No.3334

Last Mile Delivery Logistics Market in Japan: Key Research Findings 2023

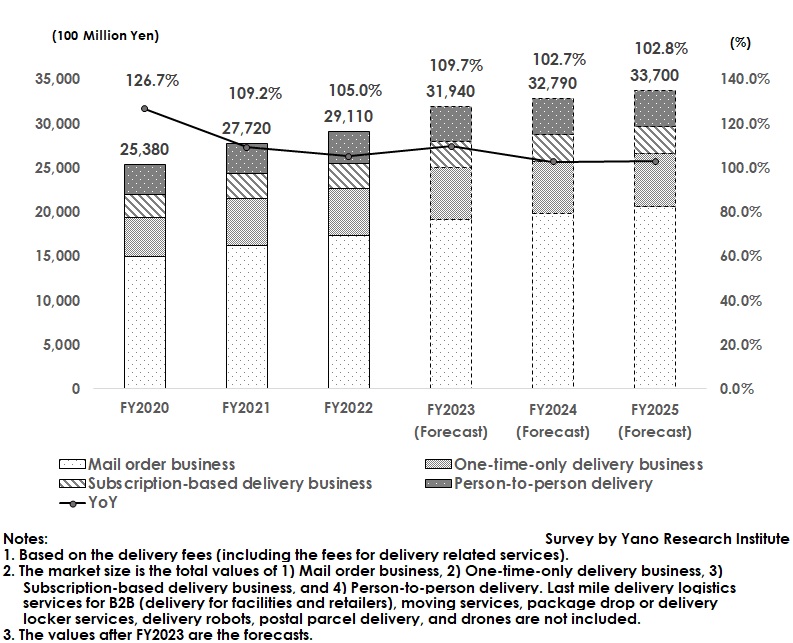

Last Mile Delivery Logistics Market Size for FY2022 Rose to 2,911.0 Billion Yen, 105.0% of Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic last mile delivery logistics market and found out the trends by category, trends of market players, and future perspectives.

Market Overview

The domestic last mile delivery logistics market size for FY2022 was estimated as 2,911,000 million yen, 105.0% of that of the previous fiscal year.

When compared to FY2020 and FY2021, no surging demand like amid the corona crisis was observed in FY2022, but the market showed favorable growth though moderate. This was reflected by increase in smaller parcels, more frequent delivery, and rise in logistics cost caused by higher labor and energy costs.

Also, in FY2022, almost 60% of the market was occupied by mail order business, indicating that the market has grown together with expansion of mail order business as well as increase in the number of parcels dealt in by home delivery service business.

When observing the market for FY2022 by category, the food delivery field plummeted, while the delivery business geared to the elderly increased, such as online supermarkets and home meal delivery services.

Noteworthy Topics

Emerge of New Players that Support Last Mile Delivery Logistics Market

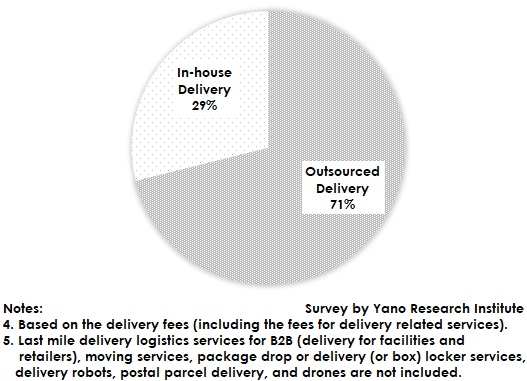

In this research, deliveries involved in the last mile delivery logistics are categorized into two types, i.e., deliveries by delivery-specialized service providers and by in-house (delivery by the company itself or the delivery responsibility taken by the company itself).

It is found out that approximately 70% of the market size for last mile delivery logistics in FY2022 is estimated to have been occupied by outsourced delivery, and the rest of approximately 30% by in-house.

In-house deliveries are categorized into asset type, where companies deliver the products themselves by having their own delivery vehicles and employees, just like pizza or sushi delivery, and non-asset type where companies do not have any delivery vehicles or employees but rely on local transporters, sole proprietors that use light motor vehicles for freight transportation, courier service providers (including gig workers that undertake one-time work through an online platform), etc. for directly ordering last mile delivery.

In the status where the number of parcels dealt in by home delivery services is regarded to increase, new bearer of last mile delivery logistics can be non-asset type businesses, which is projected to increase the market share.

Future Outlook

The last mile delivery logistics market size for FY2023 is projected to reach 3,194,000 million yen, 109.7% of the previous fiscal year. Major home delivery service businesses have already revised the reported freight rates, while those businesses that have postponed raising of their rates are showing intentions to revise their rates as well, now that the amendment to labor reform law in April 2024 is imminent, while facing soaring energy and labor costs. Furthermore, as new delivery demands such as for prescribed drugs can be expected, the market is likely to be steadfast.

The market size for FY2030 is projected to reach 4 trillion yen. Viewed from long-term aspects, the following factors are regarded as the hindrance of market growth: Decreasing consumers stemming from declining population, future stagnation expected in mail order business after peaked out, serious driver shortages against ever-increasing goods to deliver, etc.

Research Outline

2.Research Object: B2C logistics related businesses, government offices, etc.

3.Research Methogology: Face-to-face interviews by expert researchers, survey via telephone, and literature research

The Last Mile Delivery Logistics Market

Last mile delivery logistics in this research is defined as the last journey of the whole delivery process to the final destinations, i.e., from the final logistics base to the destination of a general consumer (B2C) or the delivery between general consumers (C2C). Last mile delivery logistics is classified into the following four categories: 1) Mail order business, 2) One-time-only delivery business (i.e. pizza/sushi and other food delivery business, food delivery couriers that deliver food from fast-food and family restaurant chains) 3) Subscription-based delivery business (i.e. frequently-used deliveries for regular customers to make the delivery at certain time ranges, such as meal delivery, co-op delivery, etc.) and 4) Person-to-person delivery. The market size is based on the delivery fees (including the fees for delivery related services). Note that last mile logistics services for B2B (delivery for facilities and retailers), moving services, package drop or delivery locker (or box) services, delivery robots, postal parcel deliveries, and drones are not included.

<Products and Services in the Market>

Home delivery service, freight transportation service using a light motor vehicle, delivery courier, mail order business, one-time-only delivery business, subscription-based delivery business, regional support service, delivery robot, drone, package drop or delivery locker (or box) services, and postal parcel delivery.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.