No.3884

Housing Equipment Market in Japan: Key Research Findings 2025

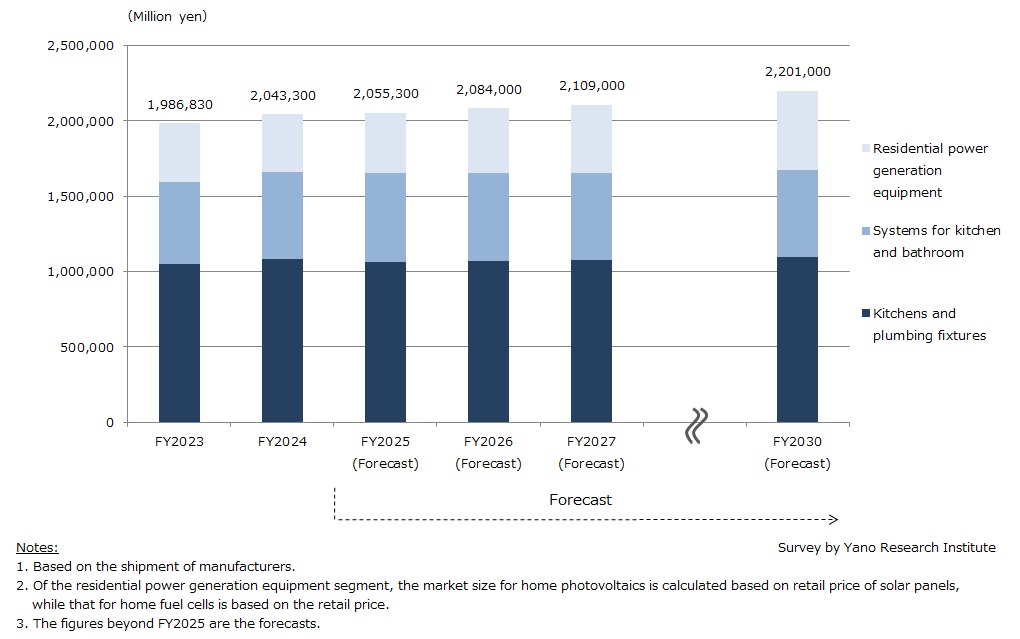

Domestic Major Housing Equipment Market Forecasted to Reach 2,201,000 Million Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic housing equipment market and found out the current market status, the trends of market players, and future perspectives.

Market Overview

The major housing equipment market size (the total of kitchens and plumbing fixtures, systems for kitchen and bathroom, and residential power generation equipment) in FY2024 was estimated at 2,043,300 million yen, up 2.8% from the previous fiscal year. By segment, kitchens and plumbing fixtures, as well as systems for kitchen and bathroom, grew by 2.9% and 7.2%, respectively, on the same basis (amounting to 1,082,700 million yen and 580,900 million yen, respectively) residential power generation equipment declined by 3.3% on the same basis to 379,700 million yen.

The kitchens and plumbing fixtures segment grew slightly thanks to price rise by manufacturers, stemming from soaring raw material prices. Government program promoting introduction of high-efficient hot water supply systems (“Subsidy for Promoting Energy Conservation in the Residential Sector through the Introduction of High-Efficiency Water Heaters”) was favorable to the market for kitchen and bathroom systems, particularly in residential sector. In the residential power generation equipment market, while “National DR*1 subsidy” contributed to the increase of home energy storage installation, the home photovoltaic system market shrank due to drop of solar panel prices. Together with the sluggish shipment of home fuel cells owing to persistent high fuel cell prices, the entire market for residential power generation equipment diminished.

*1. Demand Response (DR) is a program for controlling electricity supply-demand by efficient use of fuel cell and electric heat-pump water systems. Homeowners can store excess solar power in a fuel cell and use that energy at night hours when electricity cannot be supplied by photovoltaics.

Noteworthy Topics

ZEH Redefined / "GX-ZEH" Starting FY2027

In May 2025, the Ministry of Economy, Trade and Industry (METI) redefined the Zero Energy House (ZEH) standards*2 as part of a national plan to achieve carbon neutrality. Starting in FY2027, the new definition will align with the government's green transformation, called "GX-ZEH". The new standard is stricter, requiring homes to reduce primary energy consumption by at least 35% (compared to 20% in the previous standard).

In line with the revision, detached houses must be equipped with an energy management system and a fuel cell (with a primary effective capacity of at least 5 kWh) in addition to a home photovoltaics to be granted a status of “Nearly GX ZEH” (primary energy savings of at least 75% compared to standard level, with renewable energy generation), “GX ZEH,” (energy savings of 100% or more, on same basis) or “GX ZEH+” (energy savings of 115% or more, on same basis). By encouraging consumers to power their home with their own energy system (storing excess solar power in a fuel cell and using that energy at night hours when electricity cannot be supplied by photovoltaics), the government aims to lower the reliance on FIT system, the scheme under which grid operators purchase excess powers at fixed (premium) purchase price.

*2.A Zero Energy House (ZEH) is a dwelling that contributes to realization of carbon neutrality by introducing renewable energy such as photovoltaics to make the annual energy income and outgo to zero, while achieving significant energy savings through other ways including improving thermal insulation.

Future Outlook

The domestic major housing equipment market (kitchens and plumbing fixtures, systems for kitchen and bathroom, and residential power generation equipment) is forecasted to reach 2,201,000 million yen by FY2030, up by 7.7% from FY2024.

Impacted by the waning demand for new houses owing to the decline in domestic population*3, size of the markets for kitchens and plumbing fixtures and for kitchen and bathroom systems will stay flat. On the other hand, the market for residential power generation equipment anticipates further growth, driven by the target photovoltaic system installation rate for the "Housing Top Runner Program"*4 and the new "GX ZEH" that requires houses to install fuel cells.

*3. Source: "Population Census 2020" by Ministry of Internal Affairs and Communications

*4. "Housing Top Runner Program" mandates housing manufacturers above a certain size (measured by the number of new homes built per year) to construct homes that exceed energy efficiency standard. By the end of the target year, the average energy efficiency of the homes they build must surpass the prescribed standard.

Research Outline

2.Research Object: Housing equipment manufacturers and industrial organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone and emails, and literature research

The Housing Equipment Market

The housing equipment market in this research refers to home-use equipment installed at residence, which is categorized into three types: 1) kitchens and plumbing fixtures, 2) systems for kitchen and bathroom, and 3) residential power generation equipment. Details of each category are as follows:

(1) Kitchens and plumbing fixtures: kitchen (systematic kitchen, sectional kitchen), systematic baths, electronic toilet seats, household sanitary equipment, and washstands (*excluding taps)

(2) Systems for kitchen and bathroom: Dish washer, hot water supply system, stoves (gas stove, induction heating [IH] system), bathroom heater and dryer system

(3) Residential power generation equipment: Household energy storage systems, home photovoltaic systems, and home fuel cells

Market sizes for each housing equipment are basically calculated by the shipment value of manufacturers. Nevertheless, of (3) residential power generation equipment, the market size for home photovoltaic systems is calculated based on retail price of solar panels, and the market size for home fuel cells is based on the retail price.

<Products and Services in the Market>

Major housing equipment (kitchens and plumbing fixtures, systems for kitchen and bathroom, and residential power generation equipment)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.