No.3658

Commercial & Industrial HVAC Market in Japan: Key Research Findings 2024

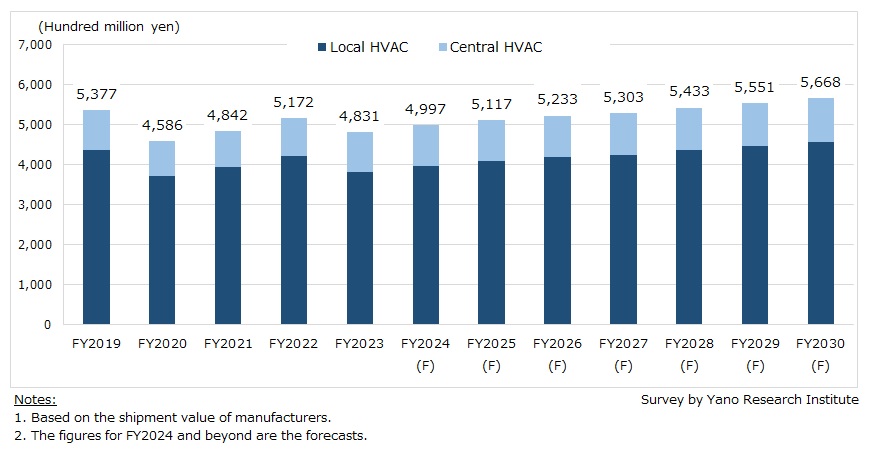

Commercial & Industrial HVAC Market Forecasted to Reach 566,800 Million Yen by FY2030, 117.3% of FY2023

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic commercial and industrial HVAC market and found out the trends by type (local HVAC system, central HVAC system), the trends of market players, and future perspectives.

Market Overview

This research focused on the commercial and industrial HVAC systems that are used for non-residential buildings such as office buildings, stores, factories, warehouses, schools, and hospitals. The market size of commercial and industrial HVAC systems for FY2023 was estimated at 483,100 million yen, 93.4% of the previous fiscal year (based on the shipment value of manufacturers.) Based on the market composition, local HVAC systems represented 79.3%, while central HVAC systems held 20.7%. This distribution aligns with the proportion of building sizes in new construction: local HVAC systems are typically used in non-residential buildings with floor areas under 10,000 m², while central HVAC systems are designed for non-residential buildings with floor areas exceeding 10,000 m².

The local HVAC system market shrank by around 10% in FY2023, as the demand for HVAC for stores and office buildings hit the plateau due to global inflation. Meanwhile, the shipment value of central HVAC system grew by almost 6% from the preceding fiscal year, stemming from the price revision accompanying soaring material prices and increase in replacement demand for district heating and cooling system*.

*District heating and cooling system: A regional system (managed in partnership with regional public organizations and private enterprises) that supplies heat media (such as hot water, chilled water, and steam) from one or more heat supply facilities (plants) to multiple buildings located within a certain area through regional conduits.

Noteworthy Topics

Adopting Low-GWP Refrigerants in Response to the “Kigali Amendment”

The Montreal Protocol on Substances that Deplete the Ozone Layer (Montreal Protocol), which regulates the production and consumption of ozone-depleting substances, came into effect in 1989 after it was discovered that CFCs, commonly used as refrigerants in air conditioning systems, destroy the ozone layer and lead to global warming. In line with this protocol, the international community has been working together to phase down the production and consumption of CFC that depletes the ozone layer.

The 28th Meeting of the Parties to the Montreal Protocol on Substances that Deplete the Ozone Layer (MOP 28) was held in Kigali, Rwanda in 2016, which amended the Protocol to include hydrofluorocarbons (HFCs) as part of its ambit (“Kigali Amendment”, which came into effect in 2019). Accordingly, regulation has become tighter on the production and consumption of HFCs for packaged air conditioner, multi-zone air conditioner for non-residential buildings, central chiller, and turbo air freezer.

