Domestic Clocks and Watches Market in Japan: Key Research Findings 2015

Research Outline

- Research period: From October to December, 2015

- Research targets: Manufacturers, wholesalers, and retailers in the clocks and watches industry, local subsidiaries of overseas companies, importers and exporters.

- Research methodologies: Face-to-face interviews by the expert researchers, mail-in questionnaire, and literature research

What is the Domestic Clocks and Watches Market?

The domestic clocks and watches market in this research is consisted of the following two markets: The retail market of watches (targeting wrist watches) and the retail market of clocks (covering table, wall, and alarm clocks.) The actual figures from 2009 to 2014 are quoted from the materials in Japan Clock and Watch Association. Note that “imported watches” indicate the products from the overseas brands, and “domestic watches” indicate those manufactured domestically, and those produced overseas but imported and sold domestically.

Summary of Research Findings

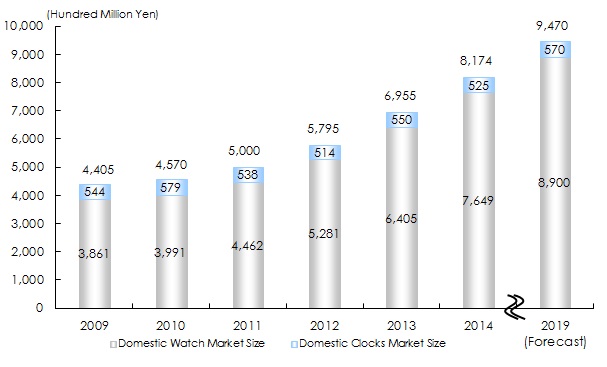

- Size of Domestic Clocks and Watches Market in 2014 Achieved 817.4 Billion Yen, 117.5% of Previous Year to Attain Five Consecutive Years of Growth

The domestic clocks and watches market in 2014 attained 817.4 billion yen, 117.5% of the size in the previous year, based on the retail price. The market was boosted by the favorable sales of domestic wrist watches, which led to double-digit growth from the preceding year and five consecutive years of expansion since 2010.

- Domestic Watches Market in 2014 Achieved 764.9 Billion Yen, 119.4% of Previous Year, Projected to Reach 890.0 Billion Yen by 2019

The domestic retail market of watches attained 764.9 billion yen in 2014, 119.4% of the size of the previous year. In recent years, the market has not only been driven by the conventional wealthy population, but also by the dual-income families with high annual household income and the newly-emerged so-called “new riches” that have made enormous fortunes from their newly launched business or from investment. Also, increase of inbound tourism demands, namely the demands stemming from shopping spree by some of foreign tourists visiting Japan, has raised the sales of expensive watches of both the domestic brands and Swiss or other European, and US brands. The domestic watches market is expected to attain 890 billion yen by 2019, 116.4% of the size of 2014, based on the retail price.

- 2014 Domestic Clocks Market Attained 52.5 Billion Yen, 95.5% on Y-o-Y Basis, Expected to Achieve 57.0 Billion Yen by 2019

The domestic retail market of clocks in 2014 ended up at 52.5 billion yen, 95.5% of the size in the previous year. In spite of some efforts of marketing value-added products at each company to cover the loss of rising costs caused by the weakened yen, the market decline was unavoidable. However, such difficult market environment has driven the market players to make various marketing attempts, including proposing new types of lifestyle through clocks, expanding the types of marionette clocks to attract more demands from foreign visitors. There is an expectation for new markets to emerge by continuing such promotions of high-value-added products and by attracting inbound tourism demands. The domestic clock market is projected to attain 57.0 billion yen by 2019, 108.6% of the size of 2014.

- Figure 1: Transition of Size of Domestic Clocks and Watches Market