No.3359

Corporate Training Service Market in Japan: Key Research Findings 2023

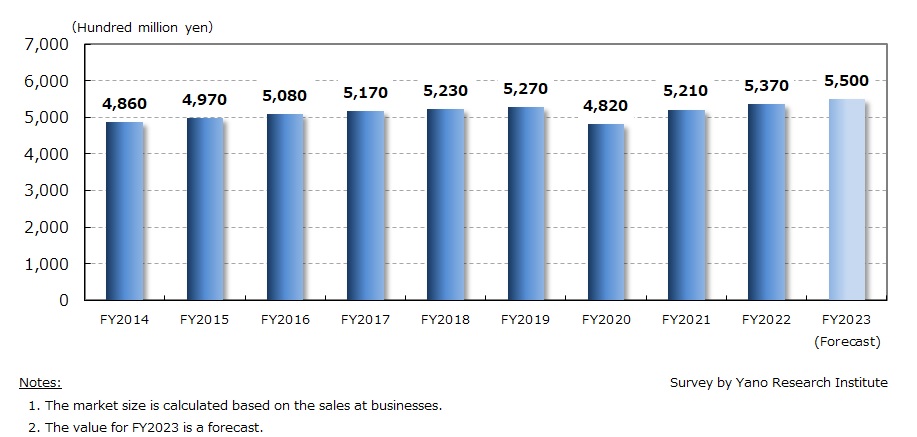

Corporate Training Service Market Forecasted to Grow by 3.1% from Prior Fiscal Year to 537 Billion Yen for FY2022, and Additional 2.4% for FY2023 to 550 Billion Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic corporate training service market, and has found out the market trends and the future perspective in view of influence of COVID-19 and changes in service demand.

Market Overview

The corporate training service market for FY2022 grew by 3.1% from the preceding fiscal year to 537 billion yen, based on the sales at businesses. Following the positive growth in FY2021, the market size exceeded pre-pandemic market size (527 billion yen in FY2019), as online training has been a successful alternative to face-to-face group sessions and has drawn out the latent demand from SMEs that had never introduced training services before. In addition, demand for face-to-face group training is driving the market expansion. Despite the negative impact of cancellations and postponements during the pandemic, the market growth has been driven by the recovery in demand for face-to-face training at the timing of new employee training starting April 2022.

From the viewpoint of training method, hybrid (a course provided by the combination of online session and in-person session) is still predominant, while the market witnesses the trend of going back to face-to-face group training as activity restrictions are terminated. The demand for classroom training (open programs and customized programs), the main offering of this market, is showing expansion, as seen in the stable sales growth of new hire training and rank-based trainings, such as training specifically for young employees, mid-level employees, next generation leaders, middle managers, and executive candidates. The growing momentum for human resource development in response to human capital management, which has become mandatory for disclosure since FY2022 (fiscal year ending March 2023), has stimulated the demand for corporate investment in education. In addition, the demand for training services is increasing due to increasing needs to support recruitment and employee retention.

Noteworthy Topics

Intention to Invest in Human Resources Gaining Momentum in Response to Mandate of Human Capital Management Disclosure

In expectations of the ease or lift of various pandemic restrictions in fiscal 2023, quite a few training service providers expect continuous expansion with the recovery of demand for face-to-face training and the development of new demand for combining online training with offline training.

Moreover, intentions to invest in recruitment, training, and developing human resources is increasing among enterprises, and it has been accelerated further by the human capital management disclosure mandated from FY2022 (fiscal year ending March 2023). Enterprises are increasingly focused on improving their human capital management practices to enhance their corporate values and reason for being.

Future Outlook

With the full-scale recovery of demand for face-to-face group training following the downgrade of COVID-19’s infectious disease categorization in May 2023, and in anticipation of new sales opportunities for services like online training that adapted to pandemic situations, the corporate training services market is projected to expand by 2.4% from the previous fiscal year to 550 billion yen in FY2023.

Research Outline

2.Research Object: Corporate training service providers

3.Research Methogology: Face-to-face interviews (including online interviews) by the specialized researchers, survey by telephone and fax, and literature research

What is the Corporate Training Services Market?

Corporate training services in this research indicate the training/education provided as “business” for client companies, in other words, it does not include in-house trainings conducted by companies’ human resource training department for their employees. Nonetheless, training services provided by subsidiaries to their parent and/or group companies are included.

For this research, corporate trainings include classroom sessions (open programs and customized programs), correspondence courses, e-learning, and organizational diagnosis/assessment. Nonetheless, the “teaching materials” refer only to the materials prepared and provided for classroom sessions and correspondence courses.

<Products and Services in the Market>

Corporate training services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.