No.3737

Beverage Container Market in Japan: Key Research Findings 2024

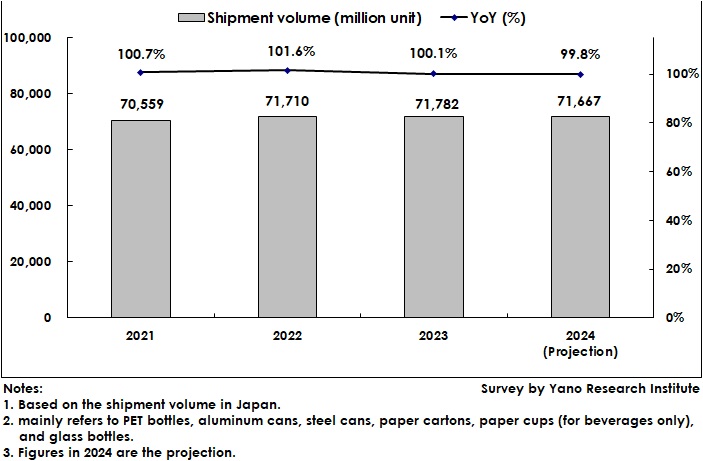

Domestic Beverage Container Market Size Expected to Attain 71,667 Million Units in 2024, 99.8% of Preceding Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic market of beverage and food containers and found out the trends by product segment and the trends at market players. This press release highlights the domestic shipment volume of beverage containers.

Market Overview

The beverage container market size based on the shipment volume is estimated at 71,667 million units, 99.8% of the size of the preceding year. Depending on the product, the beverage container market is affected by various factors during the pandemic period from 2020 to 2022 such as consumer behavioral restrictions and increased household inventories. By 2023, the market conditions have finally normalized. In 2024, the market does not seem to be as volatile as in the past few years. Since container demand is driven by content demand, as the beverage or food market matures and stabilizes, the volatility of the container shipment volume decreases.

Looking at the domestic retail market of food and beverages, repeated price hikes have resulted in consumers having a strong will to cut down on their spending. As consumer behavior is shifting to hesitant buying or to buying national brand products or cheaper private label products, container users such as food and beverage manufacturers cannot help but be conservative.

Noteworthy Topics

As Brand Owners, Distributors, and Retailers Prioritize Revenue Protection, Momentum Lost for Using Sustainable Materials in Containers

Food and beverage brand owners, distributors and retailers have been tackling corporate image improvement and consumer appeal by addressing environmental issues such as decarbonization and sustainability, and by differentiating their products.

Once a part of corporate social responsibility (CSR) or corporate social impact, environmental friendliness has become an issue that directly impacts business sustainability as brand owners, distributors, and retailers have begun to adopt plastic alternatives and initiate recycling efforts, while container manufacturers have responded to these moves by developing and promoting sustainable containers. Reducing CO2 emissions, recycling, and using renewable materials have become the norm, not a special matter, though the degree to which they are practiced may vary.

In line with the movements of container users, container manufacturers have developed and promoted products with sustainable appeals, creating new demand. However, product price increases in beverages and food from 2023 to 2024 have discouraged proactive consumer purchases, which caused brand owners, distributors and retailers to prioritize reducing container costs more than ever to protect revenue. The eagerness to switch from plastic to paper, or from virgin raw material to rPET material, or to recycle bottles (bottle-to-bottle recycling of PET bottles or rPET) has become a more moderate “within reason” attitude.

Future Outlook

In addition to the maturity of the food and beverage markets, the contraction in adopting containers using sustainable materials, which used to be associated with new product development and new demand generation, may seem like a slump in the container market in Japan. It is true that spending on containers can be difficult for brand owners, distributors and retailers in a situation where consumers are more reluctant to buy. However, maturity does not necessarily mean stagnation. Mature markets have their own way of doing business.

While the situation of conventional applications, such as food and beverages, is slowing down and not changing, indicating a limitation of new development in the existing field, there are surely new fields out there beyond the existing one when looking around the world from a broader and higher aspect. The starting point is there, leading to new growth in the next market beyond maturity.

Research Outline

2.Research Object: Manufacturers of beverage containers and food containers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

What is the Beverage Container Market?

The beverage container market in this research mainly refers to PET bottles, aluminum cans, steel cans, paper cartons, paper cups (for beverages only), and glass bottles. The market size has been calculated based on the domestic shipment volume.

<Products and Services in the Market>

Light weight plastic containers (PSP containers, A-PET containers, OPS containers, PP filler containers), PET bottles, metal cans (aluminum cans, steel cans), paper containers (paper cartons, paper cups, paper packages), glass bottles

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.