No.3762

Logistics Robotics Market in Japan: Key Research Findings 2025

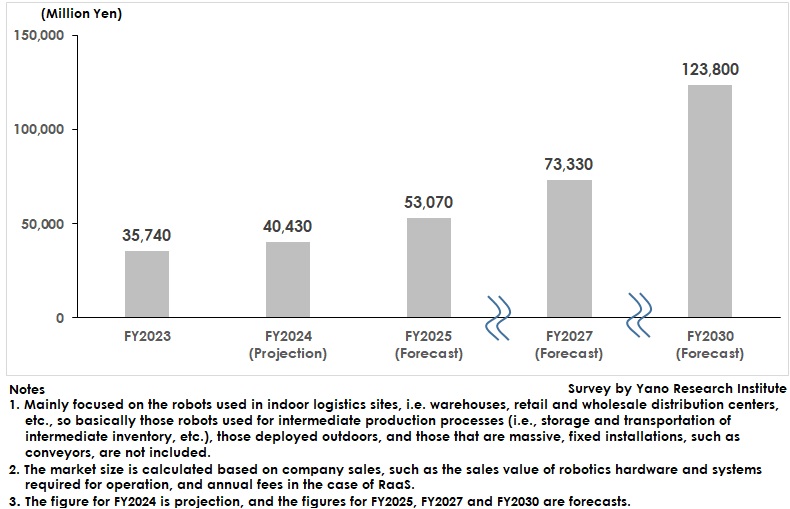

Logistics Robotics Market Size Estimated at 40,430 Million Yen in FY2024, Up 13.1% YoY

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic logistics robotics market and found out the market size, trend of market players and future perspectives.

Market Overview

The size of the logistics robotics market (based on company sales) was estimated at 40,430 million yen in FY2024 (projection), 113.1% of the size of the previous fiscal year. The growth owes to the increased variety of robots in the market, the increased use of robots at logistics sites, and the rising cost of robot deployment per case.

Demand for automated warehouse robots that achieve high effective storage up to the ceiling has increased recently, as rising warehouse rents have increased the need for warehouse efficiency. The emergence of Autonomous Case Handling Robots (ACRs), which enable multiple picking and conveying by a single robot, is gaining attention in the Japanese market.

The increasing variety of robots on the market has expanded the automation options for logistics sites, while foreign manufacturers continue to enthusiastically enter the Japanese market, intensifying the competition among logistics robot manufacturers.

It should be noted that large-scale investment in robot deployment by logistics companies has increased recently, whereas in the past such investment was made primarily by shippers. Robot deployments by SMEs are also gradually increasing due to government subsidies and the spread of robotics as a service (RaaS), not just sales.

In addition, deployments have even spread to warehouses adjacent to factories, rather than just to consumer-facing locations such as logistics warehouses and retail/wholesale distribution centers.

Noteworthy Topics

Requirements for Foreign Logistics Robot Manufacturers Entering the Japanese Market

The proportion of logistics robots from overseas, such as China and Europe, is on the rise in the Japanese market.

When foreign logistics robot manufacturers enter the Japanese market, the key is how far they can localize the Japanese specification. For example, whether they can adjust the size of their robots to what is appropriate for Japanese logistics sites, build customer-oriented maintenance support systems, etc.

There are other considerations to ensure customer convenience, such as whether there is a Japanese-language customer support, whether the support is available nationwide, whether the robot parts are available in Japan, etc.

Future Outlook

The size of the logistics robotics market is expected to reach 73,330 million yen in FY2027 and 123,800 million yen in FY2030.

The introduction of logistics robots is more advanced in Europe and the United States. This is due to the smaller number of children and declining labor force, as in Japan, as well as rising commodity prices and labor costs. Labor shortage is also a serious problem in Japan, especially in some regions, which is driving the automation in logistics sites.

In anticipation of labor shortages in the future, it is necessary to build robotic logistics centers or warehouses, which can improve the robot deployment rate. In addition to the adoption of robots from the perspective of business continuity as shown above, the strategic deployment of logistics robots for business expansion is expected to increase by both shipping and logistics companies. Based on the above, the logistics robotics market size is forecast to exceed 100 billion yen by FY2030.

