No.3891

Funeral Business Market in Japan: Key Research Findings 2025

Funeral Business Market in 2024 Estimated at 1.83 Trillion Yen, Up 8.2% from Preceding Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on funeral businesses in Japan, and found out the market size, the trends by segment, and future perspective.

Market Overview

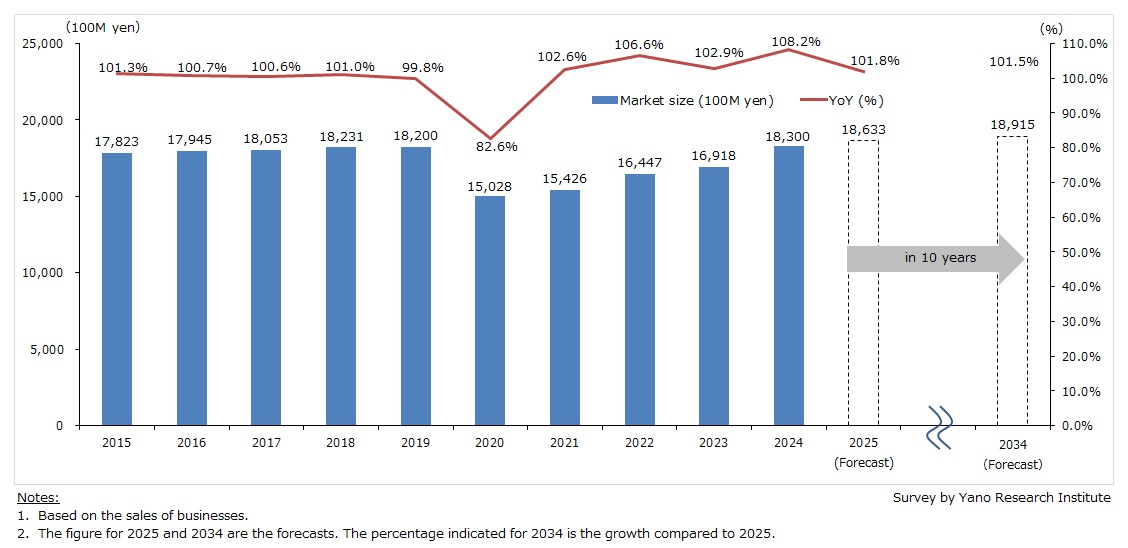

The domestic funeral business market size in 2024 (based on the sales of businesses) is estimated at 1.83 trillion yen, 108.2% of the previous year.

As Japan’s population continues to age, deaths are on the rise (source: “Vital Statistics”, Ministry of Health, Labour and Welfare), creating more demand for funeral services. The funeral business market is on a recovery trend from the downturn caused by the COVID-19 pandemic.

Additionally, average funeral costs appear to be stabilizing, while the funeral market is experiencing polarization. Small-scale funerals, such as family-only or one-day services, are becoming mainstream, yet demand is also rising for high-end, customized funerals with unique arrangements for venues, altars, music, and video. Furthermore, looking at expenses by category, related costs such as catering for post-funeral meals and gifts, which had declined sharply due to the pandemic, are also showing signs of recovery. This trend is helping to stabilize the average funeral cost.

Amid the increasing flexibility in funeral styles and diversification of value propositions, the funeral business industry as a whole is entering a phase where greater business evolution and adaptability are required.

