No.3398

Clinical Laboratory Reagents and Equipment Business in Japan: Key Research Findings 2023

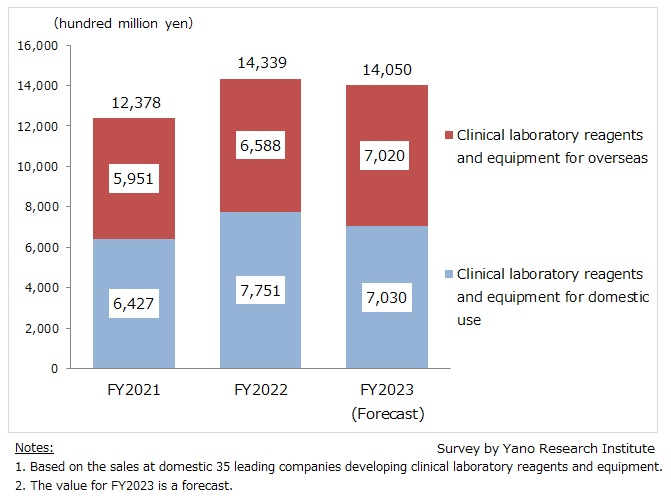

Business Size of Clinical Laboratory Reagents and Equipment at Domestic Leading Companies in FY2022 Rose by 15.8% on YoY Basis to Attain 1, 433,900 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the business of clinical laboratory reagents and equipment developed at leading 35 companies in Japan, and found out the related markets, the trends of market players, and future perspectives.

Market Overview

The business size of clinical laboratory reagents and equipment at leading companies in Japan in FY2022 (based on the sales at domestic 35 leading companies developing clinical laboratory reagents and equipment) rose by 15.8% from the previous fiscal year to 1,433,900 million yen. When separating the said business into that for domestic use and for overseas, the business for domestic use grew by 20.6% from the preceding fiscal year to 775,100 million yen, while that for overseas increased by 10.7% from the previous fiscal year to 658,800 million yen.

In addition to the sales recovery of general clinical laboratory reagents and equipment from previous fiscal year, marked increase in demand for antigen tests for COVID-19 has led the sales at related clinical laboratory reagents and equipment companies to expand considerably.

Noteworthy Topics

Use of Antigen Test Kits Become Major for Testing COVID-19

There are chiefly two methods to detect coronaviruses, which are genetic testing (mainly PCR method) and antigen testing. Antigen tests can be further categorized into rapid antigen test kit (qualitative antigen test) and quantitative antigen test.

In Japan, since in the middle of 2020, supply of test reagents and equipment for PCR testing, qualitative antigen testing, and quantitative antigen testing has been in full scale, which led the testing to be carried out extensively in medical institutions and private laboratories. While genetic testing had been a major method for testing COVID-19 at the time of initial outbreak in 2020 and 2021, as the Omicron variant infection expanded in 2022, utilization of rapid antigen test kits has been increasing, for they were preferred for primary diagnostic testing at medical institutions and for self-checks at home. Capability to supply COVID-19 rapid antigen test kits determined business performance of the companies developing clinical laboratory reagents and equipment in FY2022.

Future Outlook

Businesses in the clinical laboratory reagents and equipment generally enjoyed huge sales of COVID-19-related testing products both in FY2021 and FY2022. However, as the category of COVID-19 was reclassified to Class 5 under the Infectious Disease Control Law in May 2023, the trend is changing.

The size of the domestic clinical laboratory reagents and equipment business for FY2023 (based on the sales of 35 major domestic companies in the clinical laboratory reagents and equipment business) is expected to decline by 9.3% year-on-year for domestic business but rise by 6.6% for overseas business. Altogether, the market is projected to shrink by 2.0% on year-on-year basis to 1,405,000 million yen.

Although the spread of various infectious diseases other than COVID-19 (such as influenza) is observable in FY2023, it is unlikely to offset the reactionary decline in sales for COVID-19 testing in FY2022. Many companies in the business of COVID-related test reagent and equipment foresee considerable decline in domestic sales. Meanwhile, it is assumed that the clinical laboratory reagent and equipment business for overseas markets will remain relatively firm against the backdrop of a weakening yen.

Research Outline

2.Research Object: Leading 35 companies developing clinical laboratory reagents and equipment in Japan (Japanese companies and Japanese subsidiaries of overseas companies)

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, surveys via telephone and email

About Clinical Laboratory Reagents and Equipment Business Size

In this research, it is the size of the business regarding clinical laboratory reagents and equipment used for sample tests (blood, urine, feces, tissues, and other specimen) at medical institutions and laboratories, calculated by adding up the sales of clinical laboratory reagents and equipment both for domestic and overseas demand at 35 leading companies in Japan.

<Products and Services in the Market>

Clinical laboratory reagents and equipment in general

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.