No.3384

Consumer Questionnaire on Feminine Care & FemTech (Consumer Goods & Services) Market: Key Research Findings 2023

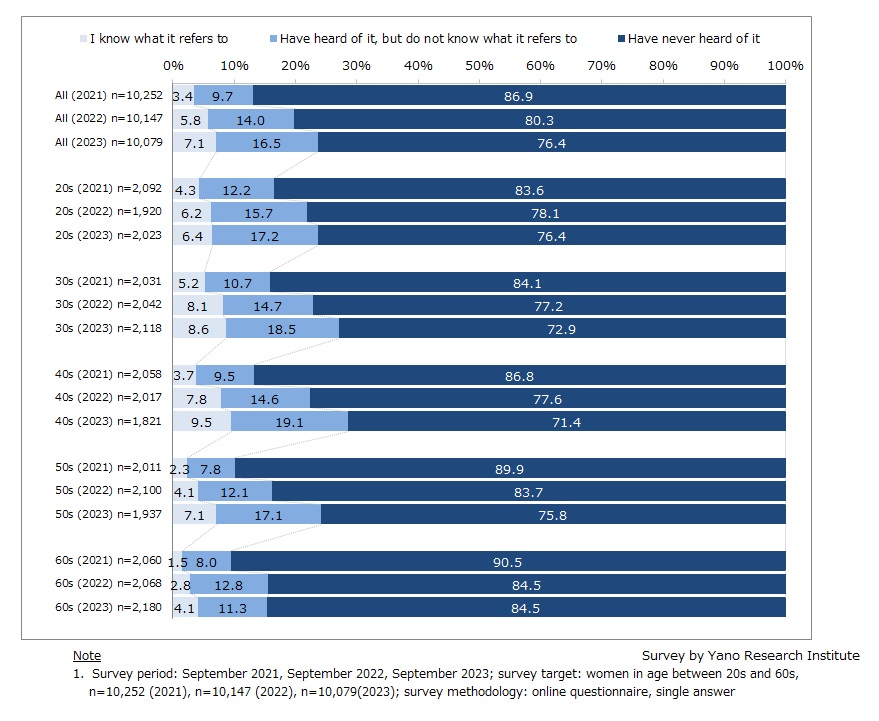

Recognition Level of “FemTech” Among 10,079 Women in 20s to 60s Rose to 7.1%, Up 1.3 Percentage Points Compared to Last Survey

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a consumer questionnaire regarding feminine care and FemTech (consumer goods and services), to find out the recognition level and use status of these items and services, and how they cope with female health concerns. This press release denotes the recognition level of “FemTech”, the purchase/use experience of the femcare and FemTech items/services, and their willingness to buy/use the femcare & FemTech items and services in the future.

Summary of Research Findings

An online questionnaire to registered participants (consumers) was conducted to a total of 10,079 women nationwide, in their age between 20s and 60s regarding the recognition and use of feminine care and FemTech (consumer goods and services).

According to the result (single-answer) of a question asking if they know what the term FemTech means, 7.1% said they recognize the term.

Compared to the numbers of the previous surveys (5.8% in 2022 Survey and 3.4% in 2021 Survey, conducted in September of the surveyed year), the recognition level showed the rise of 1.3 percentage points and 3.7 percentage points, respectively. Although the recognition level of “FemTech” has not reached ten percent, the ratio of consumers that “have not heard of the term (FemTech)” shrank to 76.4%, below 80 percent line.

The percentage of women that “have heard of the term FemTech, but do not know what it refers to” rose to 16.5%, which is up 2.5 percentage points from the 2021 survey and 6.8 percentage points from the 2020 survey. This is presumably due to increased opportunities to hear the term due to the expansion of media coverage since 2021.

In view of the recognition level by age group, women in their 30s and 40s, the target age group of the market, have shown slightly higher recognition level compared to other segments (8.6% and 9.5%, respectively). Meanwhile, the recognition level of women in their 60s sank at 4.1%, while more than 80 of them (84.5%) said that they “have not heard of (the term FemTech)”.

The result suggests the challenge of the market to expand lies in the expansion of recognition level, especially among women in young generations that may become the marketing targets in the future.

Noteworthy Topics

Survey Result Revealed Higher Purchase/Use Rate of Period Items and Pregnancy/Postpartum Care Items

