No.3357

Next-Generation Aquaculture Business in Japan: Key Research Findings 2023

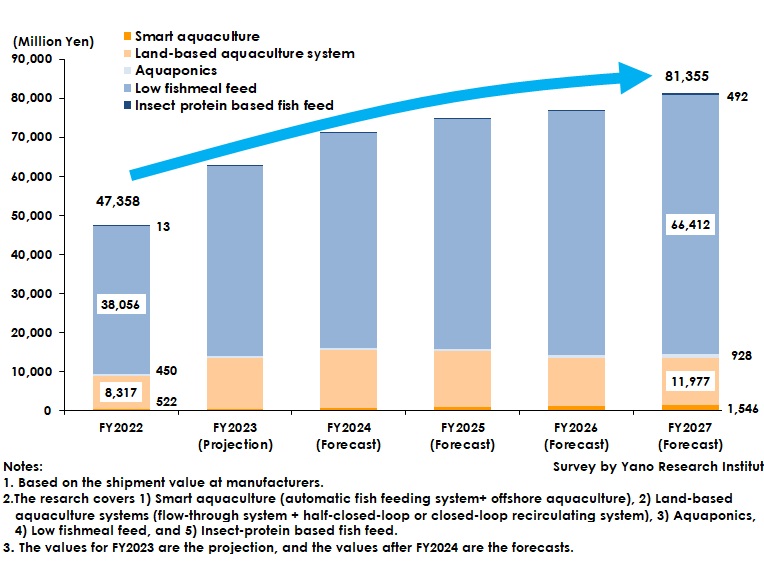

Domestic Market Size for Next-Generation Aquaculture Technologies (Total 5 Categories) Valued at 473,58 Million Yen for FY2022

Yano Research Institute (the President, Takashi Mizukoshi) has studied the next-generation aquaculture technology market in Japan and has found out the market size, trend of market players, and future perspectives.

Market Overview

With increase in the world population, food insecurity has been rising globally. According to Food Balance Sheet by Ministry of Agriculture, Forestry and Fisheries (MAFF), while domestic seafood supply per Japanese person is decreasing demand for fishery products worldwide is expanding.

In such a situation, Japanese seafood grown by aquaculture has been praised from in and out of the country and its stable supply is expected. This research covers the following five types of next generation aquaculture technologies which are “smart aquaculture” that use ICT intelligence represented by automatic fish feeding system or offshore aquaculture systems, “land-based aquaculture systems”, “aquaponics” that is an integrated farming system employing waste output from fish grown in aquaculture, “low fishmeal feed” that contains low percentage of fishmeal, and “insect-protein feed” that is the feed made from insects.

The domestic market size for next generation aquaculture technologies (total 5 categories) for FY2022 was estimated as 47,358 million yen, based on the shipment values at manufacturers. In detail, low fishmeal feed was at 38,056 million yen, land-based aquaculture systems (flow-through system + half-closed-loop or closed-loop recirculating system) 8,317 million yen, smart aquaculture (automatic fish feeding system + offshore aquaculture system) 522 million yen, aquaponics 450 million yen, and insect-protein feed 13 million yen.

Noteworthy Topics

A Series of Onshore Aquaculture Plant Construction Projects, with Prominent Entries by Major Trading Firms and Foreign Affiliates to Mega-Size Salmon Fish Farms

Land-based aquaculture systems include a flow through system (FTS) that needs flow through of water for use, closed-loop recirculating aquaculture system (RAS) that circulate the water to use by filtering and purifying it, and half-closed-loop RAS that partly circulate the water and partly drain it.

After 2021, many projects for large-scale onshore salmon farms either closed-loop or half-closed-loop have commenced construction, with annual 500 tons or more of salmons to be produced.

