No.3412

IT Investment by Domestic Enterprises in Japan: Key Research Findings 2023

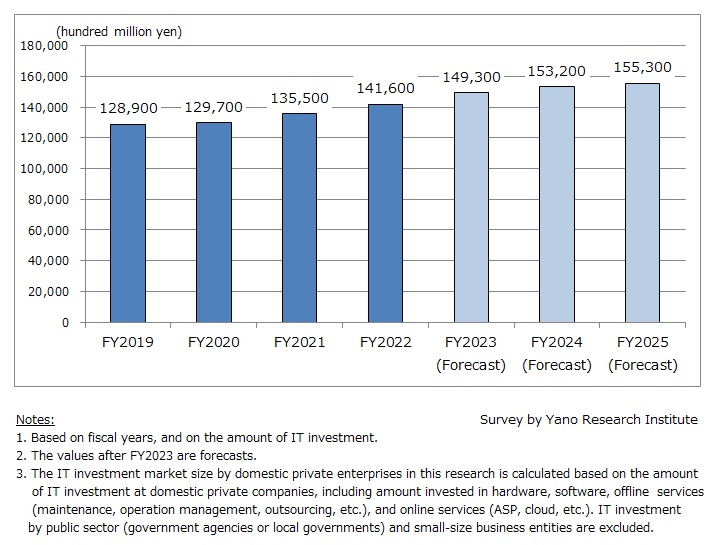

IT Investment by Domestic Private Enterprises in FY2022 Reached 14,160 Billion Yen, Up 4.5% from Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the FY2023 information technology investment by domestic private enterprises and found out the current status and future trends.

Market Overview

The market size of domestic IT investment (target items including hardware/software/services, target audience excluding public sector and small-sized private business entities) in FY2022 is estimated as 14,160 billion yen, up 4.5% from the prior fiscal year. Increase of the IT investment stemmed from 1) the replacement of existing information systems, including the migration from on-premise system to cloud-based system, 2) the implementation of systems to adapt to changes in legal requirements, such as the revision of the Electronic Books Preservation Act and the Invoice System, and 3) the promotion of digitalization, including paper form digitization and system deployment in operations that had not been managed with computerized systems.

Noteworthy Topics

Enterprises Becoming More “Proactive”

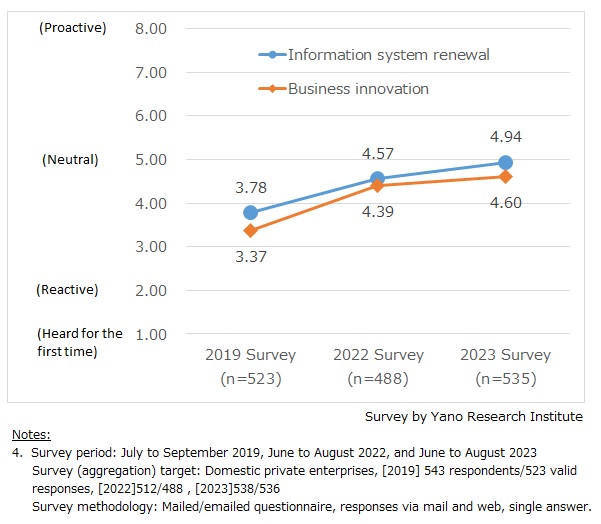

Yano Research Institute has been conducting corporate questionnaire to domestic private enterprises every year regarding IT investment, and for 2023, 538 enterprises responded. In this survey, intention to address digital transformation is categorized into willingness toward “business innovation” (starting new business by using IT, etc.) and willingness toward “information system renewal” (migrating mission-critical system to SaaS, redesigning workflow centered on cloud-based, etc.).

Respondents were asked to identify their level of willingness toward, and current status of implementing, business innovation and information system renewal in the scale of eight levels, with 8 being “proactive (eager)”, 2 being “reactive (passive)”, and 1 as “heard for the first time”. This means that the larger the numeric value, the more involved they are in business innovation or information system renewal.

Of the total 538 domestic private enterprises, the responses were earned from 535 companies. The average values of intentions for business innovation and information system renewal were 4.60 and 4.94, respectively.

Similar questions were asked in 2019 Survey and 2022 Survey. Since the survey in 2019 did not ask about their current initiatives, the comparison may not be purely apple-to-apple. Still, it is worth noting that the average values have improved to 4.57 (2022) and 4.94 (2023) from 3.78 (2019) for intentions for business innovation, and to 4.39(2022)and 4.60(2023)from 3.37(2019)for intentions for information system renewal. It is indicating that intentions to promote digital transformation is expanding at enterprises.

While new technology like generative AI garners attention as a quick means to solve a particular issue of a particular operation, digital transformation is not a one-time event, and for that quite a few private companies have mentioned the term “transformation fatigue”. Voices of ‘no more digital transformation’, and ‘boom of digital transformation has ended’ are gradually being heard.

Still, to keep pace with the rapid changes in business environment, companies must find ways to build agile operation using digital technology to constantly enhance the values they present to their customers. Seemingly aware of the situation, the private companies are mostly being persistent in investing to digital transformation initiatives.

Future Outlook

The market size of IT investment by domestic private enterprises for FY2023 was projected to expand by 5.4% on a year-on-year basis to 14,930 billion yen, for FY2024 to increase by 2.6% to 15,320 billion yen, and for FY2025 to rise by 1.4% to 15,530 billion yen.

For FY2023, the IT market is expected to increase by 5.4% over the previous year. The growth attributes to the resumption of IT investment projects that had been disrupted by semiconductor shortage, the increase of investments for utilization of cloud services and reinforcement of cybersecurity, the creation of new business models based on digital technologies mostly at large companies, the increase of projects to create/improve interactive business, and the resumption of IT spending at service industry (especially food services and lodging services) as the spread of COVID-19 subsides.

Investments for digital transformation through renewal of mission-critical systems/servers/PCs or cloud migration is expected to proceed from FY2024, particularly at major companies. Whilst active IT investment continues, the shortage of IT personnel is a growing concern. As the number of engineers is already tight at some IT vendors, it may hamper the implementation of digital transformation even if it is desired. User companies will also need to focus on developing IT personnel internally.

Research Outline

2.Research Object: Domestic private companies

3.Research Methogology: Mailed questionnaire to private companies, and literature research

What is the Domestic Private IT Market?

In this research, the domestic private IT market includes hardware, software, services (maintenance, managed service, outsourcing, etc.), and online services (ASP, cloud, etc.), and its market size is calculated based on the amount of investment at domestic private companies. Nonetheless, it does not include IT investment by public sector (government agencies or local governments) or small-size business entities.

At the same survey period, a questionnaire was carried out to clarify the current status and future directions of IT investment at private companies.

*Period of questionnaire carried out: June to August 2023; target audience: 538 domestic private companies; methodologies: mailed/emailed questionnaire, responses via mail and web.

<Products and Services in the Market>

IT investment by domestic private enterprises (hardware, software development from scratch, software package introduction and customization, managed service/outsourcing services for maintenance and operations, online services for ASP/cloud, access charges, consulting, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.