No.3041

Corporate Training Service Market in Japan: Key Research Findings 2022

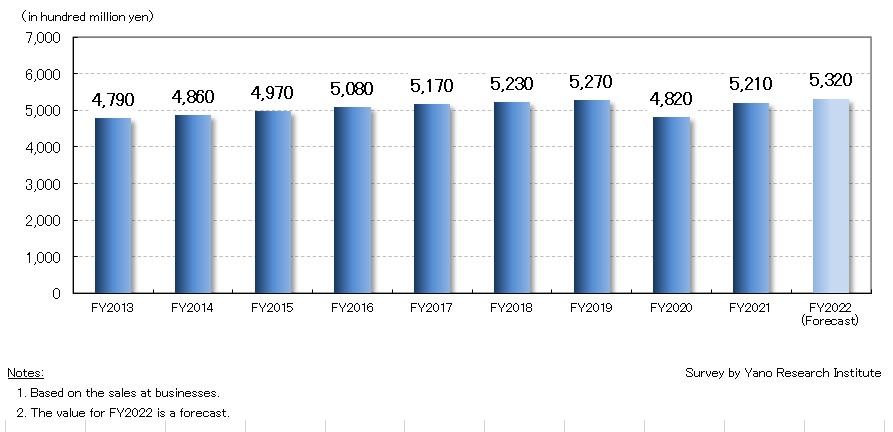

Corporate Training Service Market Rose by 8.1% YoY to 521,000 Million Yen for FY2021, Forecasted to Expand by 2.1% YoY to 532,000 Million Yen for FY2022

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic corporate training service market, and has found out the market trends and the future perspective in view of COVID-19 influence on the market and changes in customer needs.

Market Overview

The corporate training service market size is estimated at 521,000 million yen in FY2021, up 8.1% from the previous fiscal year (based on the sales at businesses). Although the market growth rate turned to negative in FY2020 due to the pandemic, which hindered the vendors to provide group training sessions, the market has made an upward turn for FY2021. This attributes to the emergence of online training courses, which are not only serving as an alternative to in-person group trainings, but also as a stimulus for new demand among companies that had not been their clients.

In addition, the market expansion has been driven by the recovery in demand for classroom sessions (open programs and customized programs), which had been one of the key applications of the industry in the last couple of years. Against the background of the rise in corporate investment in new graduate recruitment, as indicated by the improved job availability ratio, demand is growing for classroom sessions for new employee training. Similarly, rank-based trainings, such as trainings for young and mid-level employees, for next-generation leaders, for middle management, and for executive candidates, are also growing stably.

Noteworthy Topics

Willingness to Investment in Training Parallels Rising Interest in HCM

In FY2021, Japan accelerated attempts to end COVID-19 crisis and recover socio-economic environment back to pre-pandemic levels, including the start of a mass vaccination drive. Meanwhile, service providers that developed online training sessions in full-scale in the latter half of FY2020 made a successful turnaround from negative growth to positive growth, as they pivoted from classroom sessions to online sessions, which also stimulated new demand. Despite the fact that COVID-19 has not been contained and its influence is likely to continue hitting the industry more or less even in FY2022, many corporate training vendors believe that services adapted to the pandemic situation, such as online trainings, can continue to offset the negative influence.

Furthermore, client companies are still eager to invest in recruiting and training. Driven by the government-led promotion of "Human Capital Management (HCM)", an approach to human resource management that views employees as “assets” to be invested in, as well as managed, to maximize their business value in a medium- and long-term perspective, and the spread of “purpose branding”, the management practice that focuses on executing business in a way that benefits society, willingness to invest in human resources is on an increasing trend among enterprises.

Future Outlook

As corporate training businesses have resumed in-person group sessions in FY2022 to meet the needs for new employee trainings starting in April, and high demand is anticipated to remain due to a synergy generated by online trainings adapted to the pandemic situation, the market size is expected to grow greater than the pre-pandemic times. The corporate training market for FY2022 is forecasted to grow by 2.1% on year-on-year basis to 532,000 million yen (based on the sales at businesses).

Research Outline

2.Research Object: Corporate training service providers

3.Research Methogology: Face-to-face interviews (including online interviews) by the specialized researchers, survey by telephone and fax, and literature research

Corporate Training Services

Corporate training services in this research indicate the training/education provided as “business” for client companies, i.e., it does not include in-house trainings conducted by companies’ human resource training department. Nonetheless, training services provided by subsidiaries to their parent and/or group companies are included.

For this research, corporate trainings include classroom sessions (open programs and customized programs), correspondence courses, e-learning, and organizational diagnosis/assessment. Note that “teaching materials” refer only to those materials prepared and provided for classroom sessions and correspondence courses.

<Products and Services in the Market>

Corporate Training Services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.