No.3913

ERP Suite Licensing Market in Japan: Key Research Findings 2025

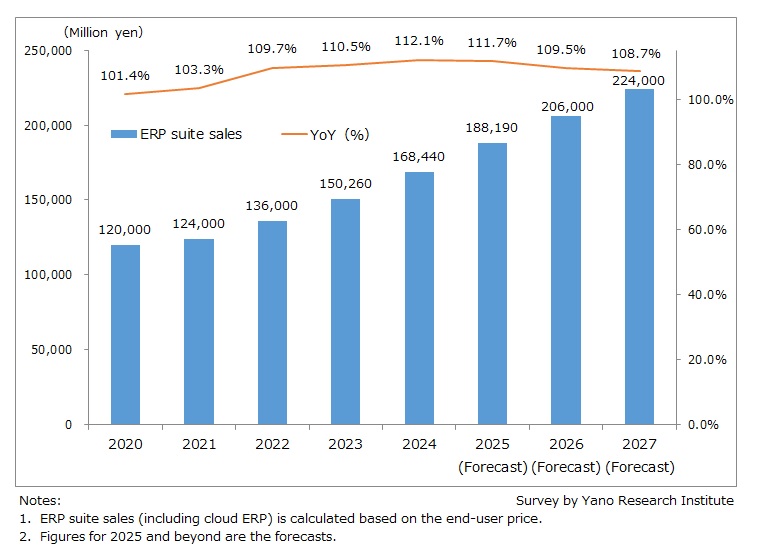

ERP Suite Licensing Market Size Grew by 12.1% YoY to Reach 168,440 Million Yen in 2024

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the ERP suite licensing market in Japan, found out the market trends and future perspectives.

Market Overview

Japan's IT investment has long been framed under the banner of Digital Transformation (DX). This term's initial ambiguity often constrained investment across many enterprises. As companies established clearer strategic priorities, however, the pace of system replacements and upgrades significantly increased.

As a result, the ERP suite licensing market grew steadily to 168,440 million yen in 2024, up 12.1% from the preceding year (based on end-user prices). This growth was primarily fueled by renewal of outdated systems, replacement of those reaching end-of-maintenance, and significant system migrations. This transition simultaneously boosted the adoption of cloud ERP solutions, particularly SaaS-based cloud ERP (i.e., user companies not hosting or customizing ERP platform, as seen in IaaS- or PaaS-based ERP). A key enabler has been the widespread shift among user companies toward a "Fit to Standard" approach—adapting internal business processes to match the standard features of the system, rather than customizing the software.

Noteworthy Topics

SaaS-based Cloud ERP Grew by More Than 30%

The market size of “ERP in the Cloud (IaaS, PaaS, and SaaS)” reached 110,615 million yen in 2024, representing 65% of the entire ERP suite licensing market (increased by around 5.5 percentage points from the previous year). Accelerated by the rise in demand for data-driven management approach (a decision-making process that relies on data and analysis to make informed decisions) and cost reduction in system operation, this share is expected to rise to more than 70% by 2026.

Associated with the intention of utilizing state-of-the-art technology, often relative to the adoption of generative AI, many user companies prefer SaaS-based cloud ERP over IaaS or PaaS model. In 2024, SaaS-based ERP licensing sales is estimated to have increased by 36.2% from the preceding year to 37,186 million yen. Along with the market expansion, the range of offerings is increasing, including ones that allow some customization and update upon requested timing. Given the circumstances, the share of SaaS-based cloud ERP is projected to rise to 25% in 2025.

* The market size of “ERP in the Cloud” (Including IaaS, PaaS, and SaaS-based ERP suite) is accounted for within the overall ERP suite licensing market size. The market size of SaaS-based cloud ERP is included in the market size of “ERP in the Cloud”.

Future Outlook

The size of the ERP suite licensing market in 2025 is forecasted to grow by 11.7% year-over-year to 188,190 million yen (based on the end user price). IT investment continues to be brisk at user companies. Centrally fueled by the renewal of outdated systems, replacement of those reaching end-of-maintenance, and system migrations, the market anticipates steady growth.

Although not as impactful as the introduction of Invoice System, green transformation (initiatives toward sustainability by reducing greenhouse gas emissions), digital invoice, and new lease accounting standard are also opening up new business opportunities in ERP domain.

The demand may rise further when ERP systems are enhanced with AI (including tools like generative AI and autonomous assistant like AI agent) in a way so that the system can be utilized for strengthening competitiveness as well as for streamlining operations.

From sales strategy perspective, ERP suite vendors are increasingly focusing on negotiating face-to-face with customers. While online interactions are valued for providing product information, many vendors believe that in-person negotiations are more effective in closing deals. For this reason, they are increasingly shifting to offline business negotiations.

From the medium- to long-term perspective, labor shortage poses a challenge for ERP vendors. Many are forming strategic partnerships to address staffing gaps, but expertise remains a hurdle. Training programs and marketing support tools are essential to equip new partners.

Research Outline

2.Research Object: ERP suite vendors

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

What is the ERP Suite Licencing Market?

Enterprise Resource Planning (ERP) is a business process management software suite that integrates key business processes such as finance, HR& payroll, sales administration, and production management.

In this research, the ERP suite licensing market is defined as the total value of ERP license sales, including sales of cloud ERP suites deployed through IaaS, PaaS, or SaaS models. The market size is calculated based on the end user price.

Note that the market size of on-premise ERP excludes revenue from services and add-ons like consulting, system integration, or maintenance services fees. However, the market size of cloud-based ERP does include maintenance fee.

<Products and Services in the Market>

ERP suite

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.