No.3350

Imported Luxury Brand Market in Japan: Key Research Findings 2023

Imported Luxury Brand Retail Market in 2022 Showed Substantial 29.9% of Growth from Previous Year, Boosted by Product Price Rise Caused by Weakened Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic imported luxury brand market and found out the market status, the trends of brands, and future perspectives.

Market Overview

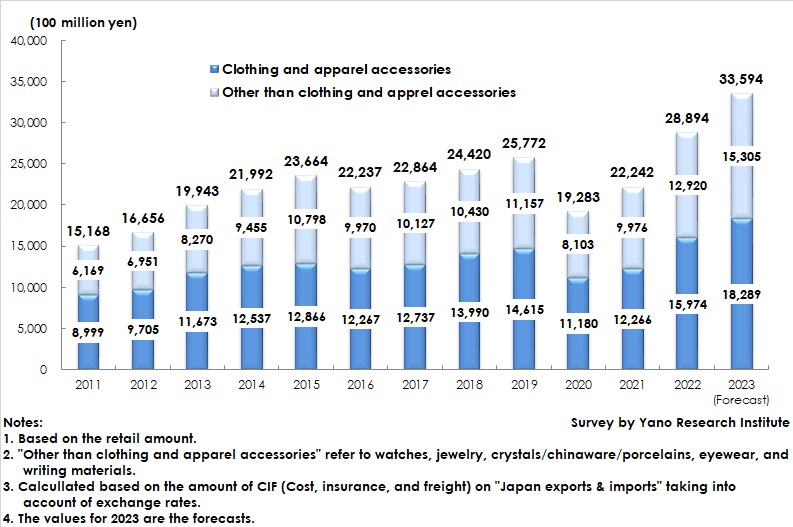

The domestic imported luxury brand (major 15 items) retail market in 2022 was estimated to have risen by 29.9% from the previous year to 2,889,400 million yen. This was up by 12.1% even from the market size in 2019, the most recently favorable market status before the pandemic, indicating a complete recovery from the corona crisis.

There were two factors for the strong market in 2022. One was product price rise stemming from rapid depreciation of yen. In 2022 each brand repeatedly raised the product prices, which did not lead to any decline in demand. Rather, popular brands even experienced last minute surge in demand just before price revisions. On average around 20% of price rise took place at target major brands researched, with the amount raised directly connected to sales increase in most cases. Another factor was the demand recovery in the "with Corona" society. Lift of behavior restrictions from the corona crisis in that year has brought about outing opportunities to increase and lifestyles to return to pre-corona statuses, which encouraged purchases for replacement as well as new items.

Noteworthy Topics

Continued Product Price Rise and Enhancement in Product Assortment

As depreciation of yen has continued in 2023, many brands have planned around twice of raising the product prices by summer, the behavior of which is expected to continue even after fall.

The repetitive price rise which has turned out as far as this, some customer groups are becoming unaffordable to buy upscale brand products like they did in the past. While the price rise is said to have not at all affected the affluent customers, suppressing the consumption behavior by young generation that has supported the brand momentums can be a negative factor.

Assuming the situation, the popular the brands are, a strategy of raising the price for major products has been taken, thereby to encourage rareness and admiration, while enhancing the product assortment affordable for the next-generation customers. This move is obvious among high-end brands but is expected to spread to the mid-price range brands.

Future Outlook

As the society has rapidly recovered to the status before COVID, 2023 has seen favorable consumption for tangible goods (products and services) in line with consumption for intangible goods (experience-based consumption). Currently, robust consumption is observed for domestic wealthy population that supports the market for imported high-end brands. With the resilience of inbound demand, the market size may exceed the strength of previous year. Although weak domestic consumption in general remains to be the main concern, the domestic imported luxury brand market for 2023 is projected to grow by 16.3% on a YoY basis to 3,359,400 million yen, due to invigorated inbound demand.

While expansion of inbound demand affected by depreciation of yen is a favorable factor, some negative influences are also the concerns, such as crowded stores causing insufficient or inadequate services to domestic customers, etc. Some measures or considerations must be taken or made for retention of domestic customers including affluent clients.

Research Outline

2.Research Object: Trading firms, manufacturers, retailers that import and sell products such as clothing, accessories, watches, jewelry, crystals/bone chinaware/porcelains, eyewear, and writing materials, produced by the European and U.S. brands, and Japanese subsidiaries of imported luxury brands

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, and literature research

Imported Luxury Brands

Imported luxury brands in this research refer to the brands for the following 15 items (conventional ten items and newly-added five items): 1) Women’s clothing, 2) Men’s clothing, 3) Babies’ clothing, 4) Bags & leather goods, 5) Shoes, 6) Ties, 7) Scarves/shawls/handkerchiefs, 8) Leatherwear, 9) Belts, 10) Gloves, 11) Watches, 12) Jewelry, 13) Crystals/chinaware/porcelains, 14) Eyewear, and 15) Writing materials. Note that luxury brands are only those imported from U.S. or Europe.

<Products and Services in the Market>

Women’s clothing, Men’s clothing, Babies’ clothing, Bags & leather goods, Shoes, Ties, Scarves/shawls/handkerchiefs, Leatherwear, Belts, Gloves, Watches, Jewelry, Crystals/chinaware/porcelains, Eyewear, and Writing materials.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.