No.3352

Golf Goods Market in Japan: Key Research Findings 2023

After Reaching 300 Billion Yen in 2022, Domestic Golf Goods Market Shows Challenges Including Deceleration of Sales Volume after Latter Half of 2023

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic golf goods market, and found out the trends by product category, trends of leading companies, and future perspectives.

Market Overview

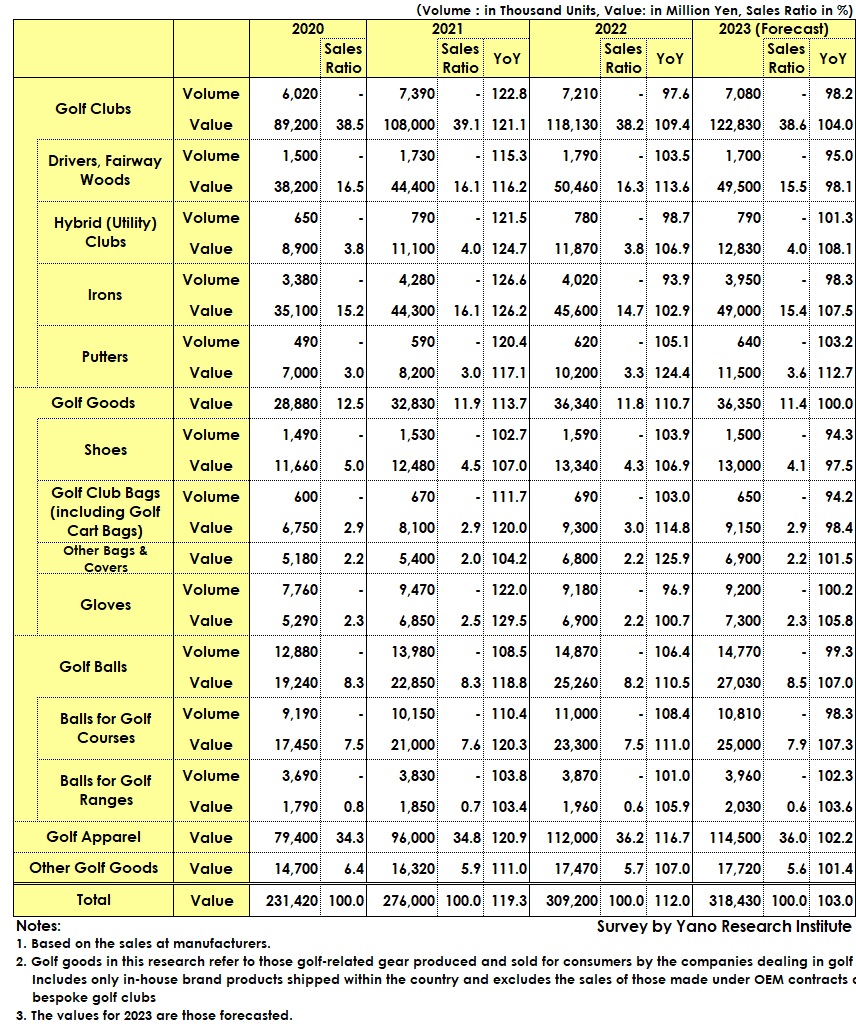

The domestic golf goods market size based on the sales at manufacturers in 2022 rose to 112.0% from previous year to 309,200 million yen. It was 2001 when the market had reached 300,000 million yen in the past, so that it was the first time in 21 years to have achieved that level.

After 2020, the golf goods market was booming from COVID-19 bubble not only domestically but also worldwide. The sport gained attention as an outdoor activity amid the pandemic, which continued thriving in 2022. Other factor to be pointed out was the soaring material prices that raised the product prices to have increased the value-based market size.

Noteworthy Topics

Trend of Golf Beginners Who Started Golf amid Corona Crisis by Consumer Survey

Aiming to quantitatively analyze the impact of COVID-19 on the domestic golf industry, consumer survey was conducted four times after 2020.

According to the survey that took place four times, there were 1,100 thousand golfers (extrapolated value) who were either beginners (started playing golf after 2019) or dormant players (have not played golf for more than a year but started again after 2019).

On the other hand, it was found out that those who had started golf due to the pandemic but had already quitted (i.e., early retirees) accounted for as many as 20% (as of July 2023).

It was easy to imagine the reasons from the similar surveys in the past such as financial or little progress in golf skills to enjoy the sport. In addition to the above, there seemed to be a certain number of those golf retirees caused by normalization of living environment, including “becoming able to travel once again”, “resumed drinking outside”, “resumed to commute”, “job relocated”, etc.

Preventing from golf quitting is difficult when the reasons for quitting are those mentioned above, so that it is helpless to see a certain number of retirees. Rather, the quitters having remained at 20% and the rest kept on playing golf can be said as a good result. The survey has suggested that, in addition to taking whatever measures to prevent from early golf retirement, it is important for the golf industry to be strategic or tactical, that is to build a scheme to sustainably generate new golf beginners i.e., a scheme to create one from none.

Future Outlook

The domestic golf goods market size by the sales at manufacturers in 2023 is projected to grow to 318,430 million yen, 103.0% of that of previous year. The growth factor is higher unit selling prices that has continued from preceding year.

When observing the sales by product category, many items are forecasted to make negative growth on a YoY basis, which include drivers/fairway woods, irons, balls for golf courses, and shoes. Although golf clubs that occupy high percentage in value are expected to end up with 7,080 thousand units, 98.2% by volume, they are projected to increase consecutively to 122,830 million yen, 104.0% of that of preceding year by value. In addition, golf apparel market is also projected to reach 114,500 million yen, 102.2% on a YoY. Both factors are affecting significantly.

Needless to say, more than a certain level of demand generation at retail market is a prerequisite to achieve the above projections. According to YPS Golf Data (i.e., data on actual sales at domestic 1,100 golf gear retailers accumulated and analyzed) at each month of 2023, it must be said that the continuous growth is a considerably high hurdle.

Research Outline

2.Research Object: Domestic enterprises dealing in golf goods (manufacturers, trading firms, wholesalers, and retailers)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers and online consumer survey

About Golf Goods/Golf Gear

Golf goods in this research refer to those golf-related gear produced and sold for consumers by the companies dealing in golf goods. The market size in this research only includes in-house brand products shipped within the country and excludes the sales of those made under OEM contracts and of bespoke golf clubs.

* Measuring instruments and golf simulators installed at some retailers by golf goods manufacturers are also excluded.

About Golf Goods Market

The golf goods market in this research is calculated based on the sales of target products mentioned above at manufacturers.

* It is the net sales subtracting returned goods sales and markdown payment slip (deducted amount) from the total sales ([sales at direct shops] + wholesale sales), excluding the overseas sales.

<Products and Services in the Market>

Golf clubs (Drivers/Fairway woods, hybrid clubs, irons, putters), golf balls (for golf courses or for golf ranges), golf shoes, golf club bags (including golf cart bags), other bags and covers, golf gloves, golf clothing/apparel (including cap, visor belt, and underwear), other golf goods (tee/marker, practicing devices, competition prizes, portable golf rangefinders, and others)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.