Research Outline

2.Research Object: Logistics robot manufacturers, logistics-focused system integrators, logistics robot service providers, etc.

3.Research Methogology: Face-to-face interviews by our researchers (including online), and literature research.

About the Logistics Robotics Market

According to the Japanese Industrial Standards (JIS), a robot is defined as “a kinetic mechanism that has a certain degree of autonomy, is equipped with two or more of joints that move as programmed, and operates in an environment to perform a desired task".

In this research, robots are those used in indoor for logistics (warehouses, logistics centers for retail/wholesale, warehouses adjacent to factories, etc.)

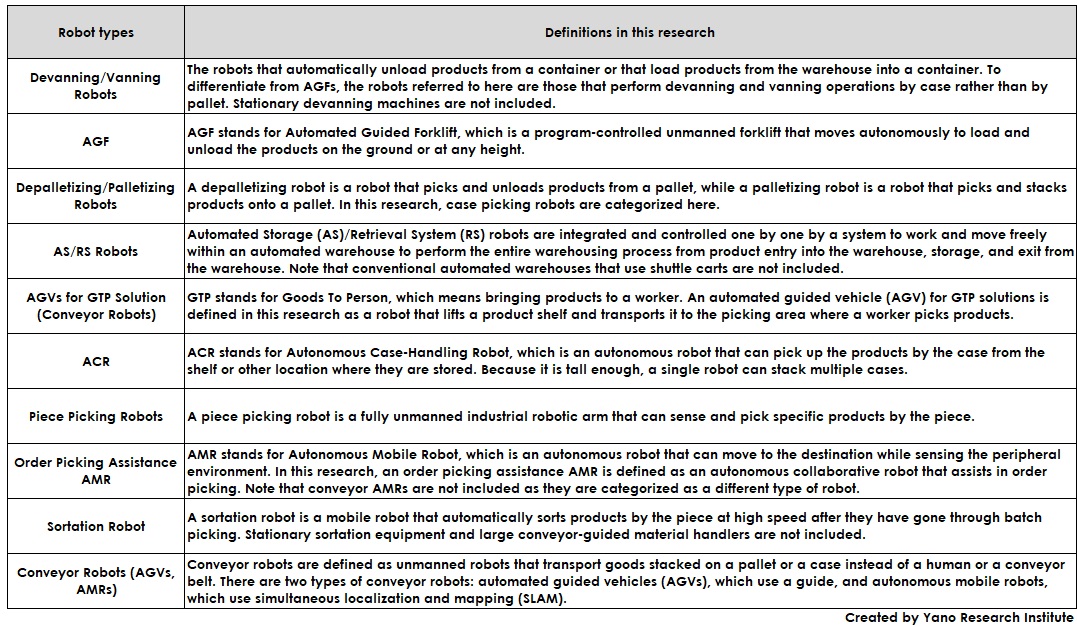

More specifically, they include devanning/vanning robots, automated guided forklifts (AGFs), depalletizing/palletizing robots, automated storage (AS)/retrieval system (RS) robots, automated guided vehicles (AGVs) for GTP (goods to person) solution (conveyor robots), autonomous case handling robots (ACRs), piece picking robots, order picking assistance AMRs (autonomous mobile robots), sortation robots, and conveyor robots (AGVs, AMRs).

The market covered in this research is mainly focused on the robots used in indoor logistics sites, i.e. warehouses, retail and wholesale distribution centers, etc. Therefore, it does not include robots used for intermediate production processes (i.e., storage and transportation of intermediate inventory, etc.), those deployed outdoors, and those that are massive, fixed installations, such as conveyors, are not included.

The size of the logistics robotics market is calculated based on company revenues, such as the sales value of robotics hardware and systems required for operation, and annual fees in the case of RaaS.

<Products and Services in the Market>

Devanning/vanning robots, automated guided forklifts (AGFs), depalletizing/palletizing robots, AS/RS robots, goods-to-person AGVs (automatic guided vehicles), autonomous case handling robots (ACRs), piece picking robots, picking assistance AMRs (autonomous mobile robots), sortation robots, and conveyor robots (AGVs, AMRs)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.