No.3492

Global xEV Infrastructure Market: Key Research Findings 2024

With All the Moment to Develop Charging Infrastructure, Global Number of Public Chargers Installed Estimated to Count 3,940 Thousand Units

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the global xEV infrastructure market and clarified the diffusion forecast for public chargers, trends of market players, and future perspectives on each type of xEV infrastructure. Here includes public charger diffusion forecast.

Market Overview

As a trend toward carbon neutrality in automotive industry, deployment of xEVs is accelerating, aiming to develop vehicles that affect low burden on environment. Those zero emission vehicles (ZEVs) including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs) go in motion via motors instead of engines, which require xEV infrastructure such as chargers or hydrogen stations to supply electricity or hydrogen as the fuel.

Among the infrastructure for xEVs, public chargers, for which users pay a fee for charging services, are rapidly being prepared in response to the global shift to BEVs. The number of public chargers (regular + rapid chargers) worldwide is estimated to rise to 3,941 thousand units in 2023, 147.1% of that of the previous year. 2024 also anticipates the increase in number globally, boosted by the subsidies in each country for the infrastructure development. Meanwhile, Japan, that has preceded in preparing chargers since 2012, somewhat earlier than other countries, is facing the challenge of updating chargers with expiring useful life span (8 to 10 years) not being in progress. Europe, the US, and China is very likely to confront the similar challenge from the latter half of 2020s to the former half of 2030s.

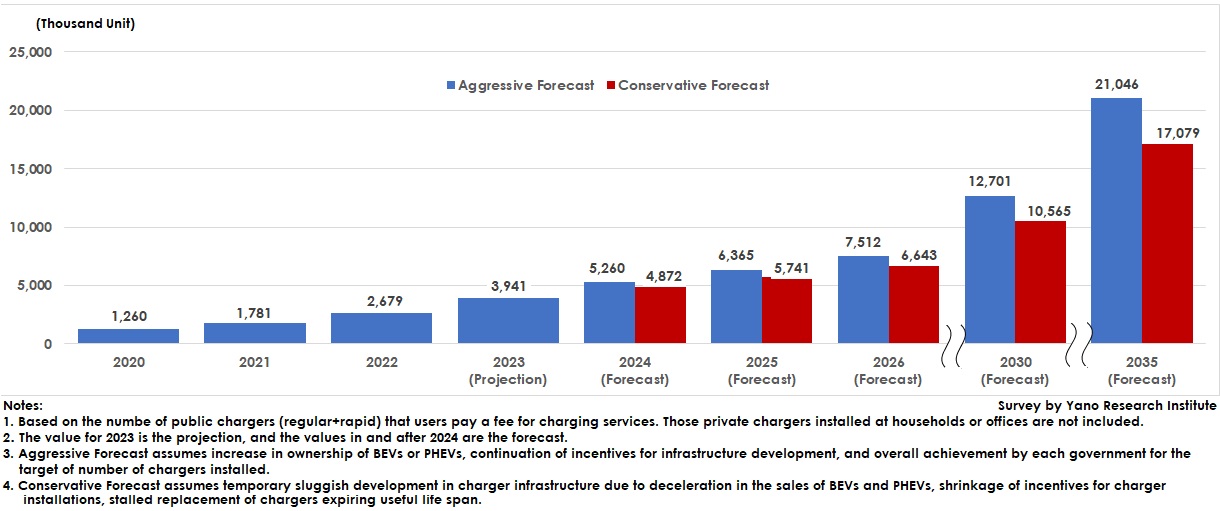

Based on these situations, we have calculated the global number of public chargers installed in two different scenarios:

One scenario assumes that each government overall achieves its target of the number of chargers installed, due to continuous implementation of their incentives, increase in the ownership of BEVs or PHEVs, and successful installations of new chargers and replacements of expired useful-lifespan chargers. Under this aggressive scenario, the number of public chargers installed by 2030 is estimated to expand to 12,701 thousand units.

