No.3364

Jewelry Market in Japan: Key Research Findings 2023

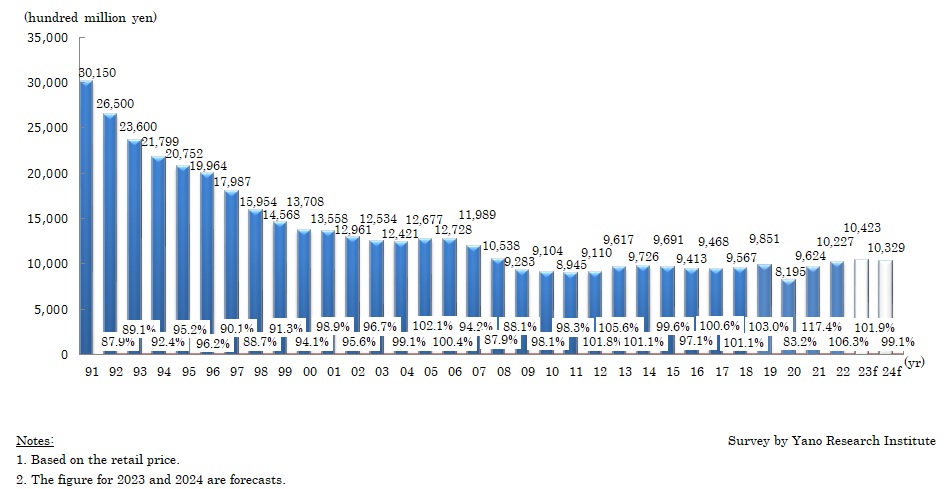

Domestic Jewelry Retail Market Forecasted to Follow Growth Trajectory in 2023 with Recovery in Inbound Demand in Addition to Rebound in Consumption Typically Among Wealthy Individuals

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic jewelry market, and found out the trends by product segment, the trends of market players, and future perspective.

Summary of Research Findings

The domestic jewelry retail market is forecasted to grow to 101.9% on year-on-year basis to 1,042.3 billion yen in 2023.

Following the reclassification of COVID-19’ category to Class 5 infections disease in May 2023, people returned to normal lifestyle from three years of restrictions and limitations, which led them to go out more often. Consequently, the domestic jewelry market is seeing a reactionary rise in consumption, especially among wealthy people, which is recovering to the pre-pandemic level. Additionally, the lifting of the ban on Chinese group tours in August 2023 and subsequent recovery in the inbound demand (the demand of foreign tourists visiting Japan) is driving sales growth at jewelry retailers.

Size of the domestic jewelry retail market in 2024 is projected to decline slightly to 1,032.9 billion yen, 99.1% of the 2023's level. In the light of continuous price hike for quite a few consumables, decline in demand is assumed for jewelry, which is not a daily necessity. The growth of overall market anticipates loss of momentum again.

Noteworthy Topics

Soaring Material Prices

The Russian invasion of Ukraine started in February 2022 had a tremendous influence on the jewelry industry, and a sharp rise in the material prices due to supply shortages was one of them. As the supply of materials from Russia, a diamond-producing country, decreased, the market witnessed a major price hike of diamonds from 2022 to 2023.

In fact, prices of platinum and palladium also rose, for Russia is the major supplier of platinum and palladium used in jewelries. Meanwhile, as gold has been favored as a "safe asset" against the background of growing concerns for downturn in global economy, the price of gold bullion has also surged.

Furthermore, the weak yen has worsened the situation, driving up the import price of materials. Remarkable rise in the unit price of jewelries also owes to the increase of all kinds of cost, such as energy prices, labor costs, the price of consumables, and logistics costs.

Research Outline

2.Research Object: Specialty jewelry store chains, retailers from other industries such as department stores, luxury watches & jewelry stores, and kimono retailers, import jewelry brands, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, and mailed questionnaire

What is the Domestic Jewelry Retail Market?

In this research, jewelries refer to personal ornaments that are typically made with precious metals like gold and platinum, which may use diamonds, precious gemstones, or pearls, including luxury watches as well as some items made with silver and/or those using semi-precious stones. The market size is calculated based on the retail price.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.