No.3609

Language Business Market in Japan: Key Research Findings 2024

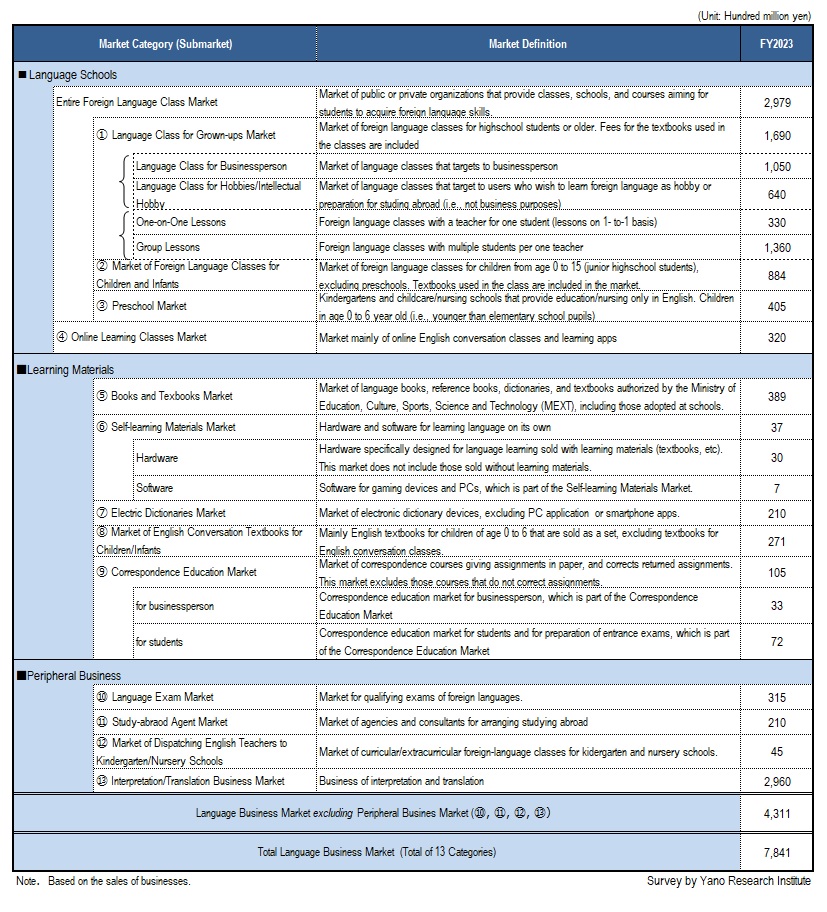

Language Business Market (Total of 13 Major Categories) for FY2023 Rose by 0.2% Year over Year to 784,100 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) performed a survey on the domestic businesses regarding language learning, and found out the trends of market players, market trend by category, and future perspectives.

Market Overview

Language business market (total of 13 categories) grew by 0.2% to 784,100 million yen for FY2023, based on the sales of businesses. Thanks to the ease of pandemic restrictions, FY2023 saw recoveries in many categories. At the same time, however, challenges also resurfaced. Low birthrate impacted the foreign language classes and language learning materials for children/infants. A shift to digital media (over paper) affected grown-ups in choosing types of foreign language classes and learning materials. The weak yen and soaring prices impacted overseas traveling market and study-abroad businesses.

Among peripheral businesses, study-abroad business recovered significantly from a pandemic drop, and interpretation/translation business was also back on track.

Noteworthy Topics

Needs for Foreign Language Learning Classes for Business Purposes & Learning Foreign Languages as Intellectual Hobby

Needs for learning foreign language for business purposes has changed the nature, as online business meetings became available during the pandemic as an alternative to business trip or sending expats, while companies refrain from sending people abroad because of soaring travel expenses due to the weak yen. For this reason, the demand for language schools for “outbound needs”, i.e., to prepare for overseas business trip or becoming expats, is not recovering notably. Meanwhile, the demand for language schools for “inbound needs”, i.e., to prepare for doing business with in-coming foreigners, is increasing especially among tourism-related industries like airlines and travel agencies as foreign tourists are rushing back after Japan reopened borders.

The demand for learning foreign language as intellectual hobby is recovering as people became eager to travel overseas upon ease of activity restrictions. In addition, people that adjourned in-person sessions to avoid infections returned to language schools. Some schools mentioned that they particularly saw senior members coming back to class. Although soaring travel expenses stemming from the weak yen may be a dealbreaker, those that missed travelling overseas during the covid crisis are craving for travelling opportunities. For this reason, the demand for learning foreign language as hobby is expected to rise swiftly.

Future Outlook

The language business market is projected to recover as activity restrictions, which precipitated an economic downturn during the pandemic, have been lifted entirely. Still, language businesses are required to adapt to uncertainties like the weak yen and high prices, as well as to the changes in business environment led by COVID crisis, such as the decrease of overseas trips and expats due to the rise of online business practices.

In addition, language learning classes are increasingly installing digital tools that help students learn online and on apps. As seen in the current release of AI-powered English conversation app, difference between language school business and other language businesses is becoming subtle. For this reason, there is a concern that competition for customer acquisition may intensifying between the markets.

Research Outline

2.Research Object: Foreign language school operators, developers/distributors of language study materials, and other language related businesses

3.Research Methogology: Face-to-face and online interviews by specialized researchers (including online interviews), surveys via telephone/email, and literature research

The language business market in this research indicates the following 13 categories: 1) Foreign language classes for grown-ups, 2) Foreign language classes for children/infants, 3) Preschools, 4) Online learning classes, 5) Textbooks, 6) Hardware/software for language self-learning, 7) Electronic dictionaries, 8)Textbooks of English conversation classes for children/infants, 9) Correspondence education, 10) Language exams, 11) Study-abroad agencies (consultants), 12) Dispatching English teachers to kindergarten/day-care centers for children, and 13) Interpretation/translation business. The market size was calculated based on the sales of businesses.

The markets of 10), 11), 12), and 13) are grouped/categorized as “peripheral business”.

Note that, from this fiscal year, we changed the category of 12) from “language school (business)”to “peripheral business”, and 4) from “learning materials” to “language school (business)”.

<Products and Services in the Market>

1) Foreign language classes for grown-ups, 2) Foreign language classes for children/infants, 3) Preschools, 4) Online learning classes, 5) Textbooks, 6) Hardware/software for language self-learning, 7) Electronic dictionaries, 8)Textbooks of English conversation classes for children/infants, 9) Correspondence education, 10) Language exams, 11) Study-abroad agents (consultants), 12) Dispatching English teachers to kindergarten/day-care centers for children, and 13) Interpretation/translation business

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.