No.3256

Fertilizer Market in Japan: Key Research Findings 2023

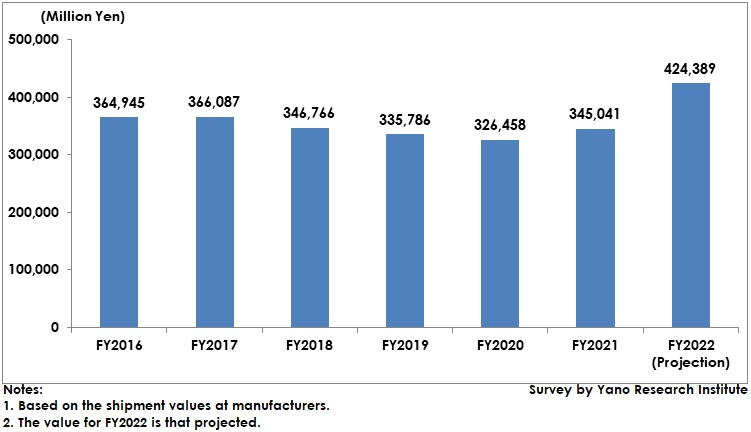

Fertilizer Market for FY2022 Projected to Rise by 23.0% on YoY to Approx. 424,400 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic fertilizer market and has found out market size, trends of market players, and future outlook.

Market Overview

As demand for food has been expanding due to global increase in population and economic development, disrupted logistics amid the corona crisis, international situations including Russian invasions to Ukraine, and international price rise for fertilizer materials, Japan suffers from instable procurement of fertilizer ingredients.

After FY2021, the prices of fertilizer materials such as phosphate ore, potassium chloride, urea, etc. have skyrocketed, which, together with higher energy cost causing higher manufacturing cost, have increased the prices of chemical fertilizer products one after another. Though the domestic fertilizer market used to be on a declining trend, the market size based on the shipment values at manufacturers for FY2021 increased to 105.7% on a YoY basis to 345,041 million yen.

Noteworthy Topics

Soaring Chemical Fertilizer Prices Led to Appealing of Materials and Technologies that Allow Smaller Amount of Fertilizer Application

Significant increase in chemical fertilizer prices has led the domestic fertilizer producers to reduce the use of chemical fertilizers furthermore. The efforts to suppress excess fertilizer applications together with soil diagnosis promoted by JA Zennoh and municipalities have been in progress at many production sites. In addition, fertilizer manufacturers and JA Zennoh have propelled to supply low-nutrient fertilizers.

Meanwhile, producers have been pressing ahead with labor saving efforts, by the use of controlled fertilizer releasing where all fertilizers needed for growing rice are applied to rice seedling in a seedling box to dispense with additional fertilizer applications after those seedlings are transferred to paddy field, or by the technological implementation to allow simultaneous soil paddling and fertilizer applications, which reduce fertilizer applications and save time.

Compost from livestock excreta has also been used. Conventionally, the fertilizer efficiency of phosphoric acid within livestock excreta compost used to be said as 60% of that of chemical fertilizers, but fully matured compost recently produced at a large-scale compost center has shown the similar efficiency with superphosphate. Livestock excreta compost has been applied during past several years as replacement of chemical fertilizers, because of lower price than chemical fertilizers.

To respond to soaring chemical fertilizer prices, the Ministry of Agriculture, Forestry and Fisheries (MAFF) is widely soliciting the cases to reduce fertilizer cost, and to spread such cases to producers.

Future Outlook

The full-scale price rise of chemical fertilizer products in FY2022 has expanded the estimated fertilizer market size for FY2022 to 424,389 million yen, 123.0% of the previous fiscal year. Each of fertilizer manufacturers expanded their fertilizer sales, but the profitability has deteriorated due to significant rise in fertilizer material prices, manufacturing cost, and logistics cost. In such worsening situations, MAFF has taken measures of preparing necessary facilities to enable domestic fertilizer production, and subsidizing the cost for storing fertilizer materials at fertilizer manufacturers.

From the middle to long-term aspect, the fertilizer material prices are likely to gradually be subdued, which makes the fertilizer product prices to decline through concentration of fertilizer brands and deployment of a bidding system. Still, as fertilizer material prices have not yet declined and as logistics cost has been increasing year by year, fertilizer manufacturers are needed to supplement the sales reduction by pressing ahead with streamlining via economies of scale and concentration of brands, building an optimal logistics network through alignment with JA Zennoh, Federation of Economic Organizations, or other fertilizer manufacturers, and expanding the sales of added-value products.

Research Outline

2.Research Object: Manufacturers, developers, and organizations related to fertilizers, soil breeding/improvement agents, and feeds, National Federation of Agricultural Cooperative Associations (JA Zennoh),etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and surveys via telephone

The Fertilizer Market

The fertilizer market in this research refers to the market on the followings: Compound chemical fertilizers, mixed fertilizers, organic fertilizers, single nutrient fertilizers, liquid fertilizers, coating fertilizers, paste fertilizers, and other fertilizers, with the market size calculated based on the shipment values at manufacturers.

<Products and Services in the Market>

1) Soil breeding and soil improvement agents (soil breeding for rice, for horticulture, for home gardening, soil improvement agents for greenery activities, micro-organic soil improvement agents) 2) Fertilizers (compound fertilizers [high analysis compound fertilizers, NK compound fertilizers, NPK compound fertilizers, organic compound fertilizers], compound chemical fertilizers, mixed fertilizers, organic fertilizers, single nutrient fertilizers, liquid fertilizers, coating fertilizers, paste fertilizers, and others), 3) Feed (formula feed, eco-feed)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.