No.3090

Non-Residential Wood Construction Market in Japan: Key Research Findings 2022

Non-Residential Wood Construction Market Forecasted to Rise to 102.5% YoY to 610,000 Million Yen for FY2022

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic non-residential wood construction market, and has found out the market size, the trends by segment, and future outlook.

Market Overview

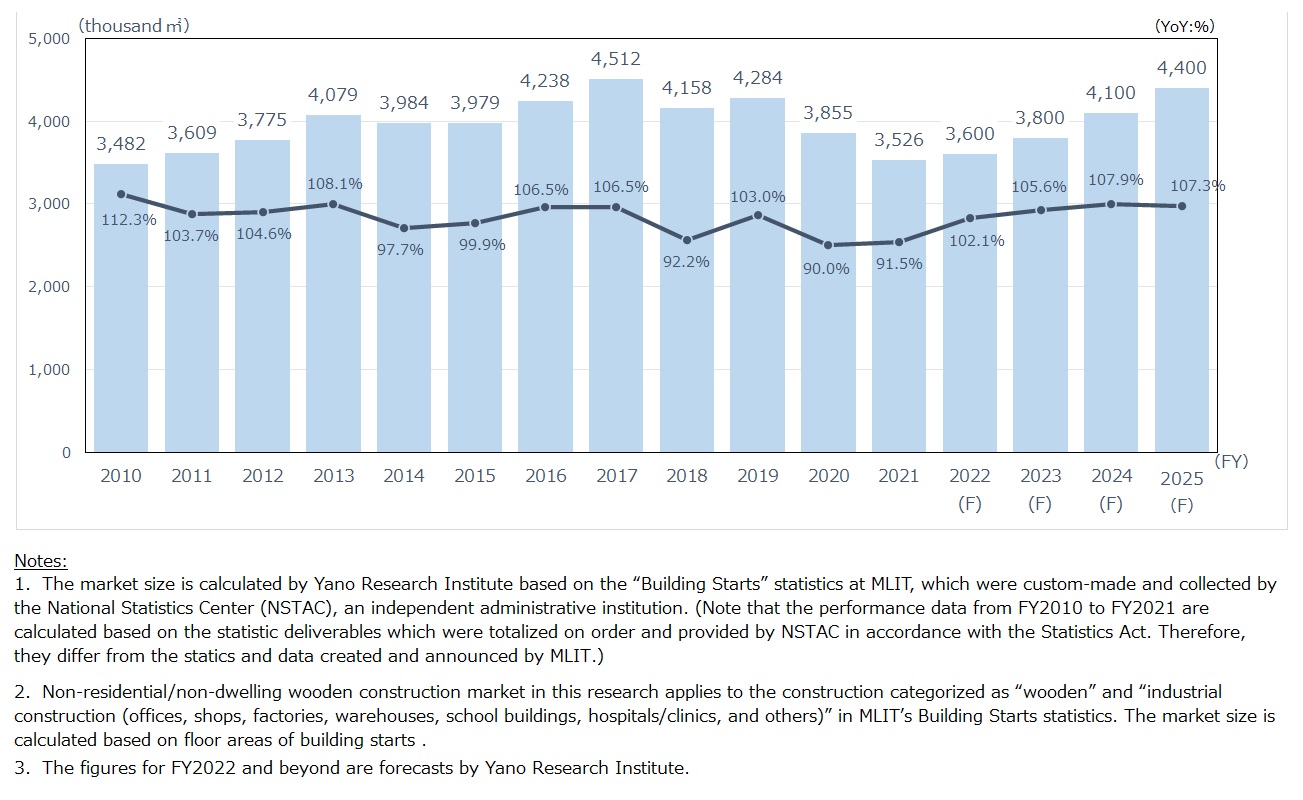

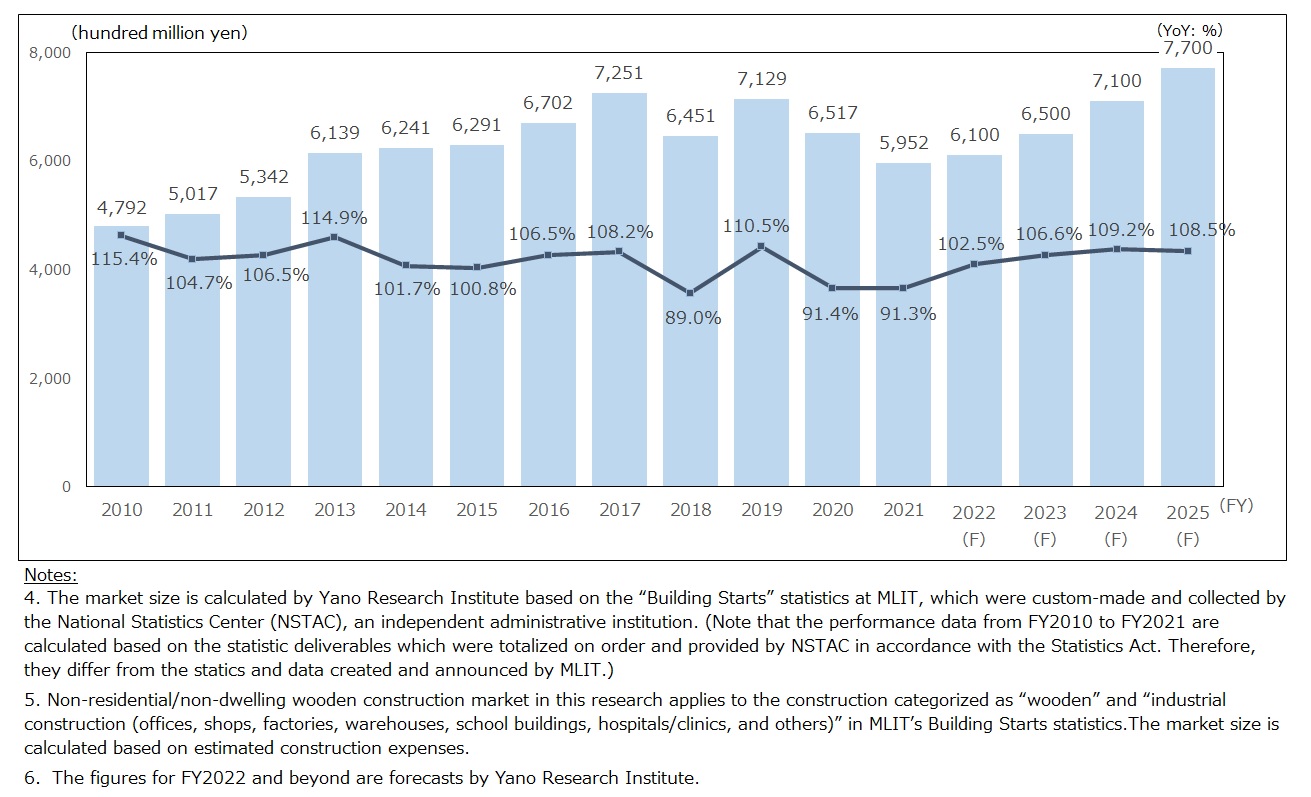

The domestic market of non-residential wood construction (new construction, extension, and renovation) for FY2021 decreased to 3,526,000m2 by floor area (down 8.5% from the preceding fiscal year), and the market size by construction costs fell to 595,200 million yen (down 8.7% from the previous fiscal year). The pandemic diminished the market for FY2020 and FY2021.

A main reason for the sharp drop is the influence of the “wood shock”. * Because of the wood shock, building owners not only faced the difficulty of obtaining timber, but also ballooning of the construction costs due to soaring timber prices. Owners suspended or postponed the construction projects for the outlook of not being being able to secure expected investment yield. As a result, non-residential wood construction market declined significantly for two consecutive years.

*” Wood shock”: A global spike in lumber prices triggered by a surge in new housing construction, particularly in China and the US, during the pandemic, which led to an unprecedented rise in lumber material prices.

Noteworthy Topics

Non-residential Wood Construction Aligns with SDGs

While awareness of SDGs and carbon neutrality rises in the society, enterprises are expected to reduce environmental impact. Attracted by the characteristics of wood that store/reduce CO2, the construction industry has been shifting their focus from traditional SRC architecture to wooden architecture.

The demand is expanding for wood and hybrid (structure combining SRC with wood) office building. Although the non-residential construction market declined in FY2020 due to the pandemic, it is worth noting that office buildings, as defined as the “office (wooden)” in the MLIT’s "Building Starts" statistics, has shown a stable growth, attaining 100.1% year-on-year by floor area, 101.1% year-on-year by construction costs, and 100.2% by the number of buildings.

Future Outlook

In consideration of the fact that restrictions on activities during the COVID-19 crisis are eased and economic activities are normalizing, which led to gradual resumption of suspended construction projects as well as elimination of wood supply shortage caused by the wood shock, the nonresidential wooden construction market for FY2022 is projected to grow to 102.1% on year-on-year basis to 3,600,000 square meters by floor area, and 102.5% to 610,000 million yen by construction expenses.

