No.3910

Language Education Business Market in Japan: Key Research Findings 2025

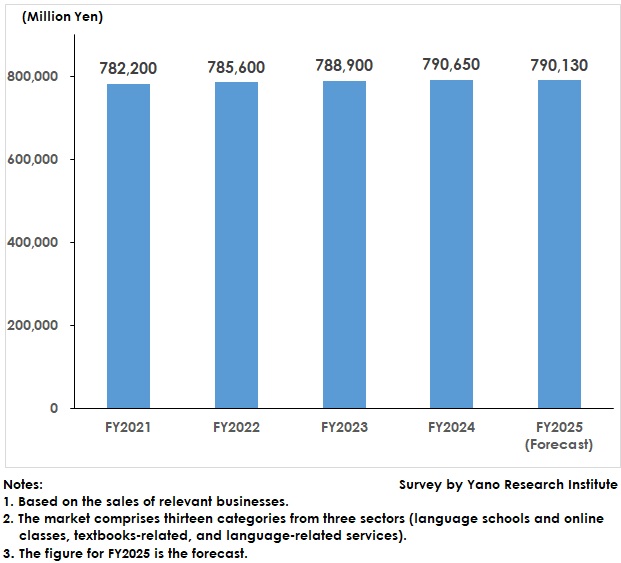

Language Education Business Market (Total of 13 Categories) Reached 79o.6 Billion Yen in FY2024, Up 0.2% YoY

Yano Research Institute (the President, Takashi Mizukoshi) conducted a study of the domestic language education business. The study revealed market player trends, market trends by category, and the future outlook.

Market Overview

Based on the sales of relevant businesses, the language education business market—comprising 13 categories across three sectors—was estimated at 790.6 billion yen in fiscal year 2024 (FY2024), representing 100.2% of the previous fiscal year’s market size.

The language school business market, which includes foreign language classes for adults, English conversation classes for children, and preschools, exceeded the size of the previous year. Specifically, the markets for foreign language classes for adults and preschools grew, while the English conversation classes for children declined.

Among the related businesses, the markets for language exams, overseas education arrangements, and English teacher dispatch services for kindergartens and nurseries surpassed their respective sizes in the previous year. However, the interpretation and translation services market declined compared to the previous fiscal year.

Noteworthy Topics

Emerge of New Services, i.e., English Coaching Services and AI-Powered English Conversation Apps

In the Language School and Online Class Sector, new services such as English coaching services and AI-powered English conversation apps have emerged.

The market for foreign language classes for adults is on the path to recovery, driven by a surge in inbound tourism and increased globalization, which has led to more Japanese people going abroad. This recovery comes despite challenging external factors such as the weaker yen and rising commodity prices. A key market driver is the English coaching service, in which a dedicated consultant provides personalized guidance and designs a curriculum tailored to each student’s proficiency level, helping them improve their English skills in a brief period.

In the online language learning market, major providers of online English conversation classes are struggling, while companies offering AI-powered English conversation apps are experiencing strong sales. These apps allow users to practice English conversation with AI partners to enhance their speaking skills. Since 2025, app providers have actively promoted their services through advertising, including on TV, which has contributed to sales growth. However, there still appears to be room for further improvement in sales performance.

Future Outlook

The language education business market, which comprises thirteen categories, is expected to remain stable at 790.1 billion yen in FY2025, representing 99.9% of the previous fiscal year’s size.

Although uncertainty persists due to external factors such as the weaker yen and rising commodity prices, significant technological advancements—particularly in generative AI—are blurring the boundaries between markets, including those of language schools and textbooks. These increasingly overlapping markets are intensifying competition among businesses as they vie to attract customers.

Research Outline

2.Research Object: Foreign-language school operators, developers and publishers of language study materials, and other businesses related to language education services

3.Research Methogology: Face-to-face and online interviews by specialized researchers (including online interviews), questionnaire survey, and literature research

About The Language Education Business Market

In this research, the language education business market (also referred to as the language business market) is defined as comprising the following three sectors, which together include 13 categories:

1.The Language School and Online Class Sector:

- Foreign language classes for adults

- English conversation classes for children and infants

- Preschools

- Online language learning

2.The Textbooks-Related Sector:

- Paper-based textbooks

- Language self-learning hardware and software

- Electronic dictionaries

- English conversation class textbooks for children and infants

- Correspondence education

3. The Language-Related Services Sector:

- Language exams

- Overseas education arrangements

- English teacher dispatch services for kindergartens and nurseries

- Interpretation and translation services

The Language-Related Services Sector is defined as “the related businesses” within the language education business market.

<Products and Services in the Market>

Foreign language classes for adults, English conversation classes for children/infants, preschools, online language learning, paper-based textbooks, language self-learning hardware and software, electronic dictionaries, English conversation class textbooks for children/infants, correspondence education, language exams, overseas education arrangements, English teacher dispatch services for kindergartens and nurseries, and interpretation and translation services.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.