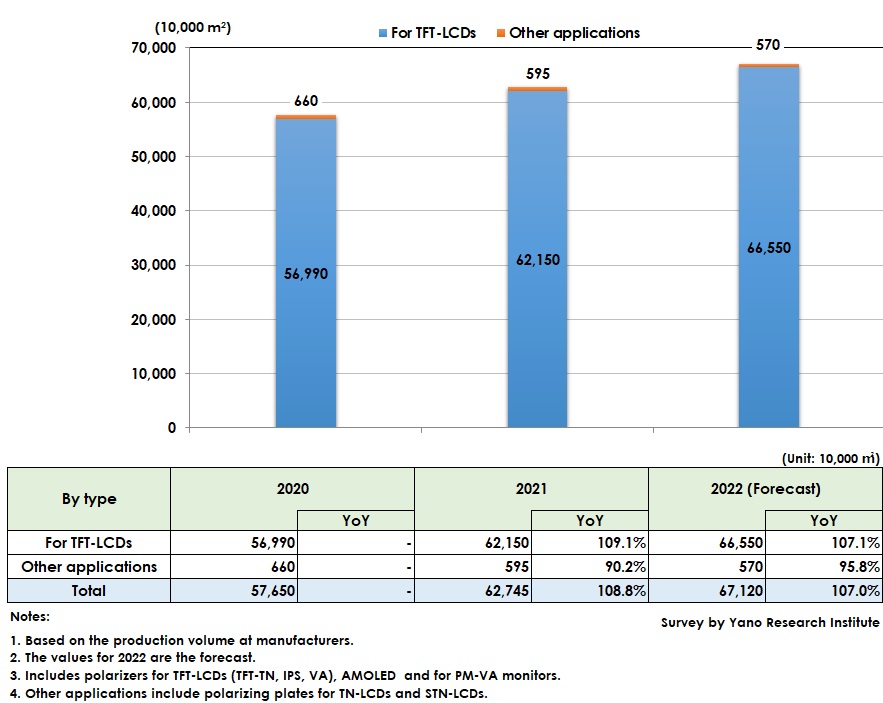

Global Production Volume of Polarizers for TFT LCD & AMOLED in 2022 Forecasted to Increase by 7.1% to 665.5 Million m2

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of polarizers and their component films for 2022 and found out trends by product type and future perspectives.

Market Overview

The global production volume of polarizers in 2021 is estimated to have attained 627.45 million square meters, 108.8% of that of previous year. By LCD type, those polarizers for thin-film-transistor liquid-crystal display i.e. TFT LCD, and for Active-Matrix Organic Light-Emitting Diode i.e. AMOLED are estimated to have occupied overwhelming 99.1% of the entire polarizer production volume.

The global production volume of polarizers for TFT LCD and for AMOLED grew prominently by 9.1% to 621.50 million square meters. Because special demand for displays caused by at-home spending stemming from self-quarantine in the COVID-19 calamity continued in 2021, almost all the polarizer manufacturers kept their full-scale production. Yet, tight supply in polarizers mainly for large display screens continued until the third quarter 2021.

In the first half of 2021, manufacturers of TV sets and display screens kept ordering polarizers to ensure safety stock and to prevent from production suspension stemming from component shortage. This led the production volume of polarizers in 2021 not to coincide with the total area of display screen shipments. There were larger polarizer areas produced than the areas of display panels shipped.

Noteworthy Topics

Over-Imaginable Demand for PET Films led Impossible for PET Film Alone to Cope With, and Made PMMA Films to be Required

The operation of a new line of domestic polyester (PET) films for optical applications was supposed to give an impact on the polarizer industry. The market size of PVA (polyvinyl alcohol) protective films on the outer side was considered to shrink by the new production capacity of PET films being introduced in the market.

However, the need for PET films as well as their increasing use amount at large-scale polarizer clients were more than imaginable, which led the film producers to be pressed to respond to further expansion in demand caused by operations of newly added polarizer production lines at clients.

New operation of polarizer production lines mainly at Chinese polarizer manufacturers and further new investments are projected to be performed in full scale from 2022. While a plastic polarizer made up of iodine-doped stretched PVA (polyvinyl alcohol) films is sandwiched by a pair of plain TAC (tri-acetyl cellulose) films for protection, such plain TAC films have no room to increase their production capacity furthermore unless new investment is made. Because supply capacity of PET films is close to full, PET film alone among non-TAC materials cannot keep up with the demand. Naturally, the demand for PMMA, or poly (methyl methacrylate) films increases, and is expected to expand their applications to PVA-film protection.

Future Outlook

The global production volume of polarizers for TFT LCD and AMOLED in 2022 is expected to achieve 665.50 million square meters, 107.1% on a YoY basis.

Production cut that began since October 2021 at major display screen manufacturers continued until January 2022. However, as production volume of large displays is increasing in BOE since February, demand for polarizers has recovered as of second quarter of 2022. In April 2022, almost all the polarizer manufacturers, mainly Chinese, are at maximum capacity, many of which accepting the largest orders since their commencement of business. Unlike the status in several months ago, polarizer demand has upturned to rapid expansion.

Still, polarizer demand in the second half of 2022 can decline again, because of those factors that lead to decreasing demand for electronics devices including TVs, against the backdrop of Ukraine invasions by Russia, the influence of lengthened lockdown in China to production and shipment of display screens and polarizers, and the impact of new production line operation at major polarizer manufacturers, etc. Therefore, the polarizer market is projected to fluctuate, due to various internal and external factors.

In the mid-term perspective, the TV display screen market is likely to enter the size of 50 inches on average by 2022. The effect of screen-size expansion may offset the declining production volume of displays, which may cause the global polarizer market to continue growing by more than 5% per year.

Research Outline

2.Research Object: Manufacturers of polarizers, retardation films, PVA protection films, and surface processed films

3.Research Methogology: Face-to-face interviews (including online) by the expert researchers, and literature research

The Polarizer Market

A polarizer is an optical filter that passes light that are polarized to specific direction and blocks waves of other polarization. Because polarizers are the major component used in every display, polarizer market is very likely to expand together with rising display market.

Polarizers in this research refer to those polarizers for TFT (Thin Film Transistor)-LCD, AMOLED (Active-Matrix Organic Light-Emitting Diode) and for PM-VA (Passive Matrix Vertical Alignment) monitors, in addition to those for TN (Twisted Nematic)-LCD, and STN (Super Twisted Nematic)-LCD. The polarizer market size is calculated based on the production volume at manufacturers in 10,000 square meters.

<Products and Services in the Market>

Polarizer, major component films (retardation films, PVA (polyvinyl alcohol) protective films, surface-processed films, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.