Moreover, the market is forecasted to grow to 4,400 thousand square meters by floor area (124.8% on year-on-year basis), and to 610,000 million yen by construction expenses (129.4% on year-on-year basis) by FY2025. A key driving force factor of the market will be the full-scale rise of environmental awareness expected in the future, especially the enterprises making further commitments in SDGs and ESG investing. Since the characteristic of wood, which stores /reduces CO2, harmonizes closely with the idea of SDGs and ESG investing, enterprises are likely to adopt wooden construction hereafter. Since the use of wood is effective in reducing environmental impact (compared to other building materials), the nonresidential wooden construction market is expected to expand to FY2025.

Research Outline

2.Research Object: Businesses of non-residential wood construction (general constructors, house makers, architectural firms, construction material makers, pre-cut pallet lumber/framing package makers, wood frame material makers, laminated wood material makers, etc.)

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews), survey via telephone/email, and literature research. *The market size is estimated by Yano Research Institute using the tailor-made tabulation of MLIT's "Building Starts" statistics by National Statistics Center (NSTAC), an independent administrative institution. The performance data from FY2010 to FY2021 are calculated based on the statistic deliverables which were totalized on order and provided by NSTAC in accordance with the Statistics Act. Therefore, they differ from the statistics and data created and announced by MLIT.

What is the Non-Residential Wooden Construction Market?

In this study, the phrase "non-residential wood construction" refers to a type of building designated as structurally “wooden" and built for "non-dwelling" (purposes) in the MLIT “Building Starts” statistics. This category comprises non-residential buildings such as offices, retail spaces, factories, warehouses, schools, and hospitals. The domestic market size of non-residential wood construction is calculated using the data for floor size and construction costs specified in the construction plans. Target buildings comprise extensions and renovations as well as new constructions.

We excluded data for residential buildings, such as apartment complexes, from MLIT’s data for "medium- to large-scale (medium- to high-rise) wooden buildings."

<Products and Services in the Market>

Non-residential wooden construction

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.