Noteworthy Topics

Funeral Favors and Funeral Catering Showed Sharp Recovery

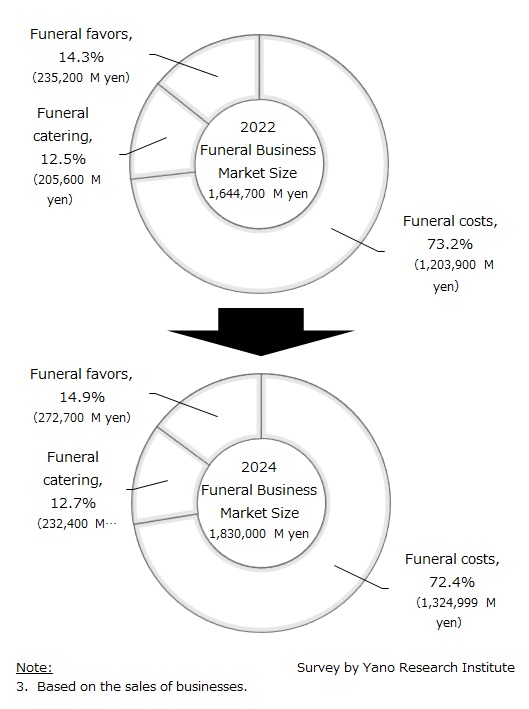

In 2024, the funeral business market by segment was composed of 72.4% funeral costs, with funeral catering and funeral favors accounting for 12.7% and 14.9%, respectively. With the COVID-19 experience, slight change was observed in the balance among the segments.

Funeral costs totaled 1,324,900 million yen (110.1% of the 2022 level), while funeral catering and funeral favors reached 232,400 million yen (113.0%) and 272,700 million yen (115.9%), respectively. The funeral favors market showed the highest growth, suggesting a full recovery in gifting demand. In addition, the funeral catering market has grown steadily by 13% over two years, reflecting the resumption of ‘tsuya furumai’ and ‘shojin otoshi’ (food and drinks to attendees at wake and funeral), that had been voluntarily suspended during the pandemic.

Future Outlook

Against the backdrop of rising mortality rates due to aging (source: “Future Population Projections for Japan”, National Institute of Population and Social Security Research), the domestic funeral business market size (based on sales of businesses) in 2025 is projected to reach 1,863,300 million, up 1.8% from the previous year. The market is forecasted to expand gradually to 1,891,500 million by 2034, up 1.5% from 2025. This equates to 103.9% of 2019 levels (1,820,000 million), suggesting recovery / growth trajectory in the long-term.

Although consumer preferences are increasingly bifurcated, favoring either very affordable or premium funeral options, the average cost of a funeral is expected to remain stable. The market is projected to enter a new growth phase as funeral service companies continue to offer high-value-added services and a wider variety of funeral formats.

Research Outline

2.Research Object: Funeral-related businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), online questionnaire, and literature research

What is the Funeral Business Market?

In this research, size of the funeral businesses market is measured as a total of the “funeral costs”, which are direct charges for services and merchandise for (at) the funeral, and indirect charges such as “funeral catering” and “funeral favors”. It is calculated based on the sales of funeral businesses.

Note that the market size excludes other payments, such as those directly paid to a temple or a shrine (such as ofuse [offertory] for officiating the service, and sotoba [a wooden grave post with a name of the deceased] for Buddhist cemetery), cremation fees, Buddhist home altars, cemetery, and headstone/gravestone.

<Products and Services in the Market>

1) Funeral costs: Items and services that directly relates to funeral, including alter, coffin/casket, portrait photo (of the deceased to be displayed at a wake or funeral), urn and a special pair of long chopsticks used to place bones in an urn after cremation, dry ice, funeral alter arrangement items, funeral floral arrangements (floral alters, flower wreath, etc.), service fees for dispatched professionals (that serves as receptionist, food server, cleaner, etc. at funerals), hot washcloth (oshibori) rentals, ihai (a wooden tag with Dharma name of the deceased, used in Buddhist funeral), fleet services (hearses for the deceased, courtesy buses for funeral attendees), funeral service fee, signboards, paper supplies, and memorial cards 2) Funeral catering: Food and drinks served to attendees at wake and funeral, described as ‘tsuya furumai’ and ‘shojin otoshi’ 3) Funeral favors: Gifts to show gratitude for attending the service, hankaeshi (half-return gift) for condolence money for a funeral, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.