No.3316

Housing Equipment Market in Japan: Key Research Findings 2023

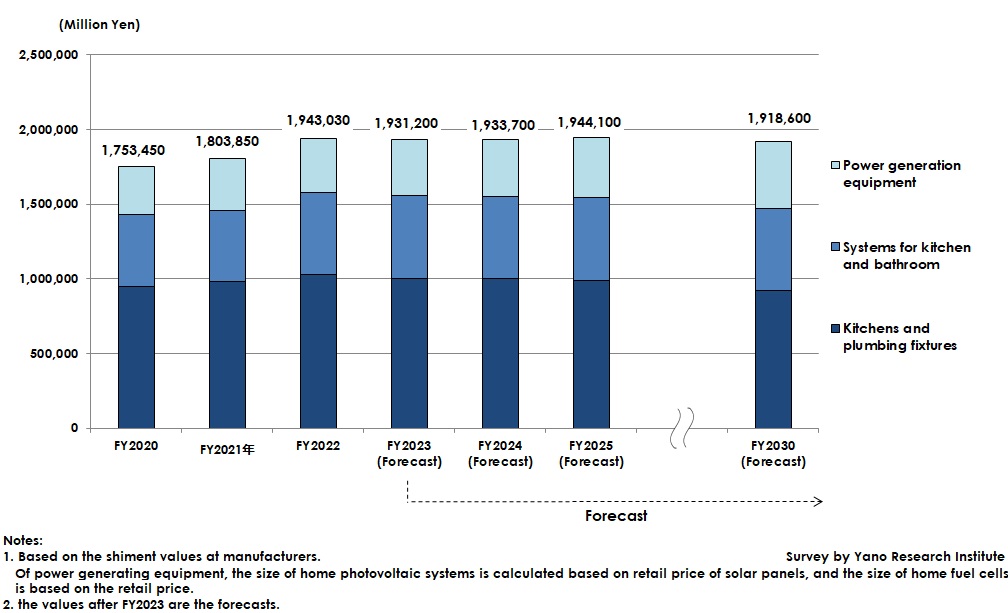

Housing Equipment Market Size (Kitchens and Plumbing Fixtures, Kitchen and Bathroom Systems, and Power Generation Equipment) for FY2022 Rose by 7.7% on YoY to 1,943,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic housing equipment market and found out current market status, trends of market players, and future perspectives.

Market Overview

The major housing equipment market size (kitchens and plumbing fixtures, kitchen and bathroom systems, and power generation equipment) for FY2022 was estimated as 1,943,000 million yen, an increase by 7.7% from the previous fiscal year.

When observing the details, all the market categories increased from the previous fiscal year, mainly because of normalization of supply chains in the countries producing equipment components chiefly in Southeast Asia having eliminated parts shortages, which led housing equipment manufacturers there to recover the reduced production, and because of soaring material prices passed on to product prices. In addition, there was stable demand for relatively high-priced house renovations after people reviewed their dwelling environment when they had extended home time due to the corona crisis.

Noteworthy Topics

Keywords in Housing Equipment Market are “Timesaving” and “Carbon Neutrality”

“Timesaving” and “carbon neutrality” are likely to be the keywords to view the housing equipment market hereafter.

First, “timesaving” becomes important, one of the reasons for this is dual-income households, which is increasing in number, are craving for reducing the burdens of household chores. In association with the social changes of increase in dual-income households, housing equipment manufacturers are actively launching products that contribute to alleviation of household-chore labor.

One example for this is dishwashers. According to Consumer Confidence Survey by the Cabinet Office the rate of having a dishwasher at households with two or more members grew to 37.1% as of March 2023, 15.5 points higher than in March 2005 (21.6%) when the tally started. Dishwashers can expect a long-term market expansion because of improvement in installation rates in newly built homes and expansion of replacement demand.

Next, carbon neutrality has the backdrop of people becoming more enthusiastic about achieving it after the government’s announcement in October 2020 for attaining it by 2050. As ZEH (net zero energy house) becomes mandatory for newly built homes after FY2030, the markets for photovoltaic systems and storage batteries that enable private power generation and private power consumption are growing. As for hot water heaters that occupy a certain level of CO2 emissions from households, it is likely for the replacement to high-efficiency water heaters such as heat pump water heaters and latent heat recovery water heaters to accelerate.

* A net zero energy house (ZEH) is a residence that contribute to achieving carbon neutrality by reducing annual energy balance into zero or less through renewable energy deployment such as photovoltaic power generation, while attaining enormous energy saving through improved heat insulation performance and other methods.

Future Outlook

The major housing equipment market size for FY2023 is projected to decline by 0.6% from the preceding fiscal year to 1,931,200 million yen.

In detail, the kitchen and plumbing fixture market is expected to decline by 2.3% on a YoY basis to 1,005,000 million yen, because new construction starts is likely to decrease, and because the consumption is expected to shift to something outward like leisure and traveling, from inward consumption during home time amid the corona crisis, which is likely for the once stable home renovation demand to settle down.

The kitchen and bathroom systems market is projected to level off at 554,600 million yen, 0.7% on a YoY, because of the continued effects of price rise, while vigorous demand in the previous fiscal year when component shortages have been eliminated by normalization of supply chains somewhat quietens down.

The power generation equipment market is projected to rise by 2.3% on a YoY to 371,600 million yen, driven by the favorable demand for household energy storage systems. Recent soaring electricity costs seems to have markedly increased those people who aim at private consumption to have the system, which is also boosting the market.

Research Outline

2.Research Object: Housing equipment manufacturers and industrial organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone and emails, and literature research

The Housing Equipment Market

The housing equipment market in this research refers to home-use equipment installed at residence, categorized into three types: 1) Kitchens and plumbing fixtures, 2) Kitchen and bathroom systems, and 3) Power generation equipment. Details of each category are as follows:

(1) Kitchens and plumbing fixtures: kitchen (systematic kitchen, sectional kitchen), systematic baths, electronic toilet seats, household sanitary equipment, and washstands (not including taps)

(2) Kitchen and bathroom systems: dish washers, hot water supply systems, stoves, bathroom heating and drying machines

(3) Power generation equipment: Household energy storage systems, home solar systems, and home fuel cells

Basically, market sizes for each housing equipment are calculated based on the shipment value at manufacturers. Nevertheless, of (3) power generation equipment, the market size for home photovoltaic systems is calculated based on retail price of solar panels, and the market size for home fuel cells is based on the retail price.

<Products and Services in the Market>

Housing equipment (kitchens and plumbing fixtures, kitchen and bathroom systems, and power generation equipment)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.