No.3939

Next-Generation Mobility Market: Key Research Findings 2025

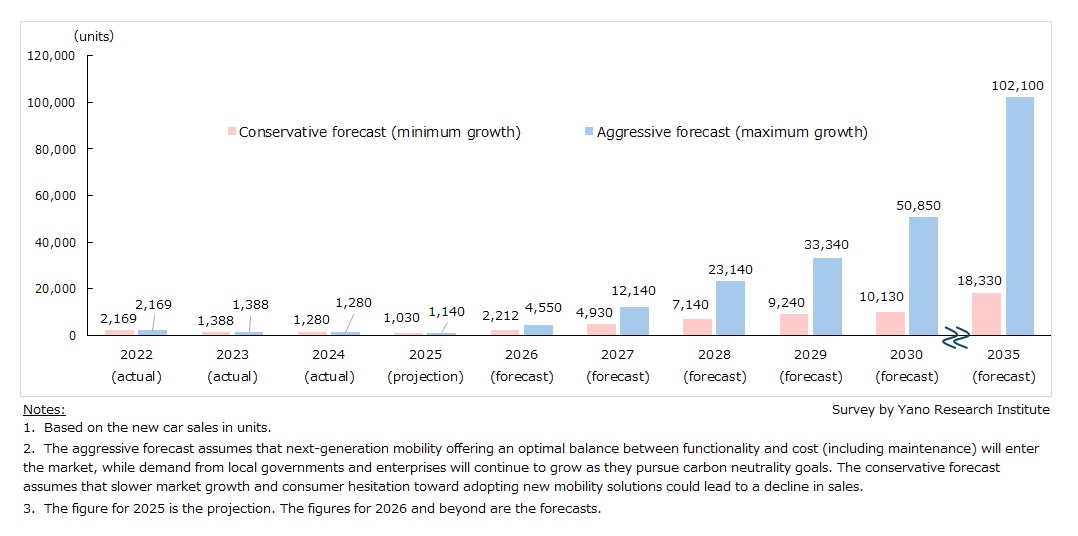

New Sales of Next-Generation Mobility (Electric Trikes, Electric Minicars, and Micromobility) Projected to Hit 102,100 Units at Maximum by 2035

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the next-generation mobility market, and found out the status of Japanese market, overview of overseas market, and business strategies of leading manufacturers. This press release announces our forecast for next-generation new vehicle sales (excluding used vehicles) in Japan through 2035, measured in units.

Market Overview

In the Japanese market, pilot projects and demonstration programs have revealed a certain level of demand for next-generation mobility. However, with appealing alternatives such as kei cars and moped scooters widely available, consumers have little incentive to choose ultra-compact mobility vehicles or electric minicars (motorized four-wheelers). Even ultra-compact mobility vehicles—whose regulatory framework took nearly a decade to establish—appeared destined for a quiet withdrawal from the market following the discontinuation of Toyota’s C+pod.

The situation may change with the launch of KG Motors’ mibot in the fall of 2025, which could become a game changer in the stagnant market. This shift is not merely about price competition; it marks the emergence of electric minicars with clearly defined use cases, being introduced one after another.

Meanwhile, in Europe, cities are transforming toward greater adoption of micromobility. This is evident in the expansion of Low Emission Zones (LEZs) restricting access for high-emission vehicles, the reallocation of road space to pedestrian and cyclists, and the development of micro-terminal hubs for last-mile delivery. Following the success of Citroën’s Ami, not only major automakers like Renault and SEAT but also smack and mid-sized manufacturers are developing urban EVs positioned as the “next Ami”. Moreover, with Toyota Europe and Chinese automakers entering the market, competition in the European quadricycle market is intensifying.

Noteworthy Topics

Next-generation Mobility Market and China’s Push in Europe

In the main survey, we have given eight aspects in social issues and backgrounds that are giving a rise to next-generation mobility in Europe, and how that relates to urban planning in the region.

Shift to EVs needs to be economically rational; it is necessary to secure makers’ profitability while maximizing customer benefits. Because next-generation mobility in conventional pricing and one-time sales model was low margin, business players are seeking new value chain, such as subscription models and mobility services.

While the market anticipates the introduction of next-generation mobility that balances practicality and cost, Europe’s automotive industry is on high alert over BYD’s new mini EV, scheduled for launch in late 2026. The vehicle is expected to feature BEV technology yet be priced disruptively lower than existing mobility options. Such a move could have a profound impact on the potential demand for next-generation mobility. With opportunities (more electric minicar options) and threats (BYD’s mini EV) intertwined, Europe’s next-generation mobility market stands at a major turning point.

