No.3293

Eyewear Retail Market in Japan: Key Research Findings 2023

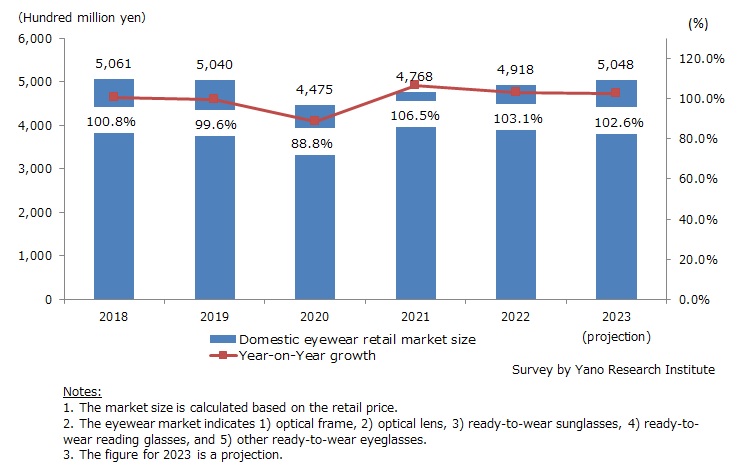

Domestic Eyewear Retail Market for 2022 Grow to 103.1% of Previous Year to 491,800 Million Yen Along with Recovery of Post-Covid Foot Traffic

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic eyewear market and found out the trend of products by segment, the newsworthy topics, and future perspectives.

Market Overview

Size of the domestic eyewear retail market is estimated at 476,800 million yen in 2021 (106.5% of the previous year) and 491,800 million yen in 2022 (103.1%), based on the retail price. Although the market observed a considerable drop to 88.8% on year-on-year basis in 2020, it turned for the better in 2021. The eyewear retail market in 2022 accumulated to 97.6% of 2019 level, thanks to the strong sales of glasses suited for outdoors and sauna (activities that gained popularity during the COVID situation), the increase of demand for sunglasses (which can be credited to the lifting of pandemic restrictions), the growth of the reading glass market, and the penetration of low-priced glasses that motivated consumers to own more than one pair of glasses.

The decline of eyewear unit price was a major factor that diminished the market size. Nevertheless, the prices are starting to rise, as soaring material prices and logistics costs are reflected on the retail price, enterprises succeeded in increasing the demand for functional lenses (tinted lenses, polarized lenses that eliminate reflection, lenses that help protect against ultraviolet rays, etc.,) with marketing promotion, and high-end glasses frames increased popularity, stemming from the growing recognition of the “Sabae Brand”, the eyewear manufactured in Sabae City in Fukui prefecture.

Noteworthy Topics

Distribution Channel Insights during Pandemic - Internet & Mail Order

Since the comfort of eyewear is determined based on the characteristics of wearer’s face, finding the right fit is difficult without a help of customer service staff, and thus eyewear has been seen as a merchandise that is not suited to be sold online. However, eyewear stores debuted their e-commerce sites one after another in the last 10 years. While they increase convenience of customers by utilizing the benefit of e-commerce, they are focused to enhance customers experience online by minimizing the gap between shopping offline and online. For example, the companies made all purchase history (online and offline) browsable, so that customers can make the next purchase on e-commerce channel based on their previous purchase.

Meanwhile, there are quite a few advantages specific to shopping at brick-and-mortar opticians, such as the joy of choosing from a vast selection of eyewear, getting a sense of products in hand, trying on, having specialized staff giving suggestions on new items, and making comparison with other stores. In particular, eyewear specialty retailers have advantages over online stores when compared to other industries, for having customer service specialists who possess high expertise and wide knowledge/ experience. Considering the fact that users need to visit retail store at least once for optometric eye exams before online purchase, or for fitting of glasses purchased online, it is difficult to envisage the eyewear industry to become completely online.

Development of the eyewear market hereafter relies on how the industry can familiarize eyewear to consumers. While businesses utilize their strength in physical stores, they are expected to increase convenience online to connect more with customers.

Future Outlook

The eyewear retail market for 2023 is expected to grow to 102.6% of the preceding year to 504,800 million yen. With multiple factors working in favor, such as the increasing demand for ready-made sunglasses and the rise in unit price of lenses stemming from the increased recognition of highly functional lenses, the market size is anticipated to recover to 100.2% of pre-pandemic (2019) level.

Research Outline

2.Research Object: Companies in eyewear business, related businesses, related associations

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, and literature research

What is the Eyewear Retail Market?

The domestic eyewear retail market in this research includes the following five items: 1) glasses frames, 2) glasses lenses, 3) ready-made sunglasses, 4) ready-made reading glasses (“ready readers”), and 5) other ready-made glasses.

The “5) other ready-made glasses” indicates the non-prescription glasses such as blue light (blocking) glasses and plano glasses as fashionable accessory.

The items cover imported brands, licensed brands, and in-house brands.

<Products and Services in the Market>

Glasses frames, glasses lenses, ready-made sunglasses, ready-made reading glasses, and other ready-made glasses

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.