No.2232

FinTech Market in Japan: Key Research Findings 2019

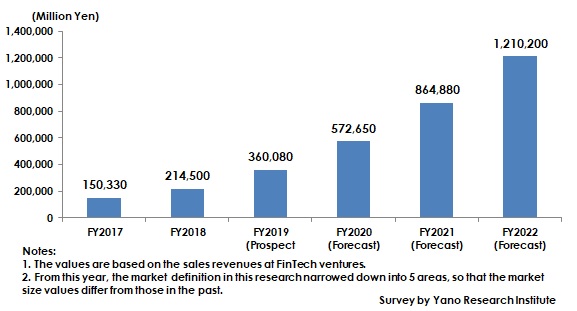

Domestic FinTech Market Grew by 42.7% to Achieve 214,500 Million Yen in FY2018, Expected to Reach 1,210,200 Million Yen by FY2022

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic FinTech market and has found out the current status, the market trend by category, and the future perspectives.

Market Overview

The domestic FinTech market (based on the FinTech venture sales revenue) in FY2018 grew by 42.7% from the previous fiscal year to have achieved 214,500 million yen. The environment surrounding the market has progressively improved from the legal, technological, and physical points of view, invigorating the attempts toward FinTech both by public and private sectors.

The revision of the Banking Act by the Financial Services Agency led all the financial institutions to hammer out “Policy for Coordination and Collaboration with Settlement Agents for Electronic Settlement Systems of Banks” by March, 2018, encouraging each financial institution to work on interconnection of API (Application Programming Interface). Also, under the Act on Special Measures for Productivity Improvement by METI, the Scheme for Demonstration of New Technologies*1 (the “Regulatory Sandbox Scheme”) was established aiming to encourage generation of innovative FinTech services. Just like the projects on blockchain*2 and other new insurance products have been approved for demonstration, the “Regulatory Sandbox Scheme” is expected to be used for more projects by the finance sector.

Right now, each financial institution has been preparing for interconnection of API, which is a part of financial infrastructure and therefore requires prior investment to drive cooperation between banking and IT ventures. Particularly, API used for transfer of funds needs adequate prior investment. Therefore, each finance institution is required to spend for prior investment for future cooperative works with the ventures.

In addition, within the private sector, the FinTech industry bases have been created to invigorate the industry at the very center of Tokyo, i.e., the cities of Otemachi and Kabutocho. At each base, business matching has taken place a number of times in the form of private meetings. Also, the efforts and attempts on FinTech have become wider to include; tours of inspection and “Ideathon (a coined word of idea and marathon, meaning a method of developing ideas through discussions by the members from various specialized areas)”.

*1 The Scheme for Demonstration of New Technologies (the “Regulatory Sandbox Scheme”) is the scheme to approve some promising new technologies, innovative business and services to be grown by temporarily deregulating the existing laws that is currently hampering them. By registering to the competent authorities and after consultations, the enterprises are able to test and demonstrate their new innovative business.

*2 Blockchain is an entirely new way of documenting data on the internet. It connects the users on the P2P (peer-to-peer) network instead of centrally managed form, so that the ledger exists on multiple computers, often referred to as nodes, the stored information is time-stamped, and letting anyone to see the ledger of transactions.

Noteworthy Topics

Expansion of Blockchain (Platform/Cryptocurrency)

Recently, the blockchain technology has gradually been used in wider range of areas, just as some local banks started using the technology. Also, demonstrations using blockchain technology have been taken place under the Act of Special Measures for Productivity Improvement (Regulatory Sandbox Scheme), which is expected to increase the use of the technology.

On the other hand, the area of cryptocurrency has temporarily been sluggish, as many cryptocurrency exchanges received Business Improvement Order after becoming obvious of having large-scale illegal leakage. However, the efforts of building and strengthening securer management inside the business aiming for healthier market environment, the market growth can be expected for the future.

Future Outlook

When observing FinTech by area, “household account book apps & asset management apps” and “financing” are promising for growth, the former because of being introduced in local banks and of the viewpoint of continuity, while the latter because of new services using AI scores have been emerging, in addition to social lending. Furthermore, as in the case of local banks utilizing blockchain, more attempts of using the Scheme for Demonstration of New Technologies (the“Regulatory Sandbox Scheme”) are likely to be implemented.

Such joint efforts of the public and private sectors are likely to lead the domestic FinTech market to attain 1,210.2 billion yen by FY2022, based on the sales revenues at FinTech ventures.

Research Outline

2.Research Object: Financial institutions, IT vendors, market players from other industries, and FinTech ventures

3.Research Methogology: Face-to-face research by the expert researchers, surveys via telephone, and literature research

FinTech (Financial Technology) and the FinTech Market

FinTech is newly created word made up by combining “Finance” and “Technology.” It indicates a range of financial services which had been unable to offer by conventional financial institutions, but have become available through the use of IT technologies.

FinTech in this research is categorized into the following 5 areas: 1) Financing (Social Lending & AI financing), 2) Investment & Operation Services, 3) Blockchain (platform, cryptocurrencies), 4) Household Account Book Apps & Asset Management Apps, and 5) Security Services for Financial Institutions.

The domestic FinTech market size is calculated based on the sales revenues of the venture companies that provide innovative services together with the basic technologies indispensable for such services, which no conventional financial institutions ever had offered before. From this year, the research has narrowed down into 5 areas instead of 8 until the previous year, so that the market size values differ from those in the past.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.