No.3879

Hydrogen Supply Business for Energy in Japan: Key Research Findings 2025

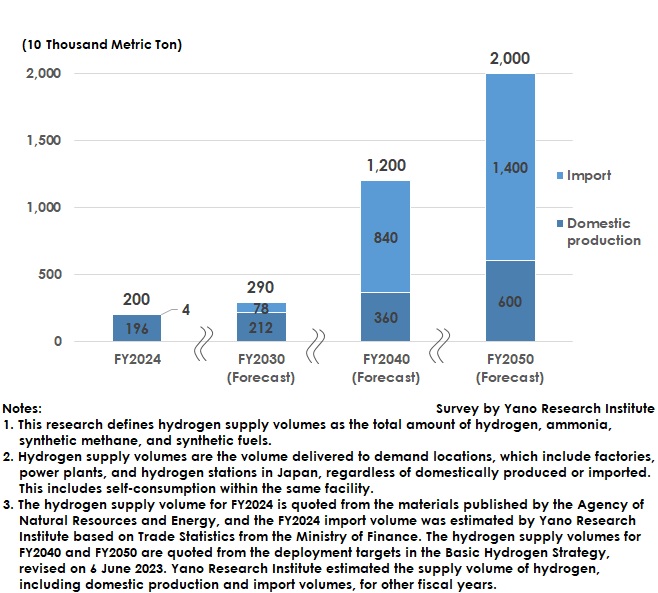

Japan's Hydrogen Supplies Are Forecast to Reach 2.90 Million Metric Tons by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on hydrogen supplies used for energy in Japan. The survey revealed the market trends, the strategies of leading market players, and future market prospects. In here discloses the forecast of hydrogen supply volume in Japan through FY2050.

Market Overview

Hydrogen can be an energy source that does not emit CO2 when burned. It can be produced from various resources, such as water, biomass resources (e.g., sewage sludge and livestock excrement), and fossil fuels. Hydrogen contributes to reducing energy-derived CO2 emissions and reinforcing energy security by supplying energy stably.

Japan announced its Basic Hydrogen Strategy in 2017, establishing a national hydrogen policy ahead of other countries. Since then, Japan has worked to increase hydrogen usage by revising the above Strategy in 2023 and passing the Hydrogen Society Promotion Act in 2024. This legislation promotes the use and the supply of low-carbon hydrogen (hydrogen produced using low-carbon methods) to facilitate the country's transition toward an economically decarbonized growth structure.

In Japan, hydrogen is considered essential for achieving carbon neutrality in the industrial and transportation sectors. Consequently, the country has initiated technological development and verification projects to expand the supply and use of hydrogen. Some local governments are developing hydrogen energy production models that utilize local resources, thereby achieving local energy production and consumption, as well as disaster-time business continuity planning.

According to the Agency of Natural Resources and Energy (*1), Japan's estimated annual hydrogen supply volume (*2) was approximately 2 million metric tons in FY2024. Of this volume, 1.96 million metric tons were produced domestically, and 40 thousand metric tons were imported (*3). Most of the domestically produced hydrogen was a byproduct of industrial processes involving chemicals, petroleum refining, and steel production. These processes emit CO2 due to the use of fossil fuels. Additionally, although demonstrations for producing green hydrogen are underway, the production volume is estimated to remain at around a few thousand metric tons.

While small-scale green hydrogen production projects have been launched nationwide, large-scale projects producing over 10,000 metric tons annually are limited, as of June 2025, because the future of domestic demand is uncertain.

*1) Source: The Current State of Hydrogen Policy and the Domestic and International Situation Surrounding Hydrogen (in Japanese only)” by the Agency of Natural Resources and Energy (September 2024).

*2) Types of Hydrogen: Blue hydrogen uses carbon capture, utilization, and storage (CCUS) techniques to reduce CO₂ emissions produced during the hydrogen production process. Green hydrogen uses renewable energy, thereby eliminating CO₂ emissions during production.

*3) Estimated by Yano Research Institute based on Trade Statistics from the Ministry of Finance and the conversion of ammonia mass into hydrogen.

Noteworthy Topics

Trends in Hydrogen Imports

By FY2030, ammonia (*4), which reduces CO2 emissions during hydrogen production, could become the primary hydrogen carrier. A hydrogen carrier is a chemical substance that transports and stores hydrogen energy. Imported ammonia is expected to be used for multi-fuel combustion at thermal power plants.