In 2022 the construction of mega land-based fish farms has been underway in Oyamacho of Shizuoka prefecture by Proximar, a subsidiary of Proximar Seafood headquartered in Norway, and in Nishikatsura Town of Yamanashi prefecture by NESIC Advanced Aquaculture Inc., a subsidiary of NEC Networks & System Integration Corporation. In 2023 and beyond, such constructions are scheduled to take place respectively in the city of Tsu of Mie prefecture by Soul of Japan, belonging to Pure Salmon Group headquartered in the United Arab Emirates, in Futtsu of Chiba prefecture by FRD Japan invested by Mitsui & Co., Ltd. among other companies, in Nyuzen town of Toyama prefecture by Atland Corporation, a new joint venture by Mitsubishi Corp. and Maruha Nichiro Corp, and in the city of Munakata of Fukuoka prefecture by Munakata RAS, a subsidiary of RKB Mainichi Holdings Corp., a broadcasting and communications company.

There are other products underway one after another, which include plants for mackerels, green alga, etc. not limited to salmons, in addition to a company invested by a powerhouse among others to construct and operate onshore salmon farms. The market is projected to expand furthermore, as scaling up of such plants and diversification of produced seafood are expected.

Future Outlook

The domestic market size for next generation aquaculture technologies (total 5 categories) for FY2027 is projected to expand to 81,355 million yen, with the details of low fishmeal feed at 66,412 million yen, land-based aquaculture systems 11,977 million yen, smart aquaculture 1,546 million yen, aquaponics 928 million yen, and insect-protein feed 492 million yen.

Of smart aquaculture mentioned above, automatic fish feeding system is likely to increase the adoption with the aim to optimize feed volume and reduce feed cost owing to further soaring feed prices. Introduction of offshore aquaculture systems is also expected to increase due to lack of coastal lands suited for aquaculture and advancement in technologies.

Land-based aquaculture systems expects market expansion as a series of construction in progress for mega-size onshore aquaculture plants.

Aquaponics anticipates increase in implementation cases because of improved general awareness caused by a series of domestic constructions of land-based aquaculture plants and exhibitions of aquaponics at aquariums.

Low fishmeal feed is projected to expand the market, owing to increased focus on the development of low fishmeal feed by each of feed manufacturers, and to feed price rise caused by soaring fishmeal prices.

Insect-protein feed expects gradual market expansion on account of commencement of full-scale sales by major companies, etc.

Research Outline

2.Research Object: Developers of next generation aquaculture technologies (smart aquaculture [automatic fish feeder system, offshore aquaculture system], land-based aquaculture systems, low fishmeal feed, and insect-protein fish feed), fish farms, universities, related public organizations, and R&D institutions

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via phone/email, and literature research

Next-Generation Aquaculture Technology Market

The next-generation aquaculture technology market in this research indicates the following five categories: 1) Smart aquaculture (automatic fish feeding system+ offshore aquaculture), 2) Land-based aquaculture systems (flow-through system + half-closed-loop or closed-loop recirculating system), 3) Aquaponics, 4) Low fishmeal feed, and 5) Insect-protein feed. The market size is calculated based on the shipment value at manufacturers. Each technology field is defined as follows:

1) Smart aquaculture: Automatic fish feeding system; sensors, cameras, submergible fish pens, image analysis software, automatic analysis software, operation fee and use charge (including cloud-based service charge) used in offshore aquaculture system

2) Land-based aquaculture systems: Fish tanks, filtration tanks, denitrification devices, temperature control devices, pumps, measuring devices, etc.

3) Aquaponics refers to a sustainable farming method that combines aquaculture with hydroponics where plants can grow by using waste output from fish that grow in aquaculture.

4) Low fishmeal feed refers to the feed with lower percentage (50% or less) of fishmeal sold by each manufacturer as low fishmeal feed.

5) Insect-protein feed refers to insect protein feed made from insects..

<Products and Services in the Market>

1) Smart aquaculture, 2) Land-based aquaculture systems, 3) Aquaponics, 4) Low fishmeal feed, and 5) Insect-protein fish feed.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.