The other scenario assumes temporary sluggish development in the infrastructure for chargers due to deceleration in the sales of BEVs and PHEVs, shrinkage of incentives for charger installations, failure to replace chargers installed in around 2020 chiefly in Europe, the US, and China. Under this conservative scenario, the number of public chargers installed by 2030 is estimated to expand to 10,565 thousand units.

Noteworthy Topics

Trend in xEV Infrastructure in Japan

Japan has 30,795 public chargers (regular + rapid chargers) installed, battery swap stations (BSS) being equipped at 35 locations, hydrogen refilling stations (HRS) at 167 locations, and many of electric road systems (ERS) via pantographs or side rollers from which to feed are in the demonstration phase.

While new installations of public chargers are likely to increase, fueled by continued incentives including subsidies to achieve the government’s goal of 300 thousand units by 2030, there also is an issue to replace those chargers installed in around 2012 facing useful life span expiration.

BSS for bikes have already been set up, and those for commercial vehicles are both under the phases of demonstration and development of international standardization. Batteries for bikes can be installed onto construction machinery and small trucks. Demand generation by exploring users is needed to increase the number of BSS installations. Eventually, BSS can be expected for storing excess electricity generated by renewable energy and for playing a role of local energy supplier.

ERS is not yet reached at the commercialization phase, except for the pantograph system. Dynamic wireless power transfer (DWPT) that transfer electricity to vehicles in motion has been commenced for the first time in the country at public roads since 2023. Though there is a challenge of creating a beneficiary pays mechanism such as the billing system, DWPT gathers attention for preferred lifecycle assessment (LCA) than the current BEVs and as a solution to the issues of electric range and sales prices. The social implementation in Japan is projected to begin in around 2030.

HRS are mainly the service for passenger vehicles but are increasing in sizes to cater to large trucks. To reduce hydrogen costs, increasing the demand volume is necessary. Large trucking FCEVs that greatly contribute to increase demand for hydrogen are likely to launch in the latter half of 2020s. In addition, HRS are expected to play the role to convert the excess electricity generated by renewable energy to hydrogen that can be stored. Demonstrations to supply manufactured hydrogen to ships, industrial machinery, households, and industrial applications are also underway.

Future Outlook

xEV infrastructure, as a strength that cannot be achieved by conventional petrol stations, can utilize excess electricity generated by renewable energy or contribute to stronger resilience against disaster.

By charging excess electricity from renewable energy to BEVs to make themselves the charger, electricity can be transferred to grid electric sources via charger at the peaking hours of electric consumption, which contributes to electricity grid stabilization. Apart from that, xEV infrastructure can be a supply source for local electricity when blackout occurs, or an effective disaster countermeasure especially in Japan which is plagued by frequent natural disasters. Users on the other hand can earn profits by automatically charging their BEVs at cheaper timing and offering the electricity from the vehicle in recess to the grid.

As storing of electricity is not available in EV chargers, ERS, and SWPT without any energy storage systems, BSS and HRS have more advantages in terms of power storage. Though some loss may be expected when storing power or converting to hydrogen, excess electricity from renewable energy can be fed in batteries or converted to hydrogen for energy storage. Stored energy can be produced and/or consumed locally, which is more preferred.

Research Outline

2.Research Object: Infrastructure developers, charging service operators, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers and surveys via telephone/email, literature research

xEV Infrastructure

xEV infrastructure includes regular and rapid chargers for BEVs and PHEVs, battery swap stations (BSS) that supply charged batteries, electric road systems (ERS) that feed vehicles in motion through pantograph or via side rollers, static wireless power transfer (SWPT) that wirelessly transfers electricity to stationary vehicles equipped with receiver coils from transmitter coil on the ground, dynamic wireless power transfer (DWPT) that transfers electricity to vehicles in motion, and hydrogen refilling stations (HRS) that supply hydrogen as the fuel for FCEVs .

Public Chargers

Public chargers in this research refer to those chargers that users pay for the charging service, and do not include those private chargers installed at households or offices which do not require users to pay for the service. Both alternating-current (AC) powered regular chargers and direct-current (DC) powered rapid chargers are included.

<Products and Services in the Market>

Regular charger, rapid charger, battery swap station, electric road station, wireless power transfer, hydrogen refilling station

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.