No.3434

Stationery and Office Supply Market in Japan: Key Research Findings 2023

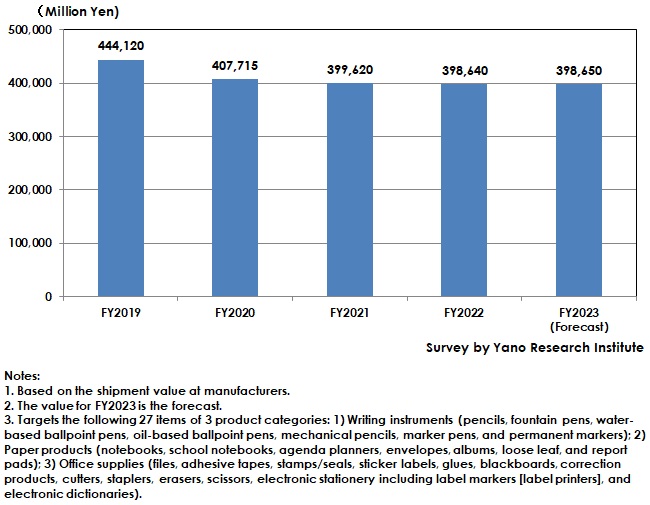

Stationery and Office Supply Market for FY2022 Declined by 0.2% Year-on-Year to 398,640 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the stationery and office supply market in Japan and has found out the market trend by merchandise, the trend of market players, and future perspectives.

Market Overview

The stationery and office supply market in Japan for FY2022 declined by 0.2% year-over-year to 398,640 million yen. Enormous market shrinkage in FY2020 due to behavior restrictions during the COVID-19 pandemic had been followed by stagnant demand in FY2021 because of repeated declarations of the state of emergency and other reasons. FY2022, too, saw a decline of the market from the preceding year because of the remaining impact of the pandemic. Nevertheless, when compared to FY2020 and FY2021, some stationery merchandises recovered in demand, though slowly, as behavior restrictions were gradually alleviated. In addition, upward revisions in merchandise prices caused by rising material and energy costs partly contributed to increase in the market size.

That said however, the market faces various issues against demand recovery, such as diversified workstyles including at-home working or telework bringing about stagnant demand for office supplies and further progress in paperless office operations, and advancement in digitalized school education stemming from promotion of the “Global and Innovation Gateway for All (GIGA) School Program”. Furthermore, as Japan suffers from waning population that cannot avert demand shrinkage, many of the domestic stationery and office supply manufacturers are pursuing expansion in overseas business, mainly emerging economies with growth space.

Noteworthy Topics

Domestic Stationery and Office Supply Manufacturers Focus More Than Ever on Personal Spending, Intensifying Development of Personal-Use Merchandises

Stagnant corporate demand ever since COVID-19 crisis has increased those stationery and office supply manufacturers placing importance more than ever on development of personal-use merchandises as they look for personal spending. As major manufacturers, mainly of writing materials, have continued launching highly functioned and high added-value merchandises for personal use since early 2010s, an environment has been built for even relatively expensive products to be accepted if the functionality has been valued by users. In recent years, mechanical pencils with high functions and prices are selling well.

Demand for stationery and office supplies as the hobby, including the arts and crafts, or as the means of self-expressions have been robust. Growing demand for unique colors or diverse color variations are also observed in water-based marker pens, water-based ballpoint pens, or fountain-pen inks. In addition, interests in customization or arrangements by users into the designs they like or collecting items have been rising. This has invigorated among women with trend consciousness for stationery, which has led to focus on the “Joshi Bungu (Women’s stationery)” category.

Future Outlook

The stationery and office supply market in Japan for FY2023 is projected to level off from the previous fiscal year at 398,650 million yen. As FY2023 expects demand recovery stemming from lift of behavior restrictions due to reclassification of COVID-19 to class 5 under the Infectious Diseases Control Law, and from comeback of inbound tourism demand, i.e., increasing foreign travelers, the markets of writing materials and office supplies are likely to grow from preceding fiscal year. In contrast, the paper product market is expected to continue going through severe business environment, because of advanced paperless operations and decreasing student population. Therefore, the overall stationery and office supplies market is anticipated to level out.

Research Outline

2.Research Object: Companies in business of stationery and office supplies

3.Research Methogology: Face-to-face interviews (including online) by our expert researchers, surveys via telephone/email, and literature research

The Stationery and Office Supply Market

Stationery and office supplies in this research indicate the following 27 items of 3 product categories: 1) Writing instruments (pencils, fountain pens, water-based ballpoint pens, oil-based ballpoint pens, mechanical pencils, marker pens, and permanent markers); 2) Paper products (notebooks, school notebooks, agenda planners, envelopes, albums, loose leaf, and report pads); 3) Office supplies (files, adhesive tapes, stamps/seals, sticker labels, glues, blackboards, correction products, cutters, staplers, erasers, scissors, electronic stationery including label markers [label printers], and electronic dictionaries). Gel-ink ballpoint pens are included in water-based ballpoint pens.

<Products and Services in the Market>

Pencils, fountain pens, water-based ballpoint pens, oil-based ballpoint pens, mechanical pencils, marker pens, and permanent markers, notebooks, school notebooks, agenda planners, envelopes, albums, loose leaf, and report pads, files, adhesive tapes, stamps/seals, sticker labels, glues, blackboards, correction products, cutters, staplers, erasers, scissors, electronic stationery including label markers [label printers], and electronic dictionaries

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.