No.3365

Package Printing Market in Japan: Key Research Findings 2023

Package Printing Market in Recovery Phase

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic package printing market and explored the trends of each market/demand field, the trends at market players, and future perspective.

Market Overview

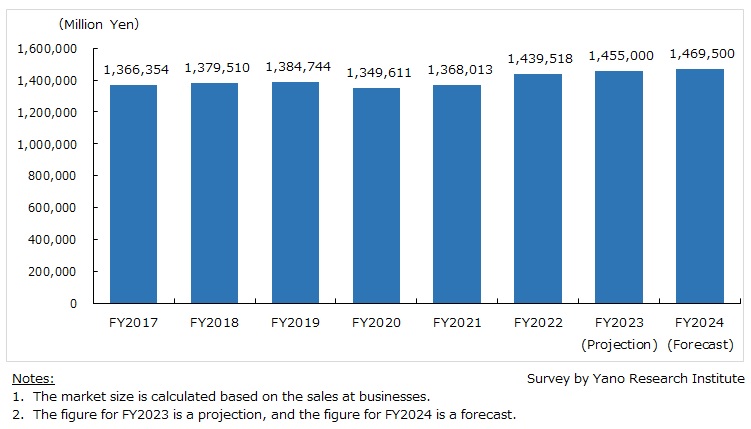

Size of the domestic package printing market was valued at 1,439,518 million yen in FY2022, with 5.2% growth from the preceding fiscal year, which is the largest leap in the last couple of years (based on the sales at businesses). In accordance with the ease of COVID-19-related restrictions, the flow of people increased with more people travelling or going out for events. Relaxation of strict border control measures increased the inbound demand (foreign tourists demand). Against the backdrop of economic recovery, the demand for package printing in FY2022 was generally robust. Nonetheless, while raw material prices and logistics cost skyrocketed, the price pass-through (changes in prices of the products or services following soaring material prices and logistics costs) was one of the major factors behind the growth of the package printing market in FY2022.

Driven by the full-scale recovery of people’s flow and the growth of inbound demand promoted by the reclassification of COVID-19’s category to Class 5 in May 2023, the market is expected to follow the growth trend. The domestic market of package printing in FY2023 is forecasted to grow to 1,455 billion yen, up 1.1% from the preceding fiscal year.

Noteworthy Topics

Market in Confusion Due to Raw Material Shortage and Rushing Customer Orders

The flexible packaging market faced disruptions in FY2022 due to the procurement crisis of raw materials, chiefly in the field of food packaging. The major raw materials that fell short were ethyl acetate, OPP (Oriented Polypropylene: biaxially oriented polypropylene), aluminum foil, and nylon (PA66), and the shortage became noteworthy around the fall of 2021. At the same time, economic recovery from the COVID pandemic has soared the demand for raw materials around the world, resulting in excess demand, which further aggravated the situation. The disruption in supply-demand balance exacerbated the rise of raw material prices.

While the industry suffered the raw material shortage, customers (user companies), one after another, stormed in to place purchase orders ahead of schedule, for the fear of uncertainty over procurement and repeated price hikes. Converters faced difficulty producing flexible packaging materials on schedule. With the risk of raw material supply, converters struggled to commit delivery dates that meet customer needs. The chaotic situation remained until around the fall of 2022.

With the rush of purchase orders, the flexible packaging market enjoyed the rise in demand in the first half of 2022. However, in view of the market on a full-year basis, the demand growth did not seem to have had a positive influence on the market overall, since the demand saw a reactional decline as the raw material shortage ease, besides, converters could not keep up with the swelling demand due to scarcity of raw materials.

Future Outlook

Size of the domestic package printing market for FY2024 is projected to grow by 1.0% on year-on-year basis to 1,469.5 billion yen. For the paper container market, where demand fluctuations from the Corona crisis have come to an end, it may be challenged again with conventional structural issues from early years, such as population decline, the trend for package-free, and the shift to flexible packaging. In the meantime, the flexible packaging market expects to enjoy continuous growth, which may be marginal or stable, against the background of steady demand seen for packaging of foods and toiletries.

Research Outline

2.Research Object: Flexible packaging converters, aluminum processed foil manufacturers, paper container converters and related manufacturers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), interviews via telephone, mailed questionnaire, and literature research

What is the Package Printing Market?

Package printing market in this research refers to the conversion (post-press processing) of flexible packages and paper containers. The market size is calculated based on the sales at businesses.

Flexible packaging indicates packages made of plastic films, including those using aluminum processed foils.

Paper containers refer mainly to paper boxes used for outer packaging. Liquid containers such as paper cups and liquid cartons, as well as paper bags are not included. In respect of the paper containers, this research specifically focuses on converted cardboard boxes; rigid paper boxes with its surface covered with finishing papers (wrappers), simple boxes without print processing, and corrugated boards are not included. Nevertheless, out of those corrugated boards, micro-flute (F-flute and G-flute) and some laminated corrugated cardboards used for similar applications are included.

<Products and Services in the Market>

Flexible packaging, paper containers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.