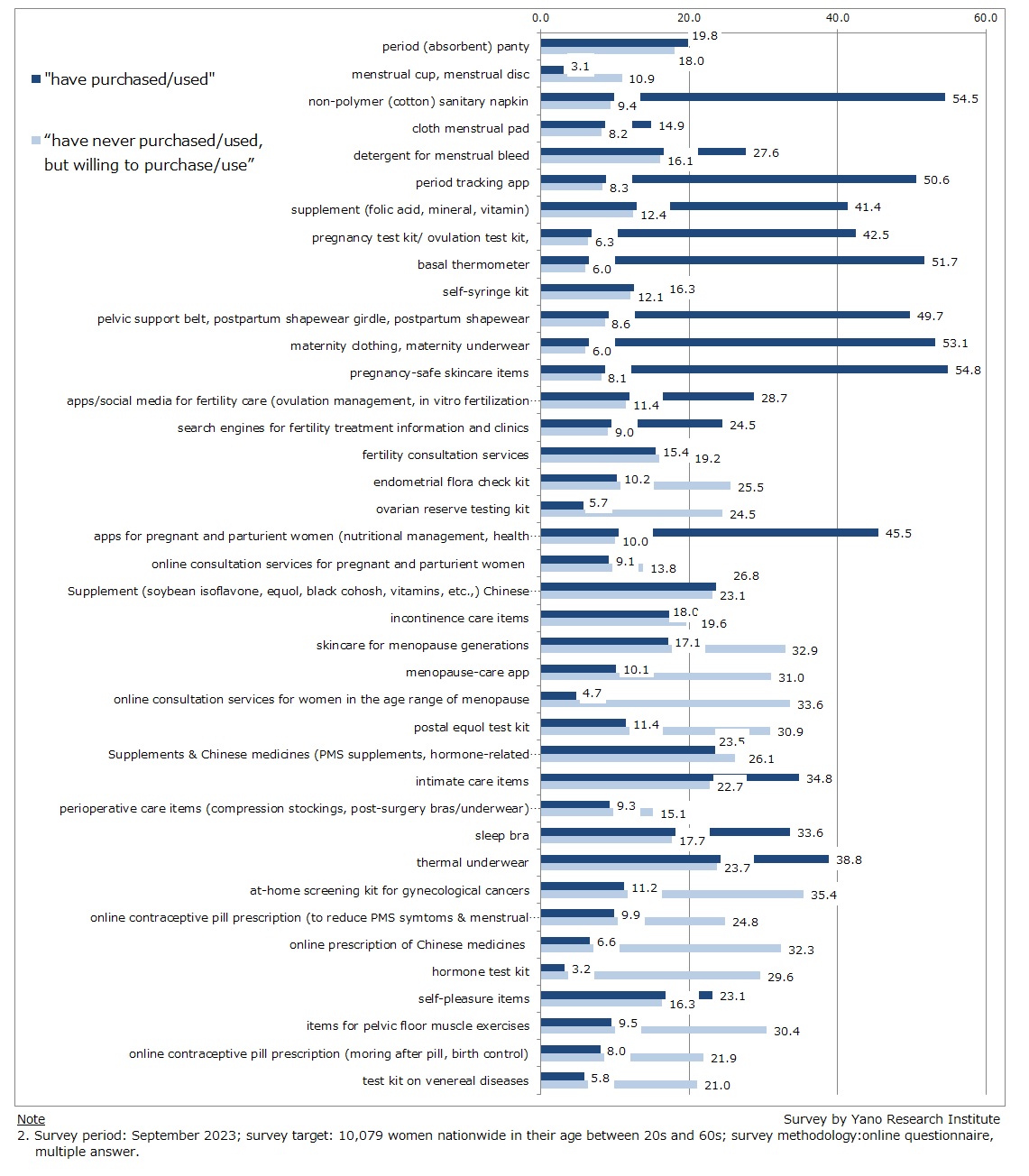

In the survey, a question on the experience and willingness of purchase/use are asked to those who indicated that they know any of the 39 items of consumer goods and services. They were asked to choose answer(s) from the following options: “have purchased/used” (including item/service not in use at the moment), “have never purchased/used, but willing to purchase/use”, and “have never purchased/used, and have no intention to purchase/use”. (multiple answer)

The result revealed that the percentages of purchaser/user tend to be higher for period items and pregnancy & postpartum care items. For instance, 54.8% purchase(d) postpartum skincare items, 54.5% use(d) non-polymer [cotton] sanitary napkins, 53.1% wore maternity underwear & maternity clothing, 51.7% use(d) basal thermometer, and 50.6% use(d) period tracking apps. For the period tracking apps, it is striking to see 33.2% have indicated that they “have been using the app purchased before 2020”. The result indicates that women tend to stay on the app once they start using it.

Meanwhile, despite the low purchase/use experience rate at present, women have shown keen interest in the purchase/use of test kits across the category (such as at-home screening kit for gynecological cancers [35.4%], hormone test kits [29.6%], endometrial flora check kit [25.5%]) and menopause-related items and services (such as online consultation services for women in the age range of menopause [33.6%], skincare for menopause generations [32.9%], menopause-care app [31.0%]).

Research Outline

2.Research Object: 10,079 women nationwide in their age between 20s and 60s

3.Research Methogology: Online questionnaire geared to registered participants (consumers)

An online questionnaire to registered participants (consumers) was conducted to a total of 10,079 women nationwide, in their age between 20s and 60s.

The questionnaire participants were asked about the women-specific health concerns, how they care/treat them, the recognition level of femcare/FemTech items (consumer goods) and services, the utilization status of femcare/FemTech items and services, the possibilities of recommending such items and/or services to friends/colleagues/family, and where/how they gather information regarding female-specific health issues.

This press release denotes the recognition level of FemTech, the purchase/use experience by item/service, and their willingness to buy/use the femcare & FemTech items and services in the future.

<Products and Services in the Market>

Results of the consumer questionnaire regarding feminine care and FemTech items and services (a total of 39 items and services of menstruation related items/services, sterility, pregnancy & postpartum care, menopause care, women's healthcare, and sexual wellness).

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.