No.3295

Questionnaire to Life Insurance Sales Representatives in Japan: Key Research Findings 2023

55.5% of Life Insurance Sales Reps Say Annual Client Contact Frequency Decreased from Before Covid

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a questionnaire to sales personnel, a mainstream sales channel in the domestic life insurance industry, to analyze the status and future perspectives of insurance sales by the sales reps. Here discloses a part of the survey results, regarding the priority between new and existing customers.

Summary of Research Findings

Life insurance products are mainly sold through sales personnel, but the environment surrounding them is changing dramatically. In addition to sales rep turnover (mass recruitment and mass departures) that is a challenge in the life insurance industry, diversified sales channels, due to the advent of new channels such as bank tellers and joint agencies (agencies that deal in insurance products from multiple life insurance companies), and the coronavirus pandemic have affected the positioning and the values of life insurance sales personnel.

A questionnaire geared to 400 life insurance sales personnel (sales representatives at life insurance companies, or insurance agents dedicated to a certain life insurance company) has been conducted in this research.

Although sales activities by life insurance sales reps are basically done by meeting their clients face-to-face, the corona crisis has disrupted such a routine and has forced them to experience non-face-to-face client contacts that use online.

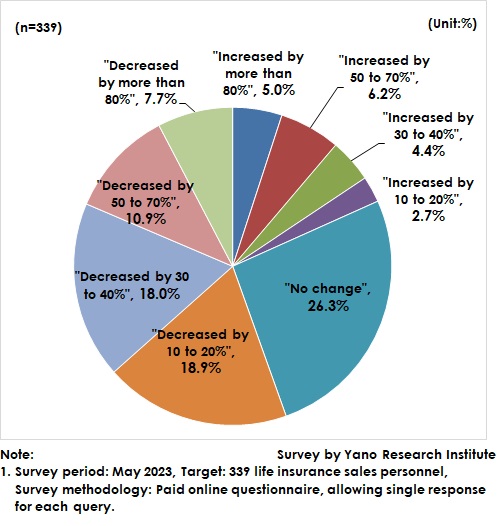

In such a situation, we have asked them how different the annual frequency in face-to-face meetings with clients is between before (FY2019 or before) and after Covid crisis (FY2020 to FY2022).

The largest number of responses is “No change” in the frequency to meet clients at 26.3%, but the total rate of those applying to each of four options from “Decreased by 10 to 20%” to “Decreased by more than 80%” is 55.5%, indicating that more than half of sales representatives recognize a decrease in the frequency of meetings with clients due to the corona crisis.

On the other hand, the total rate of those applying to four options of “increased” is 18.3%. Those sales reps that have been able to adeptly use the online tools seems to have succeeded in increasing the client contact frequency even amid the corona crisis.

Noteworthy Topics

Gap between Corporate and Sales-Rep Recognitions toward Client Priority

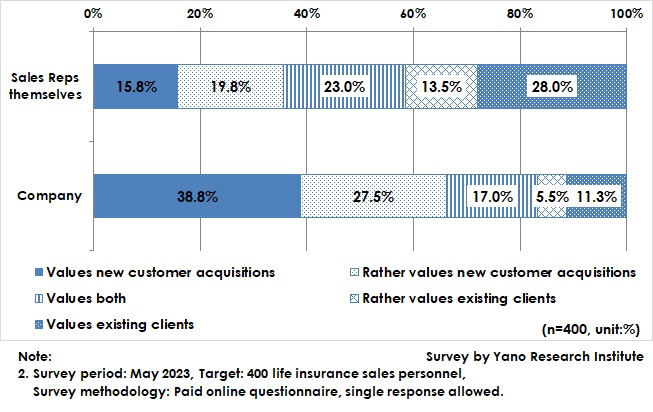

First, we have asked about the corporate policy on which to prioritize, new customer acquisition or continuous relationships with existing clients. Then asked which they prioritize as sales personnel.

The total rate of corporate policies placing importance on new customer acquisition (38.8%) and rather putting importance on new customer acquisitions (27.5%) has exceeded 60%, indicating many sales reps percept that their companies value obtaining new clients.

Next, their own priorities have been as follows, according to the response rate orders: “Gives much account on existing clients (28.0%)”, “Attaches importance on both (23.0%)”, and “Rather putting importance on new customer acquisitions (19.8%)”. The results have shown that the sales rep opinions vary. Despite the corporate policy to place more importance on new client acquisitions, the total rate for “Gives much account on existing clients” and “Rather gives much account on existing clients” has exceeded 40%.

When having asked about the reasons for giving importance on existing clients in other queries, the responses have included “the sales activities to existing clients are more comfortable” and “less stressful”. There also is an opinion, “Follow-up for existing clients has a lot of work to do, and no time for new customer acquisitions”. As the environment surrounding the sales personnel has been changing dramatically, new customer acquisitions seem to have become more difficult for them psychologically and temporally.

Research Outline

2.Research Object: Life insurance sales representatives

3.Research Methogology: Online questionnaire geared to registered applicants

Life Insurance Sales Representatives

There are several sales channels for life insurance business, including the traditional sales personnel and others such as tellers of financial institutions, joint agencies, and through online. Yet, the mainstream is still the sales representatives.

According to “Life Insurance Fact Book 2022” by the Life Insurance Association of Japan, the number of sales representatives registered in Japan as of FY2021 is 240 thousand. Accordingly, the sales of life insurance is supported by many sales personnel, but the industry faces a challenge of sales-rep turnover (mass recruitment and mass departures).

<Products and Services in the Market>

Life insurance sales representatives/sales personnel

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.