No.3828

Rent Guarantor Market in Japan: Key Research Findings 2025

Rent Guarantor Market Size Forecasted to Exceed 350 Billion Yen-Level by FY2029

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic rent guarantor market, and found out the market trends and future perspective.

Market Overview

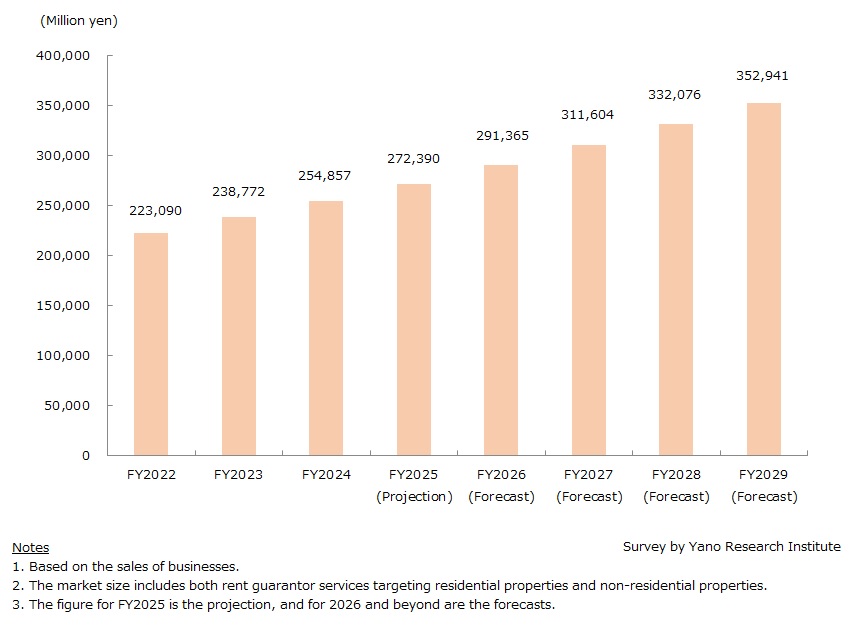

The size of the rent guarantor market in FY2024 (a total of rent guarantors for residential and nonresidential properties) grew to 254,847 million yen (106.7% of the previous fiscal year) and is projected to expand to 272,390 million yen (106.9%) in FY2025.

The revision of the Civil Code in April 2020 introduced a requirement to document the upper limit of liability that a joint guarantor could bear under a rental agreement. This change led landlords to become more concerned about the risk of bad debts, as they could potentially suffer losses once the guarantor’s liability limit was reached. At the same time, tenants also became increasingly anxious about securing a personal guarantor. Some worried that personal guarantors might refuse to sign an agreement if the exact amount of their potential liability was explicitly stated. As a result, demand for professional rent guarantors grew rapidly. The professional rent guarantors offer a simpler, more transparent process and make it easier for both landlords and tenants to manage risks.

Meanwhile, changes in social structure, such as an aging population, the rise of nuclear families, and an increase in foreign workers, have also driven demand for rent guarantor services as an alternative to traditional joint (personal) guarantors. This trend has been further accelerated by the growing popularity of these services among property owners and property management companies. Rent guarantor services help reduce the risk of bad debts, allow for outsourcing the process of rent collection and related processes, improve efficiency in handling overdue payments, and help prevent vacancies. Properties that accept guarantor companies instead of requiring personal guarantors may attract more tenants, as the application process becomes easier and more accessible.

Noteworthy Topics

Rise of Rent Guarantor for Nonresidential Properties (Corporate Customers)

