No.3374

Reward Points Services Market in Japan: Key Research Findings 2023

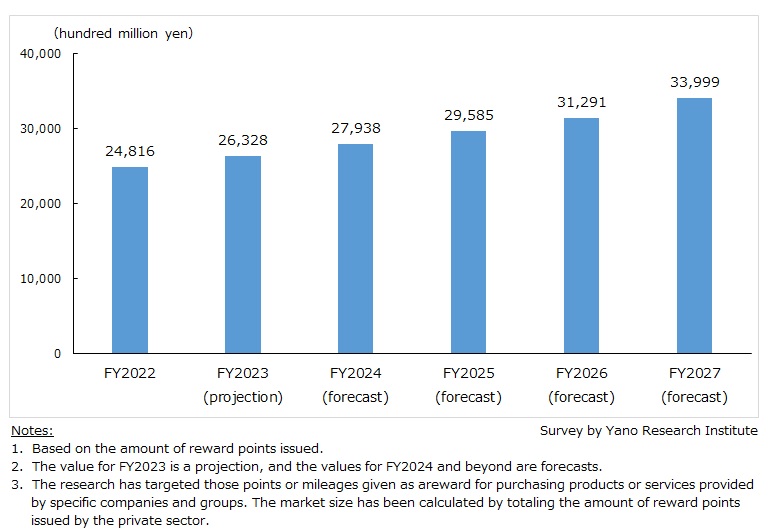

Domestic Market of Reward Points Services Valued at Approximately 2.5 Trillion Yen for FY2022

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic reward points services market, and found out the current status, trends of market players, and future outlook.

Market Overview

Size of the domestic reward points services market (based on the amount of reward points issued) for FY2022 expanded to 2,481.6 billion yen. It is expected to grow further by 6.1% to 2,632.8 billion yen for FY2023.

Although the market observed consumption decline due to pandemic restrictions in FY2020 in some business categories, such as department stores, shopping centers, and food services, the return of people’s flow and gradual recovery in spending has been uplifting the amount of reward points issued.

As shared reward point service providers made progress in recent years in acquiring franchisees, especially large store chains, adoption of shared points penetrated in a wide range of industries. With the development of multiple-shared-point service (in which customers can earn shared reward points for multiple services at a single purchase) and the rapid increase in the amount of points issued mainly for code payments, which became increasingly popular as cashless payment method, the market anticipates further expansion.

Noteworthy Topics

Advancements in Merge of Reward Points System to Cashless Payment System & Digital Membership Card Apps

Amidst the trend of developing multiple-point service, mainly among shared-reward point services, the “merge” of reward point service with cashless payment is advancing. In addition to the demand for increasing the variety of reward points available, demand for a unified infrastructure is rising at franchisees for managing “house”-type electronic money (which can be used only for payment at the stores of the issuing company [the “house”]), credit card payment, code payment, and reward point system. In addition, there is a view that the use of reward points will promote the spread of cashless payments. There is growing momentum at service providers to offer a one-stop solution for reward point services and cashless payments.

Meanwhile, since smartphone apps have the advantage of strengthening customer engagement, service providers of shared reward point are embarking on providing digital membership cards as smartphone apps. They have increased the value of digital membership cards for franchisees by sending (“pushing”) relevant ads to each customer through smartphone apps. Moreover, the service providers are trying to increase convenience of the end users by enhancing the point service apps (e.g., showing available points and history of points earned/used, notifying promotion campaigns, offering digital coupons, etc.).

Digital membership card app is not just meant to eliminate membership cards physically, but also to interlink membership to cashless payment. By connecting the membership card to cashless payment app, shared point service providers aim to multiply the use rate of digital cards.

Future Outlook

The total amount of reward points issued is expected to increase hereafter for reasons of further penetration of shared point services, recovery in consumption in areas that declined during the pandemic such as travel (tourism), and the rise of logistics price due to inflation. The domestic reward point services market is projected to grow to 3,399.9 billion yen for FY2027.

The trend of introducing multiple point services is expected to continue as companies issuing house points are also increasingly shifting to multiple-point systems including shared reward points. While ‘tap to pay’ in smartphone apps that “merge” cashless payment and point service as one-off interface increase popularity, how well they are presented will be a key for driving the use of apps.

In addition, it is assumed that digital membership card app with ‘tap to pay’ will enable franchise merchants to evolve their marketing strategy from traditional ‘customer enclosure’ with point offers and customer analysis based on ID-POS (purchase data linked to customer ID) to strategy based on more data-driven analytics.

Research Outline

2.Research Object: Shared reward point service providers, mileage service providers, website operators of point service programs, point-exchange service providers, and reward points solution providers

3.Research Methogology: Face-to-face interviews (including online interviews) by our expert researchers, survey via email and telephone, and literature research

What is the Reward Points Services Market?

The market of reward points services in this research indicates the market of points or mileages given as a reward for purchasing products or services provided by specific companies and groups. The market size is calculated by totaling the amount of reward points issued by the private sector.

The total amount of reward points issued include those points and mileages issued by the specific companies, those reward points given when specific payment methods are used (credit cards, electronic money, code payment, etc.,) and shared reward points available to use at any member stores regardless of industry or form of business (T Points, Ponta, Rakuten points, d POINT CLUB, etc.)

<Products and Services in the Market>

Reward point services, shared reward point services, mileage services, loyalty program websites, reward points exchanging services, reward points related solutions

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.