No.3393

Vending Machine Market in Japan: Key Research Findings 2023

Vending Machine Market Dwindled During Pandemic, Yet Potential Demand for Vending Machines is Growing as Unmanned Sales is Seen Effective to Address Labor Shortage

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic market of vending machines, and found out the trends by market players (vending machine makers, vending machine operators, makers of products sold via vending machines), the trends by products sold via vending machines, the trends by location (installation sites), and future perspectives.

Market Overview

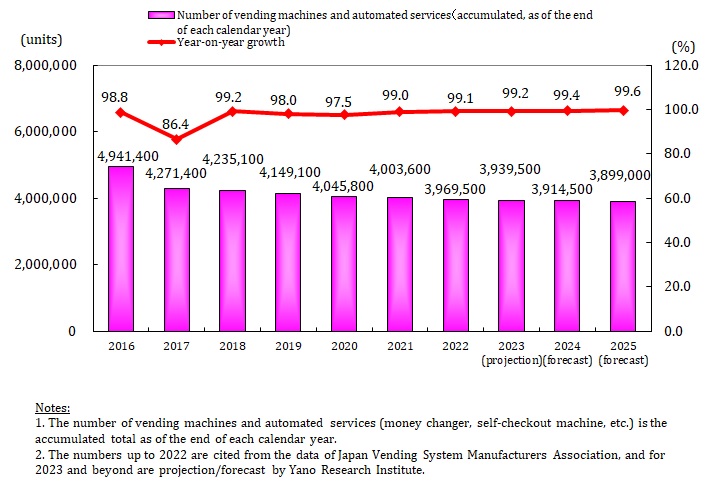

According to the Japan Vending System Manufacturers Association, the number of vending machines and automated services (such as money changers and self-checkout machines) as of the end of 2022 fell below 4 million, at 3,969,500 units (99.1% of the previous year). The number has been on a downward trend since 2014, and the stagnation is expected to continue for the foreseeable future, given the penetration rate of vending machines is at high limits, both for outdoors and for indoors, and the fact that new installations are mostly limited to indoors.

The total number of vending machines and automated services in operation includes beverage vending machines, snack/food vending machines, cigarette vending machines, ticket machines, daily necessities vending machines, and automated services. However, for this research, vending machines surveyed and analyzed are mainly vending machines for beverages (excluding alcoholic beverages) and snacks/foods.

Noteworthy Topics

Attempts for Implementing Connectivity in Vending Machines Accelerated Especially by Beverage Manufacturers

As the vending machine market continues to decline, profitability per machine is declining in tandem with the rise of costs of labor, logistics, and recycling. A common challenge for the industry is to improve profitability per machine by implementing connectivity in vending machines with use of IT as well as by streamlining operation, improving productivity, and reviewing overall business.

From the aspect of improving profitability per machine, there is a trend of embarking on increasing attractiveness of vending machines to turn it into a part of social infrastructure. Specifically, implementing connectivity in vending machines is in progress, coupled with the use of smartphones and introduction of AI technology. In addition, beverage manufacturers have made various types of payments available for using vending machines.

From the viewpoint of efficiency, implementing connectivity in vending machines is important for beverage manufacturers and operators (those that manage vending machines) as a means to monitor sales performance of each vending machine, so that replenishment can be done systematically, in terms of which item and/or how much items to load on delivery trucks, as well as of selecting most efficient delivery route.

Future Outlook

The number of vending machines in Japan at the end of 2023 is expected to reach 3,939,500, which is 99.2% of that of the previous year. Despite the reclassification of COVID-19 to Class 5 under the Infectious Disease Control Law and the ease of activity restrictions, it is assumed that considerable amount of time will be needed to recover the number of vending machines to pre-pandemic level. Interestingly, the food vending machine market is growing, and is expected to be vigor for years to come, as unattended sales of food (via vending machines) is reevaluated as a means to address labor shortages. Nevertheless, as the food vending machines account for only 2.0% of the total number of vending machines in use, contribution to the overall market growth is marginal.

Outbreak of the COVID-19 has brought about a major change in the conception of “good location” for vending machines. Outdoor locations were reevaluated, which were mostly seen unprofitable before the pandemic and thus removed or relocated. However, looking back as of fall 2023, this was a temporal trend.

The profitability and productivity of vending machines located indoors remain higher than those in outdoor locations, and the industry's emphasis on improving profitability per machine for those installed indoors and developing new locations indoors remain unchanged.

Research Outline

2.Research Object: Vending machine manufacturers, vending machine operating companies, product manufacturers (beverage makers, snacks/food makers), and other related associations

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey by telephone/email, questionnaire, and literature survey

A vending machine is a machine that automatically dispenses product or provide a service by inserting money or its alternatives (e.g., ticket). For this research, vending machines refer mainly to vending machines for beverages (excluding alcoholic beverages) and snacks/foods.

However, please note that the total number of vending machines includes not only the number of beverages vending machines and snack/food vending machines, but also cigarette vending machines, ticket machines, daily necessities vending machines, and automated services*.

[*Translator’s note: The “automated services” include money changer, coin-operated lockers, automatic photo booth machines, automatic ticket gates at train stations, etc.]

<Products and Services in the Market>

Beverage vending machines, snacks/foods vending machines

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.