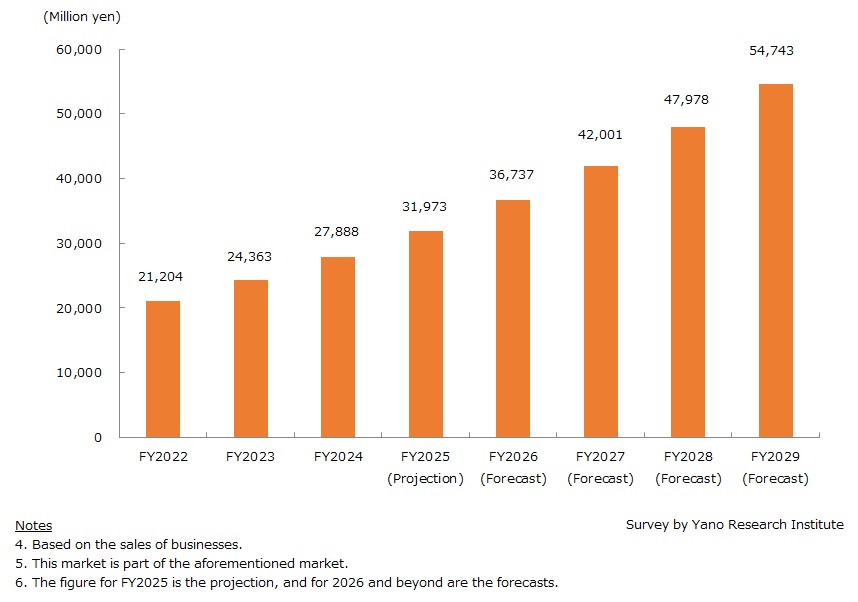

In recent years, the growing trend of companies relocating offices to multiple locations and the rise of shared office spaces have increased the importance of rent guarantor in the non-residential real estate market.

The rental application process for non-residential properties tends to be more complex than for residential leases. Unlike renting to individuals, leasing to corporations requires thorough screening, including detailed background checks and information verification, to mitigate various risks. For landlords, using a rent guarantor service has become an essential part of this process.

Corporations (lessees) also benefit from utilizing rent guarantor services. With a guarantor contract in place, they are often exempt from paying the large deposits that would otherwise be required. This makes it easier for businesses, especially those with limited budgets, to secure rental properties.

Against these backgrounds, the market for rent guarantor targeting non-residential properties (corporate tenants) is expected to continue expanding. The market is forecasted to grow at a compound annual growth rate (CAGR) of 14.4% between FY2025 and FY2029, reaching 54,700 million yen by FY2029. We also believe that rent guarantor will serve as an effective strategy for generating new demand and reducing property vacancies.

Future Outlook

The rent guarantor market is forecasted to grow at a compound annual growth rate (CAGR) of 6.7% between FY2025 and FY2029, reaching 352,941 million yen by FY2029 (based on the sales of businesses; a total of rent guarantor service targeting residential properties and non-residential properties).

The market growth is largely driven by the expansion of rent guarantor services targeting non-residential properties (corporate tenants). Meanwhile, rent guarantor services for residential properties, which have already gained widespread adoption, are also expected to see further growth. This is fueled by the increasing number of lessees who are older adults or foreigners.

Additionally, the market is being further propelled as guarantors enhance and diversify their offerings to better meet the needs of both property owners and tenants. The enhancements include elderly monitoring and mediation support for landlord-tenant disputes related to rent issues.

Rent guarantors play a significant social role in ensuring safe and secure rental agreements. For this reason, we believe the market will continue to expand steadily hereafter.

Research Outline

2.Research Object: Leading rent guarantors

3.Research Methogology: Face-to-face interviews by our expert researchers as a main source, with literature research

What is the Rent Guarantor Market?

In this research, the term “rent guarantor” refers to a system in Japan where a lessee or tenant (whether an individual, corporation, or self-employed person) is required to make a contract with a guarantor company. Under the agreement, the property owner (landlord) receives stable monthly rental income even if the tenant defaults on payments. The lessee pays a service fee to the guarantor company for this coverage.

Traditionally, rent agreements in Japan required a joint guarantor (typically a family member or friend with stable employment). However, following the revision of the Civil Code in April 2020, which imposed strict legal limits on the total amount of liability a joint guarantor could bear, the use of professional guarantor companies has grown rapidly. Today, these companies have become commonplace in the real estate market.

It should be noted that the market size discussed in this research is calculated based on the total sales of rent guarantors for residential properties and for nonresidential properties.

<Products and Services in the Market>

Rent guarantor services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.