No.3300

Global Motorbike Market: Key Research Findings 2023

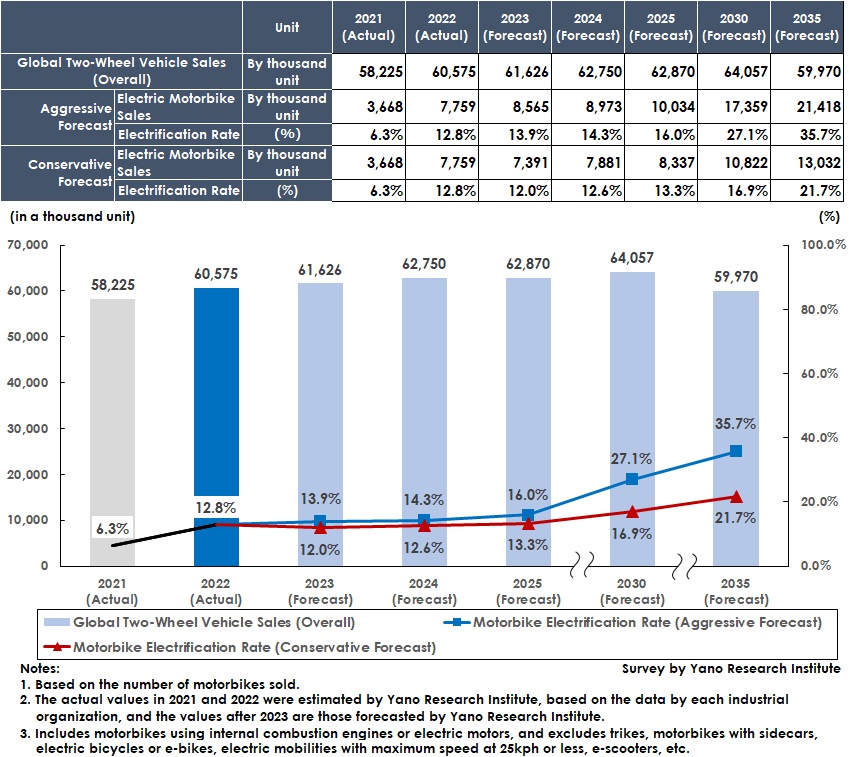

Electrification Rate of Two-Wheel Vehicles to Grow Up to 27% by 2030

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global motorbike market and provided the market overviews for major countries and the trends of major manufacturers. This paper mentions about the global motorbike sales and motorbike electrification rate forecasts by 2030.

Market Overview

Normalization of economic activities from the COVID-19 pandemic was in progress in 2022, which expanded the motorbike market in major countries, bringing about the global motorbike sales to reach 60,575 thousand. As was able to see from sales expansion on a YoY basis in India by approximately 7% and the total of six ASEAN countries by approximately 10%, strong demands were observed in major markets. Still, the motorbike market projection for 2023 has been uncertain than ever, due to global high inflation rates, soaring raw material prices, and changes in world affairs.

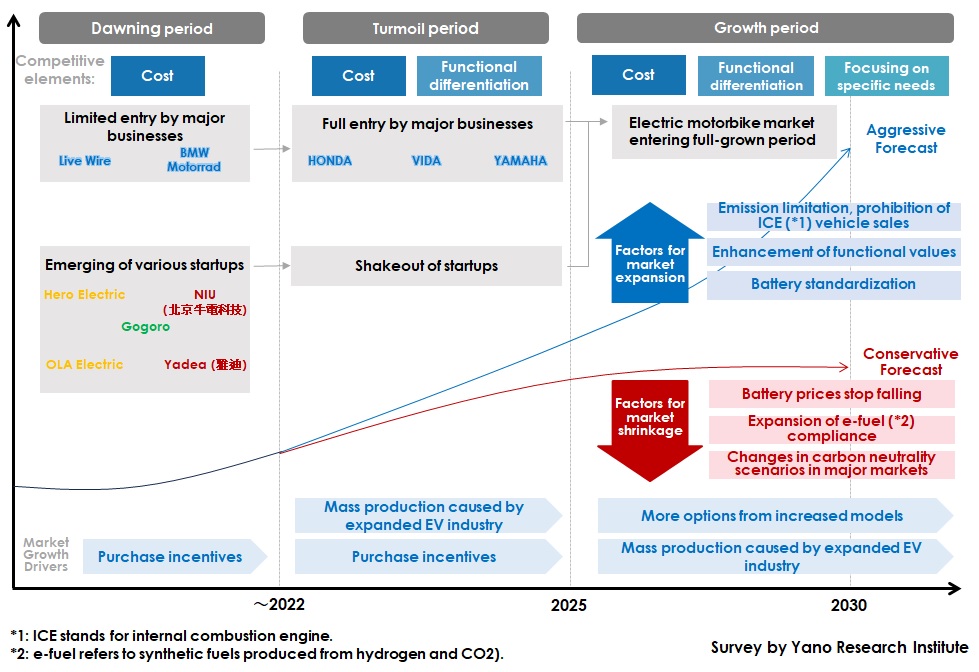

The electric motorbike market has shown steady sales in India, China, and ASEAN countries. In regions with many price-oriented users, local startup companies have obtained market superiority by means of penetration pricing (a strategy aiming at market penetration by setting the products at low prices). As major motorbike manufacturers have started the full launch of electric motor bike models during 2022 and 2023, the electric motorbike market is showing a sign of entering the growth period.