Ammonia is produced by reacting to hydrogen and nitrogen. Since the industrial sector has already developed safe and low-cost technologies for manufacturing, transporting, and storing ammonia, it is easier to handle than other carriers, such as liquified hydrogen. Another benefit of using ammonia is the potential to reduce capital investments by repurposing some of the existing transportation and storage infrastructure. Using ammonia solely as a fuel for combustion after its arrival in Japan will eliminate the need for catalytic cracking and minimize the increase in supply costs.

*4) Types of Ammonia: Blue ammonia uses carbon capture, utilization, and storage (CCUS) techniques to reduce CO₂ emissions produced during the hydrogen production process. Green hydrogen uses renewable energy, thereby eliminating CO₂ emissions during production.

Future Outlook

The projected volume of the domestic hydrogen supply is 2.9 million metric tons by FY2030. Of this total, 2.12 million metric tons will be produced domestically, and 780 thousand metric tons will be imported. Most domestic production consists of small-scale projects because large-scale projects with an annual production capacity exceeding 10,000 metric tons are scarce. Consequently, while domestic production will likely increase slowly, imports will likely fuel the expansion of the supply volume in and beyond FY2024.

Based on the Hydrogen Society Promotion Act, which aims to promote the supply and use of low-carbon hydrogen to facilitate Japan’s transition toward an economically decarbonized growth structure, support for price gaps and hub development is expected to increase the domestic hydrogen supply. However, achieving the maximum deployment target of three million metric tons per year specified in the Basic Hydrogen Strategy seems difficult.

According to the Basic Hydrogen Strategy (*5), the target for domestic hydrogen deployment (hydrogen supply volume) is 12 million metric tons by 2040 and 20 million metric tons by 2050. Of these volumes, domestic production is projected to remain at 3.6 and 6 million metric tons, respectively, accounting for only about 30%, as estimated by Yano Research Institute. Unlike Australia and the Middle Eastern countries (*6), Japan has limited land suitable for large-scale renewable energy plants necessary for producing green hydrogen. Japan also lacks the appropriate land for storing CO2 that is necessary to generate blue hydrogen. Therefore, Japan will need to continue relying on imports for hydrogen supplies.

*5) Source: The Ministerial Council on Renewable Energy, Hydrogen, and Related Matters “Basic Hydrogen Strategy” (Revised on 6 June 2023).

*6) Due to their vast, continuous dry lands and deserts, as well as high solar irradiation, Australia and the Middle Eastern countries are well-suited for developing photovoltaic energy among various renewable energy sources. Conversely, Japan has limited flatlands, and the amount of land suitable for photovoltaic facilities with large ground equipment installations is decreasing. Therefore, when compared to the aforementioned countries, Japan has little room to newly develop renewable energy for green hydrogen production.

Research Outline

2.Research Object: Companies involved in the manufacturing and supply of hydrogen in Japan (i.e. petroleum companies, heavy industries companies, industrial gas companies, city gas companies, power companies.)

3.Research Methogology: Face-to-face interviews by expert researchers (including online interviews), surveys via telephone and email, and literature research

Hydrogen Supplies in Japan

This research defines hydrogen supply volumes as the total amount of hydrogen, ammonia, synthetic methane, and synthetic fuels that are delivered to demand locations in Japan, which include factories, power plants, and hydrogen stations, regardless of domestically produced or imported. This includes self-consumption within the same facility.

The hydrogen supply volume for FY2024 is quoted from the materials (*) published by the Agency of Natural Resources and Energy, and the FY2024 import volume was estimated by Yano Research Institute based on Trade Statistics from the Ministry of Finance. The hydrogen supply volumes for FY2040 and FY2050 are quoted from the deployment targets (**) in the Basic Hydrogen Strategy, revised on 6 June 2023. Yano Research Institute estimated the supply volume of hydrogen, including domestic production and import volumes, for other fiscal years.

*) Source: “The Current State of Hydrogen Policy and the Domestic and International Situation Surrounding Hydrogen (in Japanese only)” by the Agency of Natural Resources and Energy (September 2024).

**) Source: The Ministerial Council on Renewable Energy, Hydrogen, and Related Matters “Basic Hydrogen Strategy” (Revised on 6 June 2023).

<Products and Services in the Market>

Hydrogen energy (including both domestically produced and imported hydrogen)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.