For this reason, HVAC manufacturers are replacing HFC with alternative refrigerants like R32 and R1234yf. Although R32 is a hydrofluorocarbon (HFC), with low GWP (global warming potential) it is viewed as an alternative refrigerant (R32’s GWP is 675, while GWP of R410A is 2,090). R1234yf is a hydrofluoroolefin (HFO) with a GWP about one-sixth that of HFC.

In the future, even R32 will be replaced with refrigerant with GWP even lower. Under the circumstances, NEDO (New Energy and Industrial Technology Development Organization) has initiated a project “Development of Refrigeration and Air-Conditioning Technologies for Practical Use of Next-Generation Low-GWP Refrigerants” project (FY2023 - FY2027) as MAFF’s “Green Refrigerant/Cooling System Project”. Next-generation refrigerants with low GWP are inferior to HFCs in terms of efficiency and safety (flammability). In light of this, NEDO is embarking on narrowing down the best alternative refrigerant, as well as developing and evaluating compatible equipment.

Future Outlook

With the implementation of the Revised Building Energy Conservation Law, large non-residential buildings are required to meet energy conservation standards, driving increased momentum for energy efficiency. In the commercial HVAC market, along with the share of high-efficiency model (air conditioner with higher efficiency than standard models) at higher unit prices is expected to rise, price revisions are anticipated due to rising raw material prices. Given these factors, shipments are expected to continue growing. The commercial HVAC market size is forecasted to grow at a compound annual growth rate (CAGR) of 2.3% from FY2023 to FY2030, reaching 499,700 million yen in FY2024, 103.4% of the previous year, and 566,800 million yen by FY2030.

By FY2030, the share of local HVAC is projected to rise slightly more compared to that of FY2023 to 80.7%, which means the share of central HVAC will decline to 19.3%.

For new non-residential buildings, the growing emphasis on carbon neutrality and streamlined equipment design is expected to drive increased adoption of multi-zone air conditioners or turbo chillers. However, replacements will occur at a slower pace, as existing absorption chillers and refrigeration systems are typically replaced with similar models. As a result, the market share between local HVAC systems and central HVAC systems is unlikely to see significant changes.

Research Outline

2.Research Object: Domestic commercial and industrial HVAC manufacturers

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews) and literature research

Commercial &Industrial HVAC Systems Market

In this research, commercial and industrial HVAC indicates the heating, ventilation, and air conditioning systems to control the indoor environment of non-residential buildings ( industrial buildings like factories and warehouses, as well as commercial buildings like office buildings, stores, schools, and hospitals). The market size is calculated based on the shipment value of HVAC system manufacturers.

However, the numbers do not include the shipment of commercial portable air conditioner, commercial portable air cooler, commercial refrigerator, or commercial freezer.

Commercial and industrial HVAC systems are roughly classified into “local HVAC system (local heat source equipment system)” and “central HVAC system (centralized heat source equipment system)” based on system components.

Local HVAC system (local heat pumps, local heat source equipment) supplies cold/warm air from heat source equipment (outdoor unit) to the corresponding indoor unit in each room of the building through refrigerant piping. Types of heat source equipment used in local HVAC system include electric packaged air conditioner for stores/offices, electric packaged air conditioner for industrial facilities, multi-zone air conditioner for non-residential buildings, and Gas Head Pump air conditioner (GHP).

Central HVAC system (centralized heat source equipment system) is a system that delivers the conditioned air using heat source equipment system located in a central equipment room, which produces cold/hot water. Using the chilled/hot water, fan coil units (FCUs) and air handling units (AHUs), which are blanketly called secondary systems, do the air conditioning. Types of heat source equipment used in central HVAC system includes electric central chiller, electric turbo air freezer, and absorption chillers that use gas, Kerosine, petroleum, or waste heat as energy source.

<Products and Services in the Market>

Packaged air conditioner for store/office, packaged air conditioner for industrial facility, multi-zone air conditioner for non-residential buildings, Gas Head Pump air conditioner (GHP), central chiller, turbo air freezer, absorption chiller, fan coil unit (FCU), air handling unit (AHU)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.