Noteworthy Topics

Full Market Entry by Major Companies Leads to Fiercer Competition in Electric Motorbikes

Motorbikes have overcome the emission regulations only by tuning catalytic converters and rewriting of ECU (Engine Control Units) programs without relying on cutting-edge technologies such as downsizing and hybrid. To achieve carbon neutrality, which now is the global trend, however, motorbikes need to be electrified.

Electric motorbikes are demanded also from the aspects of mobility management (a traffic measures to encourage individuals to use public transportations rather than relying on automobiles they own) and CSR (Corporate Social Responsibility). Nevertheless, they face various issues such as price differences from ICE (internal combustion engine) vehicles, cruising distance, shortage of charging infrastructure, decreasing attraction as a hobby caused by the loss of gearshifts and exhaust notes.

In such a situation soaring gasoline prices and increased amount of purchase incentives in some countries have become the tailwind, which have expanded the global electric motorbike sales in 2022 to approximately twice as larger than the previous year. The market status of being driven by local startups are about to change, as major companies have attained full market entries, which include that of Hero, a major Indian company in 2022, releases of electric motorbike models by Honda in the European and Chinese markets in the same year, and its market launch plans for electric motorbike models in India in 2024.

Future Outlook

Although sterner regulations against emissions and environmentally friendly urban planning have increased the sales of electric motorbikes in Japan and Europe, the scale of motorbike sales in these countries has been small in the first place, making it difficult for electric motorbikes to be the major market in these regions. On the other hand, while global population is said to be occupied mainly by emerging countries, it is challenging for EVs (electric four-wheel vehicles) to penetrate there as the mobility (a means of transport) in terms of cost and social infrastructure. Taking account of all these, electric motorbikes are less challenging, and are expected to spread in such countries. In particular, China, India, ASEAN countries are projected to be the three poles to form electric motorbike markets.

As can see from Honda’s announcement of launching more than 10 models of electric motorbikes worldwide by 2025, each manufacturer has started being enthusiastic in developing electric models. India has seen many local venture companies gaining power and some major manufacturers fully entering the market. Indonesia, as its national policy, has been nurturing supply chain for electric motorbikes and encouraging penetration. Against these backdrops, the electric motorbike market is projected to enter growth period in around 2025.

Of the Global Motorbike Penetration Rate Forecasts in this research, the Aggressive projection assumes that all the issues having prevented wide acceptance of electric motorbikes (battery prices and charging infrastructure) are to be solved, and expansion of mass production makes electric models to be price competitive with existing ICE-driven motorbikes. The Conservative forecast, on the other hand, assumes that demand for electric motorbikes cannot be generated in the motorbike market where users tend to be price-sensitive, against the backdrop of continuous high inflation rates and rising interest rates. The following assumptions are also included: Purchase incentives to be suspended in the situation where the market has not yet formed sufficiently, and changes in carbon neutrality scenarios from those centered on EVs (electric vehicles) to those such as on e-fuels (synthetic fuels produced from hydrogen and CO2) and biofuels (fuels produced by using plant-based ethanol as a raw material).

Research Outline

2.Research Object: Motorbike manufacturers, suppliers, and related organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, and literature research

The Motorbike Market

A motorbike is defined as a 2-wheel vehicle with its propulsion usually provided by an internal combustion engine or an electric motor.

This report targets motorbikes using internal combustion engines or electric motors, and excludes trikes (three-wheel motorbikes), as well as two-wheeled motorbikes with sidecars. Also, electric bicycles or e-bikes, though two-wheeled and equipped with motors, that need to be pedaled, electric mobilities with maximum speed at 25kph or less, though autonomous, and those that belong to personal mobilities such as e-scooters, are not included.

Of the Global Motorbike Penetration Rate Forecasts in this research, the Aggressive projection assumes that all the issues having prevented wide acceptance of electric motorbikes (battery prices and charging infrastructure) are to be solved, and expansion of mass production makes electric models to be price competitive with existing ICE-driven motorbikes. The Conservative forecast, on the other hand, assumes that demand for electric motorbikes cannot be generated in the motorbike market where users tend to be price-sensitive, against the backdrop of continuous high inflation rates and rising interest rates. The following assumptions are also included: Purchase incentives to be suspended in the situation where the market has not yet formed sufficiently, and changes in carbon neutrality scenarios from those centered on EVs (electric vehicles) to those such as on e-fuels (synthetic fuels produced from hydrogen and CO2) and biofuels (fuels produced by using plant-based ethanol as a raw material).

<Products and Services in the Market>

Internal-combustion-engine motorbikes, electric motorbikes

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.