Future Outlook

Affected by the discontinuation of Toyota’s “C+pod”, new vehicles sales in the next-generation mobility market in Japan (electric trike, electric minicar and micromobility) declined to 1,280 units.

Potential demand for next generation mobility appears to be growing, driven by the increasing number of seniors giving up driving—the number of seniors surrendering their driver’s license rose in 2024 for the first time in 5 years, according to the statistics of National Police Agency. At the same time, areas lacking public transportation, such as local buses, are expanding. Moreover, demand for new mobility solutions designed for specific applications is expected to rise, particularly in areas where using kei-car may be excessive—for instance, in urban MaaS (Mobility as a Service), transportation for sightseeing, door-to-door sales, and last-mile delivery.

The new sales of next-generation mobility (electric trikes, electric minicars, and micromobility) in Japan is forecasted to reach 102,100 units by 2035 at aggressive forecast (best-case scenario) or 18,330 units at conservative forecast (worst-case scenario).

The aggressive forecast (best-case scenario) assumes that next-generation mobility offering an optimal balance between functionality and cost (including maintenance) will enter the market, while demand from local governments and enterprises will continue to grow as they pursue carbon neutrality goals. The conservative forecast (worst-case scenario), on the other hand, assumes that slower market growth and consumer hesitation toward adopting new mobility solutions could lead to a decline in sales.

Looking at overseas market, the spread of subscription-based businesses (such as car sharing and short-term leasing), the introduction of microfinance schemes, and the creation of new ecosystems involving mobility equipment recyclers are expected to accelerate the adoption of new mobility. This trend is also likely to influence the Japanese market.

In conclusion, new business models will be the key game changer for the next-generation mobility. Rather than competing head to head with kei cars and conventional two-wheelers, new generation mobility should focus on specific applications at a lower cost, with businesses structured around recurring revenue models.

Research Outline

2.Research Object: Manufacturers of next generation mobility, businesses in services pertaining to new mobility

3.Research Methogology: Face-to-face interviews by our expert researchers (including online), survey via telephone, and literature research

What is the Next-Generation Mobility?

Amid global efforts to achieve carbon neutrality and improve transportation efficiency, demand is reportedly growing for new eco-friendly compact vehicles designed for one or two passengers.

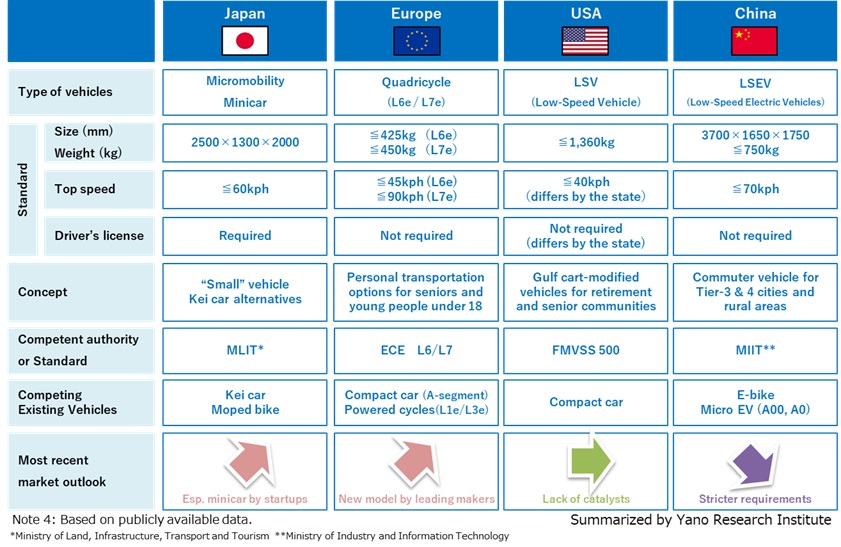

In this research, “next-generation mobility” refers to vehicles positioned between two-wheelers and kei cars in Japan, including electric trikes, electric minicars, and other forms of micromobility.

Although the market report refers to electric scooters and ‘Green Slow Mobility (Gurisuro)’, these vehicles are not included in the market size forecasts.

In comparative studies, Europe’s L-class (L6e, L7e), China’s Low Speed Electric Vehicle (LSEV), and three-wheelers (rickshaws and tuk-tuks) commonly seen in India and ASEAN countries are regarded to as counterparts to “next-generation mobility”.

<Products and Services in the Market>

[Japan] Electric trike, electric minicar, micromobility, electric scooter [Europe] L-class (L6e, L7e), [China] LSEV, [India/ASEAN] three-wheelers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.